GreenTree Hospitality Group: Value Is In The Details

Recommendation Summary

(Click on image to enlarge)

*Source: Bloomberg

In my opinion, GreenTree Hospitality Group (GHG) has been a company mostly under the radar. Except for a big drop in July 2018 the stock hasn’t seen much action, so could we expect anything worthwhile from the company anytime soon?

The core investment thesis is that GHG has been undervalued by the market. The company grew revenues by an average of 20.7% for the last 2 years, has kept operating margins around 50% and according to their last earning’s call, they are expecting to grow around 20-25% in the next year. On top of that GreenTree acquired a majority stake in the Australian hotel chain, Argyle Hotel Management Group. Such a move will allow GHG to tap into a broader market in Southwest China especially focused on the growing middle-class in the country. Considering all this I find GHG a lucrative long target.

Company Background and Overview

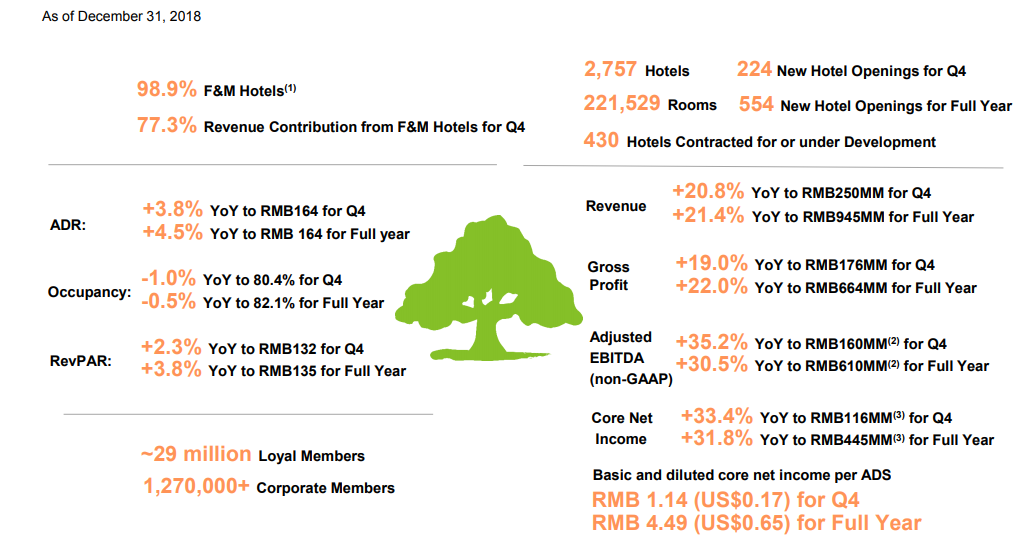

*Source: Company Presentation

GreenTree Group is the leading pure-play franchised hotel operator, headquartered in Shanghai, China, with the majority of its hotels both franchised-and-managed. In 2017, GreenTree was the fourth largest economy to mid-scale hotel group in China based on number of hotel rooms according to China Hospitality Association. Based on their last annual report, the company operates 2,757 hotels, which 368 of them were opened in the last 6 months. From all the hotels 98.9% fall under the franchised-and-managed model, which remains as the company’s primary focus.

In the last 2 years, GreenTree has focused more on opening new economy and up-scale hotels than their prevailing mid-scale. I find this as good news since this should bring diversification to GHG’s business and revenue stream as China’s upper-middle-class is expected to “explode” according to a McKinsey luxury report.

Investment Thesis

*Source: Company Presentation

Currently I believe the market overlooks GHG and as a result, it trades at a valuation below, its fair value. However, in the long-term I think the stock could present as an attractive long position due to the following reasons listed below:

- Above average metrics – With operating margins of 43% and ROIC of 30% GreenTree completely surpasses industry average operating earnings and returns on invested capital by 3 times.

- Increasing presence – GHG continues to build up the hotel pipeline and fuels accelerated growth. With further developments of business to mid-to-up-scale brands, the company has experienced rapid growth and increased number of hotels in operations. This has further fueled the increase in the revenue per available room of an average of around 4% YOY growth in the last year.

- Majority stake in Argyle Hotel Management Group - Argyle hotel network consists of eight mid-scale and upscale brands, from stylish business hotels to five-star luxury hotels. With such high-end hotels GHG will further be able to tap into the high-end hospitality industry while also increasing their geographic coverage.

