Hassett To Replace Powell: Betting Markets Are Confident

Based on comments from President Trump and the odds on the Kalshi betting site, shown below, Kevin Hassett is the likely nominee to replace Jerome Powell when his term as Fed Chair ends in May. While still half a year away, the market is beginning to price in what a Hassett leadership might mean for Fed policies.

For starters, it appears that Hassett will support lower interest rates. Per Morningstar:

In November, Hassett told Fox News that he would be “cutting rates right now” if he were Fed chair. Also last month, during an event with the Economic Club of Washington, he indicated a preference for a more substantial 50 basis-point rate cut and said he agrees with Trump’s view that interest rates could be much lower.

Based on prior comments, he is also likely to steer the Fed toward rules-based monetary policy. This entails abandoning discretionary policymaking in favor of a mathematical formula(s) to set interest rates based on economic and financial indicators.

On the regulatory front, Hassett has a supply-side economic philosophy. Such a view emphasizes deregulation as a tool to stimulate economic growth and investment. Thus, he would likely favor easing post-2008 bank capital rules, as President Trump has also discussed.

Assuming Hassett is the next Fed chair, the bond markets will have to figure out whether Hassett intends to put too much emphasis on driving growth with lower rates and fewer banking regulations. If so, will he neglect the Fed’s price-stability mandate?

What To Watch Today

Earnings

(Click on image to enlarge)

Economy

(Click on image to enlarge)

Market Trading Update

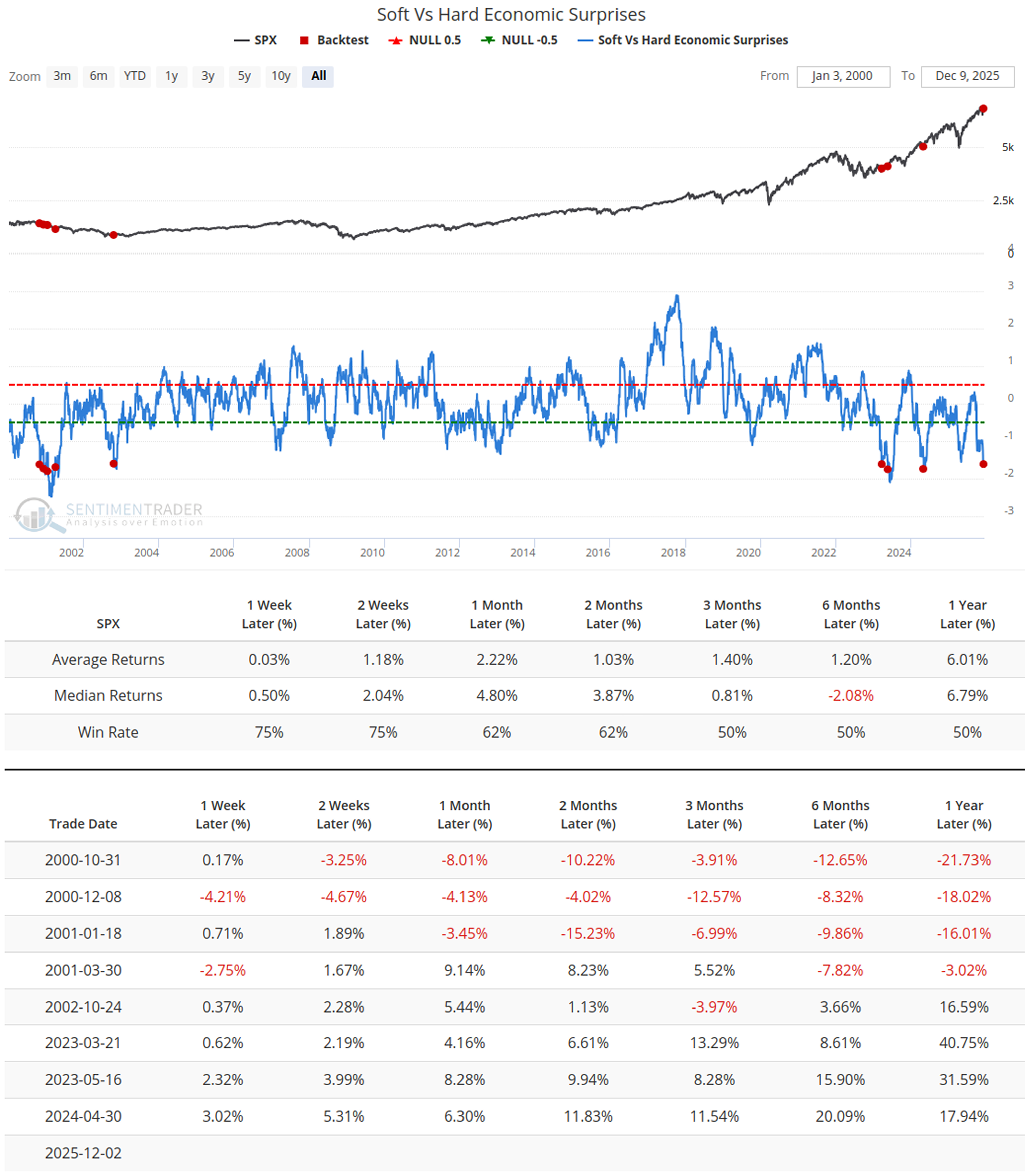

Yesterday, we discussed the resurgence of bullish optimism that is supporting markets heading into year-end. Interestingly, Sentiment Trader had an excellent piece discussing the divergence between sentiment, capital, and data. To wit:

“As the saying goes, “Confidence is more valuable than gold.” We use the gap between the Soft Vs Hard Economic Surprises Index to quantify this disconnect-soft data reflects people’s perceptions (surveys, confidence), while hard data represents actual economic output (employment, GDP). Recently, this indicator has fallen below -1.6, and the chart below shows market performance when the index hit this level historically.”

