Intel’s Down Big: Is This A Discount Or A Worrying Harbinger?

Image Source: Pexels

Long a tech laggard, Intel (INTC) received a critical lifeline in August from an unexpected source: the U.S. government. Under the agreement — facilitated by the Trump administration to support the continued expansion of American technology and manufacturing leadership — the government will invest $8.9 billion in INTC stock. Combined with other funds, the total investment came out to $11.1 billion.

Naturally, INTC stock has benefited handsomely from the catalyst. In the trailing six months, the security jumped about 73%, bringing its year-to-date performance to nearly 75%. However, the sharp spike raises an important question that everybody’s asking: how long can this rally last?

Apparently, Wall Street provided an answer: not long.

During Tuesday’s late-morning session, INTC stock dropped roughly 6%. Essentially, analysts have started to raise concerns about the security’s premium justification. Currently, INTC trades at 56.5-times forward earnings. Around this point last year, the multiple was between approximately 21 and 22.

Of course, it’s not that these figures have absolute intrinsic meaning. However, the point is that investors are now paying considerably more for each dollar of expected earnings. If Intel can’t deliver the goods (and then some) for its upcoming disclosure — which is scheduled to be released in around a week-and-a-half from now — INTC stock risks stumbling.

More and more, it’s looking like a case of buy the rumor, sell the news. While INTC stock has obviously benefited from executive support, the underlying company must now convince investors to continue putting their capital at risk. Given the company’s history of miscues, that could be a tall order.

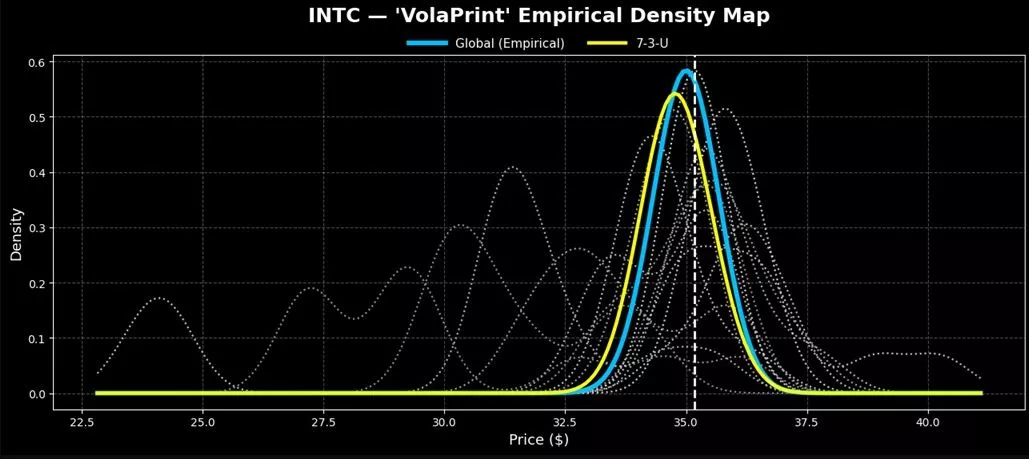

Another factor warranting caution regarding INTC stock is its probabilistic distributional curve. As a baseline, the chances that a long position entered into Intel stock will be profitable over the next 10 weeks (assuming data starting from January 2019) is poor, around 46%. Under a bell curve distribution, more outcomes are likely to fall south of the starting point.

Quantitatively, INTC stock is currently flashing a 7-3-U sequence: seven up weeks, three down weeks, with an overall upward trajectory. When isolating just for this population group, the expected long-side success ratio is worse, closer to 44%.

When considering the steep wall that Intel must climb, along with the rich premium that the Trump administration provided INTC stock, the better approach may be to wait. If INTC reverts to the mean, speculators would be able to dive in at a lower price.

More By This Author:

Palantir Prepares To Explode: Why $220 Is In Play

Energy Fuels Soars on Renewed Enthusiasm For Next-Gen Resources

Trump ‘TACO’ Trade Helps Skyrocket Rigetti Computing Stock

See disclaimers here.