Groping For A Low… Again

The streak was broken! Whether you look at the S&P 500 or the NASDAQ 100, we no longer have to hear about either index being up X straight Mondays. It was certainly an odd phenomena. My cursory view of Fridays didn’t reveal any “sign of relief” type rally where Thursdays and/or Fridays were sold ahead of the weekend. I am sure someone a lot smarter than me can probably find some rationale.

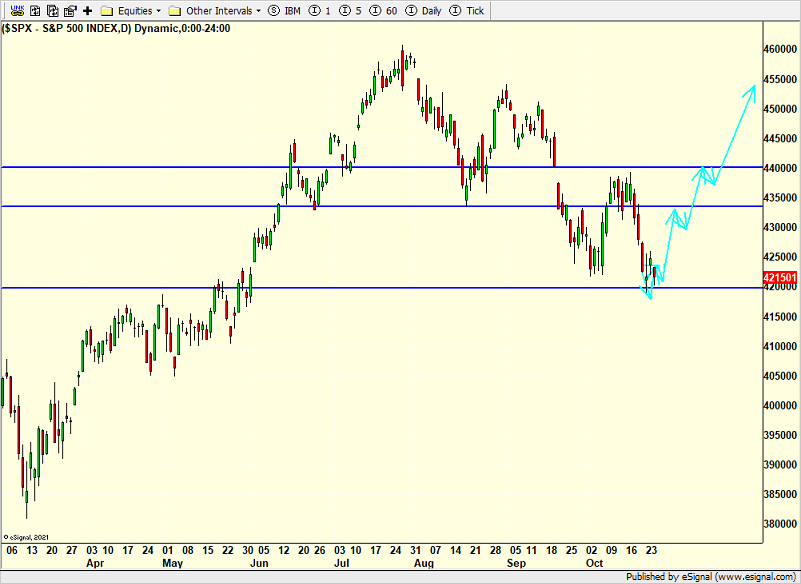

The S&P 500 fell below 4200 on Monday and into the next range for a potential bottom. As we saw a few weeks ago, price has met at least the minimum downside target. The key now is for there to be confirmation which is supposed to come this week.

(Click on image to enlarge)

One of the items that continues to not line up for the low that launches the rally into January is that the Volatility Index (VIX) seems to just be rallying and isn’t spiking like we usually see at solid bottoms. Mind you, it doesn’t have to do, but it’s something I like to see. Maybe it comes today or tomorrow or not at all. We will see.

(Click on image to enlarge)

More By This Author:

After An Ugly Friday For The Bulls, It's Monday - Time To Build Some Q4 Scenarios

Short-Term Turns Down – Q4 Studies Still Point Higher

Medicare, Social Security And A Drop In Stock Market Risk

Please see HC's full disclosure here.