High Dividend 50: Southside Bancshares Inc.

Image Source: Pexels

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current dividend yield is only ~1.2%.

High-yield stocks can be very helpful to shore up income after retirement. For example, a $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is Southside Bancshares Inc. (SBSI).

Business Overview

Southside Bancshares Inc., headquartered in Tyler, Texas, is a prominent financial holding company primarily engaged in providing a broad array of commercial banking services.

Through its wholly-owned subsidiary, Southside Bank, the company offers a comprehensive suite of services, including personal and commercial loans, deposit accounts, and wealth management solutions.

With a focus on serving the needs of both individual and business clients, Southside Bancshares has established a strong regional presence across Texas, leveraging a robust network of branch locations to deliver convenient and personalized banking experiences.

Founded in 1960, Southside Bancshares has steadily grown through strategic acquisitions and organic expansion, emphasizing sound financial management and community-oriented banking principles.

The company’s commitment to customer satisfaction and prudent risk management has earned it a reputation for stability and reliability.

Source: Investor Relations

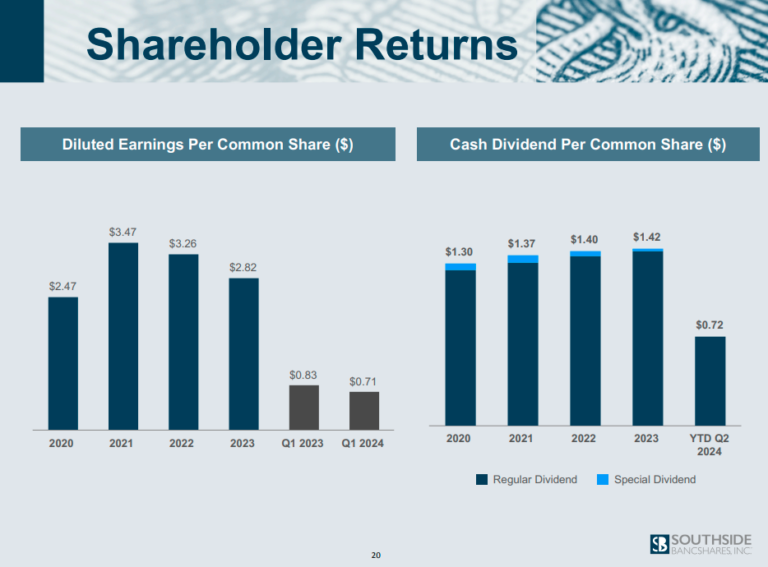

Southside Bancshares Inc. reported a net income of $21.5 million for the first quarter of 2024, reflecting a 17.4% decrease from the $26.0 million reported in the same period of 2023.

This decline was primarily attributed to reduced non-interest income and increased non-interest expenses. Earnings per diluted common share dropped to $0.71 from $0.83 year-over-year.

The annualized return on average assets was 1.03%, down from 1.38%, and the return on average equity was 11.02%, down from 13.92%.

Despite these declines, the company achieved a linked quarter loan growth of 1.2%, maintaining a low nonperforming asset ratio at 0.10% of total assets.

Net interest income for the quarter was $53.3 million, nearly unchanged from the previous year, although it decreased by $1.1 million from the fourth quarter of 2023 due to higher funding costs and the maturity of low-interest-rate swaps.

The net interest margin also declined to 2.72% from 3.02% year-over-year.

Source: Investor Relations

Noninterest income fell by 19.2% to $9.7 million, impacted by reduced gains on equity securities sales and lower income from bank-owned life insurance.

Conversely, noninterest expense rose by 5.8% to $36.9 million, driven by higher salaries, benefits, and FDIC insurance costs.

Growth Prospects

Southside Bancshares Inc. is well-positioned for growth, leveraging its solid regional presence and strategic initiatives to expand its market share.

The company’s focus on enhancing digital banking capabilities is a key driver as it adapts to the increasing demand for online and mobile banking services.

Additionally, Southside’s commitment to prudent risk management and maintaining a strong capital base provides a stable foundation for sustainable growth.

The company’s strategic acquisitions and organic expansion efforts further strengthen its competitive position within the Texas banking market.

Moreover, Southside Bancshares’ emphasis on cost containment and revenue optimization reflects a proactive approach to navigating economic uncertainties.

The anticipated annualized cost savings of approximately $3.5 million, driven by workforce reductions and other efficiency measures, are expected to enhance financial performance in the coming quarters.

Competitive Advantages & Recession Performance

Southside Bancshares has a few key competitive advantages that distinguish it from other regional banks. First, its strong community presence in Texas enables the bank to offer tailored financial solutions that meet the specific needs of its customers.

In addition, the bank’s conservative approach to lending and risk management ensures a high-quality loan portfolio, contributing to its reputation for stability and reliability.

In terms of recession performance, Southside Bancshares has demonstrated resilience in challenging economic conditions. The bank’s focus on maintaining a strong capital position and low levels of nonperforming assets allows it to navigate downturns effectively.

During economic slowdowns, Southside’s diversified revenue streams, including noninterest income from wealth management and brokerage services, provide a buffer against fluctuations in interest income.

The company performed excellent during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: $1.50

- 2009 earnings-per-share: $2.15

- 2010 earnings-per-share: $1.92

This combination of prudent financial management and strategic adaptability positions Southside Bancshares to sustain performance and emerge stronger from economic downturns.

Dividend Analysis

Southside Bancshares Inc.’s annual dividend is $1.42 per share. At $26.22, Southside Bancshares Inc has a high yield of 5.49%.

Given Southside Bancshares Inc.’s outlook for 2024, EPS is expected to be $2.70. As a result, the company is expected to pay out roughly 54% of its EPS to shareholders in dividends.

The dividend appears sustainable, and we estimate the company will grow it at a 2% rate going forward. Overall, the stock and its 5.5% dividend yield are attractive for investors focusing primarily on income.

Final Thoughts

Southside Bancshares is expected to offer a total annual return of 11.3% over the next five years. This projection is based on a 3.0% earnings growth rate, a starting dividend yield of 5.3%, and a mid-single-digit contribution from multiple expansions.

The company continues to post solid loan growth in multiple areas and has seen deposits return to growth following the recent banking crisis.

Southside Bancshares’ dividend track record is solid, and the current yield remains generous. We reaffirm our five-year price target of $38 due to earnings estimates and now rate shares of Southside Bancshares as a buy due to projected returns.

In addition, the dividend payout appears sustainable.

More By This Author:

High Dividend 50: Comerica Inc.High Dividend 50: Clearway Energy Inc.

High Dividend 50: UGI Corporation

We provide an annual ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis ...

more