- Investment in Gingko – Ginkgo is considered to be a pioneer in developing and providing higher education services for the hospitality industry in China. The company is currently ranked as China's number one hospitality university by the "Gaosan Web Association". This will help GHG not only with access to better personnel, but could also help offset the increasing wages in China. By hiring university graduates the company could also minimize the time-to-hire period, thus cutting out search time and skipping straight to the interview stage.

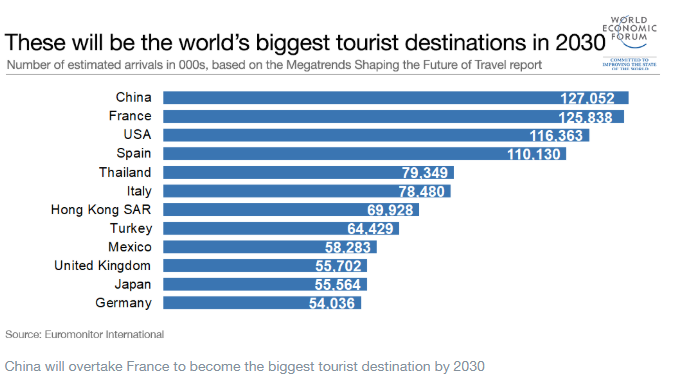

- China, the tourist destination of tomorrow – According to a research conducted last year in November, by 2030 China is expected to become the top tourist destination. The report estimates there will be 127 million arrivals in China each year by the end of the next decade, compared to 126 million in France and 116 million in the US. Euromonitor International’s Head of Travel Caroline Bremner said:

“Destinations like China are poised for a successful performance in inbound tourism, with China set to overtake France as the leading destination worldwide by 2030”

All of the factors presented will be extensively reviewed in more detail further in the analysis.

Below you can find several company metrics (based on my calculations) and see where the company stands right now. The numbers I have used for calculating these metrics are as follows, share price of ¥94.7 per share or $13.7 per share, Enterprise Value of ¥8,846 million and an EBIT of ¥428 million (EBIT has been calculated by including an adjustment for operating leases of ¥-107 million Chinese yuan) and shares outstanding of 101.6:

- P/E Ratio – 16x – Global industry average: 73.64x

- EV/Revenue – 9.4x – Global industry average: 2.48x

- EV/EBIT – 20.7x - Global industry average: 17.28x

Keep in mind the numbers I have used for global and U.S. industry averages are gotten from professor Damodaran’s website.

Per the numbers presented above, the company trades at P/E below the global industry averages for the sector and EV/EBIT and EV/Revenue above global numbers. These numbers may not incorporate the true underlying value of the company, but offer a quick overview of where it sits in a market of its peers.

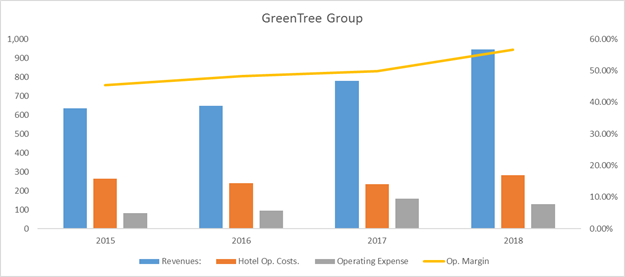

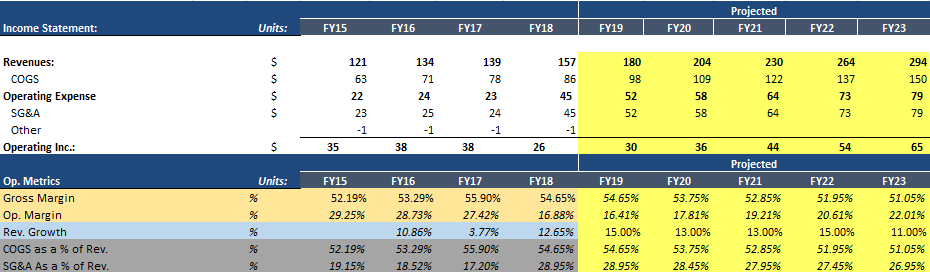

In the graph below, you can see how the company’s operating metrics have performed through the last few years, with margins clearly increasing with every coming year:

(Click on image to enlarge)

*Source: Company filings and author’s own estimates

Latest Results and Developments

*Source: Company Presentation

GHG recorded a 2018 FY revenue of ¥945 million, representing a yearly increase of 21.45% for the year, this reflects the continued growth of the hotel network with the pipeline of new hotels increasing to 430 at December 2018. In my opinion, the biggest highlight for the year was the increase in loyal members for the hotel group. Individual loyal members increased to 29 million, up by 38.1% from approximately 21 million members as of December 2017 and over 1.27 million corporate members, up by 54.9% from approximately 820,000 as of December 31st, 2017.

