Here’s Rigetti’s Buy The Dip Price Target

Image Source: Unsplash

Is the Run Over for Rigetti Computing?

After surging more than 200% in just over a month, shares of Rigetti Computing (RGTI) are finally cooling off - and that’s not a bad thing.

As of Thursday morning, the stock is down another 5% and has now slipped more than 10% from recent highs. The sharp pullback marks the first meaningful correction since the stock exploded off its September lows, and it's happening right as the stock tests a critical round-numbered price level: $40.

Timely Bubble Talk Triggers Selling

The decline was triggered, in part, by a Barron’s article warning that “Quantum Stocks Look Like They’re Forming a Market Bubble.” The timing of the headline aligned almost perfectly with the peak in RGTI’s price, underscoring how sentiment shifts can act as a catalyst for short-term tops - especially in speculative growth sectors.

Technically, Rigetti was overbought heading into October. The stock’s Relative Strength Index (RSI) pushed well above 70, a classic signal that prices have stretched too far, too fast. That’s typically followed by a period of consolidation or outright correction - exactly what we’re seeing now.

Options Traders Signaling a Short-term Trading Range

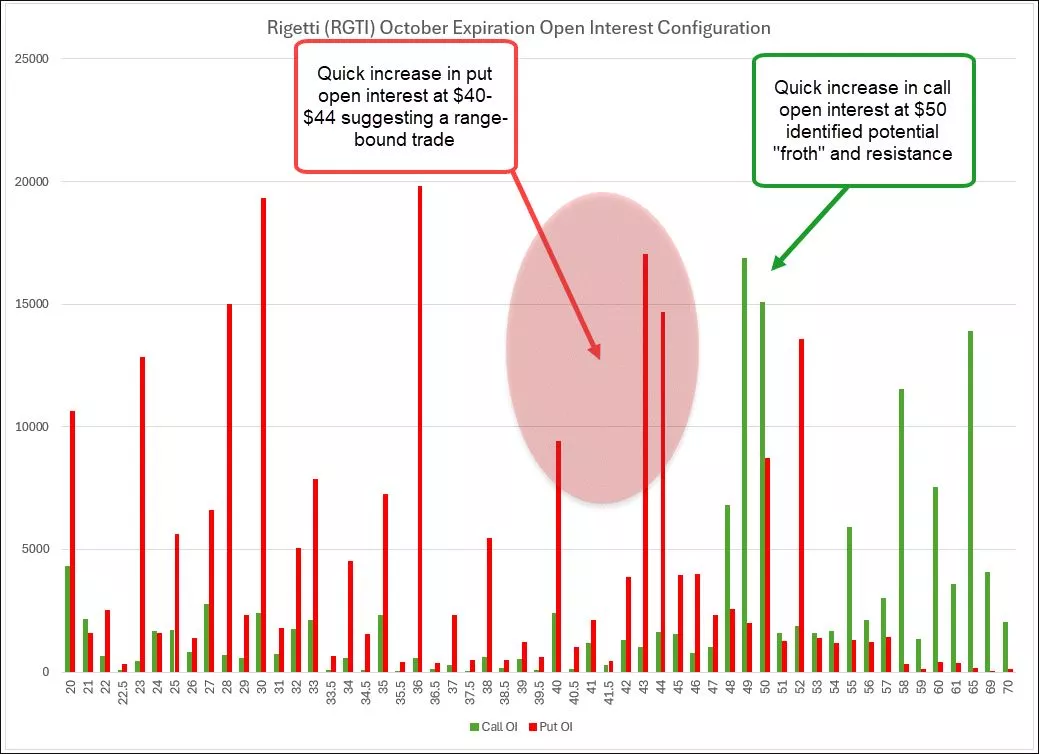

On top of stretched technicals, Rigetti’s options market was flashing red flags.

In the first week of October, there was a surge in call buying at the $50 strike, a clear sign that short-term sentiment had gotten frothy. This kind of speculative activity tends to mark local tops, as too many traders begin leaning bullish at the same time.

At the same time, interest in the October $40 puts has been rising, suggesting growing hedging activity, or outright bets that RGTI will fall further in the short run.

Together, the $40–$50 range is shaping up to be a battleground zone and a likely short-term trading range.

Rigetti’s Technicals Support a Buy the Dip Opportunity

From a technical perspective, $40 is key support, coinciding with the 20-day moving average, what I refer to as the “Trader’s Trendline.”

As long as RGTI holds above this level, the short-term uptrend remains intact. Even deeper support comes into play at the rising 50-day moving average, currently near $22.80.

Bottom Line:

Rigetti’s recent move was parabolic, and the current correction is both healthy and expected.

Traders should watch the $40 level closely. A dip toward that zone - especially if paired with slowing volume - could offer a high-conviction buy-the-dip setup in one of quantum computing’s most promising pure-play names.

More By This Author:

Lithium Americas Is Down Big: Is This A Warning Or An Opportunity?

ASML Stock Breaks Back Above $1,000: Earnings Signal A Durable Bullish Trend

Intel’s Down Big: Is This A Discount Or A Worrying Harbinger?

See disclaimers here.