ASML Stock Breaks Back Above $1,000: Earnings Signal A Durable Bullish Trend

Image Source: Pexels

Shares of ASML Holding (ASML) are trading back above $1,000 this morning after the company’s latest quarterly report reinforced confidence in the semiconductor equipment leader’s long-term growth trajectory.

ASML is one of the very few companies that designs and manufactures extreme ultraviolet (EUV) lithography systems. These machines make the world’s most advanced chips possible.

ASML’s technology is essential to customers like TSMC, Intel, and Samsung as they race to produce smaller, faster, and more energy-efficient processors that power the expanding AI and data center ecosystem.

On Wednesday, ASML reported third-quarter earnings of €5.49 per share, slightly above expectations. Revenue came in at €7.52 billion, just shy of forecasts, while new orders totaled €5.4 billion, including strong demand for its advanced EUV chipmaking systems.

Looking ahead, the company expects fourth-quarter sales between €9.2 and €9.8 billion and 2025 revenue growth of about 15%, roughly in line with analyst estimates. Profit margins should stay healthy at 51–53%, and management said 2026 sales won’t fall below 2025 levels.

ASML also announced a €1.60 dividend and plans to extend its share buyback program next year.

ASML’s Chart Analysis Remains Bullish

From a technical standpoint, the stock’s recent behavior highlights remarkable strength within the semiconductor sector.

ASML shares rebounded sharply from a 10% correction that tested and held the 20-month moving average near $950, a textbook display of support confirmation ahead of earnings.

The stock’s surge back above the $1,000 psychological threshold now reestablishes its long-term bullish trend.

The broader semiconductor space received an additional boost Wednesday after Nvidia (NVDA) was upgraded, extending the momentum across AI hardware suppliers.

Year-to-date, ASML is up 45%, outperforming the broader market as investors continue to prioritize exposure to AI manufacturing infrastructure rather than the chip designers themselves.

Wall Street Upgrades Likely

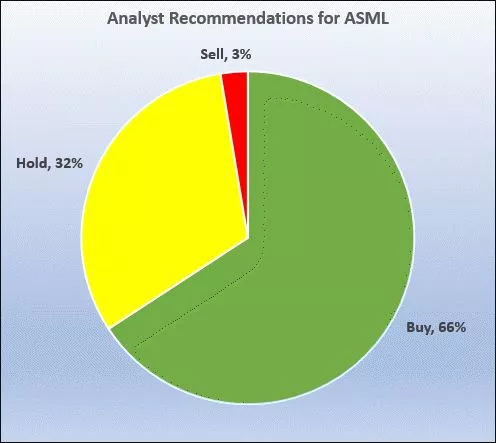

Despite the strong run, analyst sentiment still trails price action.

Only 66% of 38 analysts currently rate ASML a “Buy,” while the average price target remains $938.20, well below current levels. That disconnect implies that a wave of price target upgrades is likely in the coming weeks, adding another technical tailwind to the rally.

With fundamental guidance intact, bullish momentum accelerating, and AI-driven chip demand expanding, ASML remains positioned to lead the next phase of the semiconductor upcycle.

Bottom Line

From a long-term view, the chart supports an extended price target of $1,200 as institutional money continues to rotate back into core semiconductor infrastructure plays.

Beat the market, without relying on brokers or biased institutions.

More By This Author:

Intel’s Down Big: Is This A Discount Or A Worrying Harbinger?

Palantir Prepares To Explode: Why $220 Is In Play

Energy Fuels Soars on Renewed Enthusiasm For Next-Gen Resources

See disclaimers here.