“This signal has been triggered 9 times in history. It first emerged at the end of 2000: people’s perceptions were extremely negative, and subsequent events validated these feelings-hard data collapsed, and the stock market plummeted by approximately 18%-21% over the following year. The signal reappeared in early 2023: despite widespread fears of an imminent crisis, hard data remained resilient, eventually disproving the pessimism, and the stock market surged by around 30% in the subsequent year.

The index has now fallen below -1.6 once again. If future hard data (nonfarm payrolls, GDP) can maintain even mediocre performance, this pessimism will instead present a trading opportunity; conversely, a weakening in hard indicators will open up downside potential for the market.”

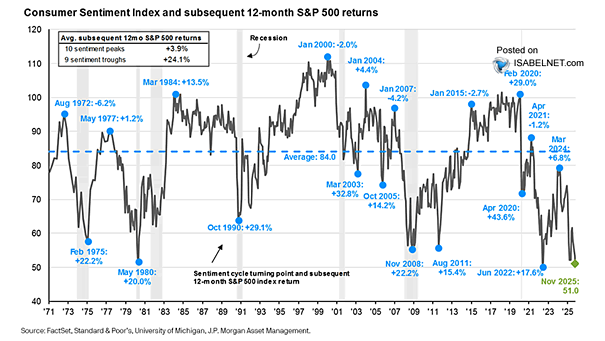

That is correct; if the data can maintain its current levels, it has historically marked near-term market lows. We discussed the same concerning consumer sentiment yesterday morning on X.

“Historically, sharp drops in consumer sentiment have tended to precede strong stock market rallies, often turning pessimism into a springboard for future gains. In other words, sharp drops in sentiment eventually reverse as the “wealth effect” takes hold.”

The point here is that sometimes weak economic data or sentiment can mark turning points in those data sets. In other words, economic slowdowns and recessions don’t last forever. They eventually end, and growth returns. However, the difference is that markets are currently near all-time highs, rather than being washed out, which typically occurs during periods of weak economic growth and sentiment. Does that mean “this time is different?” Probably not, however, as Sentiment Trader concluded:

“The current market exhibits complex structural characteristics. Short-term sentiment indicators (e.g., the LOBO Put/Call Ratio) point to exuberant trader sentiment, suggesting the market may enter a phase of volatility or face pullback pressure. Meanwhile, there are divergences in market structure: a disconnect between asset valuations (negative ERP) and capital behavior (high institutional positioning), as well as a gap between economic perceptions (weak survey-based soft data and consumer confidence) and actual output (hard data performance).”

In other words, continuing to manage risk and exposures remains an optimal strategy until the market declares its next move.

A Hawkish Cut

Markets are increasingly focused on the possibility of a “hawkish cut” at tomorrow’s Fed meeting. Such entails a cut in the Fed Funds rate, alongside messaging that stresses data dependence and elevated inflation risk. Furthermore, they will likely frame the rate cut as an adjustment from a highly restrictive stance rather than the start of an aggressive easing cycle. If they take such an approach, Powell could highlight the resilience of the labor market and repeat that inflation is not yet back to target. That combination would allow the FOMC to justify a cut while also trying to pacify the market’s inflation concerns.

A hawkish cut could reveal itself in both the statement’s language, Powell’s press conference, and the Fed’s quarterly SEP dot plot. The statement and press conference might emphasize phrases about inflation risks being “elevated” or “moving sideways,” and resist any suggestion that the balance of risks has clearly shifted toward growth. Powell could push back against the market’s assumption of a preset path of easing, insisting that future decisions will be “meeting by meeting.” The FOMC members’ forward projections (SEP) for 2026 might only include one or two rate cuts. Moreover, inflation estimates may tick slightly higher than last quarter’s SEP estimates. Such would further put the market on notice that the Fed is close to what they think is a neutral rate, given the circumstances.

It’s worth adding that expectations are growing that the ECB could increase rates over the next three to six months. It would be an odd situation for the Fed to be in a cutting cycle while Europe is raising rates.

How To Reduce Taxes On Investment Gains

Building wealth requires more than market awareness; it requires keeping as much of your earnings as possible. High net worth investors face steeper tax exposure, wider reporting thresholds, and more complex investment structures. Learning how to reduce taxes on investment income is one of the most effective ways to strengthen long‑term performance.

Below are the core ideas this guide will break down.

Key Takeaways

- Tax‑loss harvesting, applied strategically, can offset gains and lower taxable income

- Smart asset location improves after‑tax returns by placing the right investments in the right accounts

- Advanced tools like donor‑advised funds, trusts, and Qualified Opportunity Zones help reduce long‑term tax drag

- Income timing strategies can soften the impact of high‑earning years

- Working with a fiduciary advisor ensures your investment and tax plan operate in sync

Tweet of the Day

More By This Author:

Is Japan In A Death Spiral?: A Contrarian TakeThe DPI Link To Margin Debt

1 Million Layoffs

Disclaimer: Click here to read the full disclaimer.