Below I will break-down the group’s key hotels they operate and focus on the revenue drivers.

GreenTree Inns

*Source: GreenTree Inn

The GreenTree Inn is the company’s biggest brand, it makes up for 67% of the total hotels in the group and accounts for 27.5% of the total revenue (I have calculated this using the ADR number). From this, I can conclude that the performance of the inns will strongly determine the company’s future. The GreenTree Inn falls under the mid-scale segment and focuses on the company’s main revenue driver, the middle class.

The first thing that caught my attention here was the fall in occupancy rate. Occupancy rate fell from 84.5% to 84.0% in 2018, but it was offset by the increase in ADR from RMB156 to RMB163 (this represented an increase of 4.49%) and at the end of the year revenue’s from the GreenTree Inn brand increased by 13%. Since the target market of the brand is the middle class, I will tie the brand’s future to China’s middle-class forecasts, 2-nd and 3-rd tier cities as tourist destinations and the country’s investment in Tier 2 and Tier 3-4 cities, since growth in these locations could actually fuel more business travel, thus increase occupancy rates throughout the GreenTree Inn and similar mid-scale brands.

Low-Tier City Growth

From the year 2000 to 2018 China’s middle-class urban population rose over 30%. A study by McKinsey projects that 76% of China’s urban population will enter the middle-income bracket by 2022.

Since the year 2000, China introduced several projects designed to fuel economic growth in lower Tier cities like the “Rise of Central China” and the “Go-West Strategy”. These projects focused on infrastructure development and were set to decrease the economic gap between East and West China. Since the development of this program several Tier 2 cities like Chengdu, Wuhan and Chongqing have shown tremendous growth. The strategies attracted many foreign business investments from wholesale, retail, and commercial/lease service sectors to bioscience and high-end equipment and high-tech services.

There has also been growing consumption demands in lower-tier cities. Cities including third- and fourth-tier ones and those below, have seen significant consumption upgrading. Moreover, the population in lower-tier cities has grown faster than in major metropolitan areas and with that, we could also expect urban and industry developments to grow along. Five industries are considered to be presenting the main prospects for growth: Internet, autos, healthcare, education, and tourism. Robin Xing, chief China economist at Morgan Stanley said:

“In our big picture now, these so-called lower-tier cities, they will be basically the major driver of growth in China in the next 10 to 15 years,”

With industrialization being a key focus in the government’s plan to fuel economic growth, thus accelerating in-country travel by 7.6% since a year ago, we could expect occupancy rates and ADR numbers throughout GreenTree group to increase.

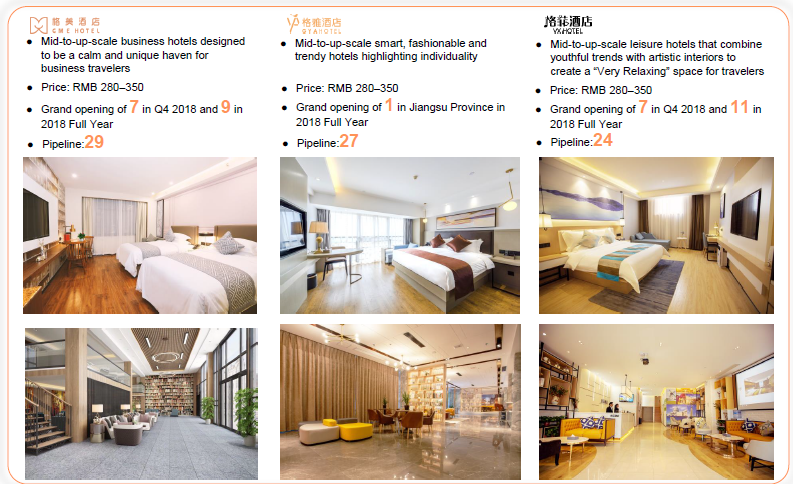

New Brands

*Source: Company Presentation

As mentioned above in the article the company has started diversifying its portfolio into a more mid-to-up-scale hotels. These hotels will support the growth in the overall average ADR and will further expand brand awareness among the upper-middle class of the population. I have tied the forecast for this group of hotels growth to the growth of salaries in China along with a growth of the upper-middle class.

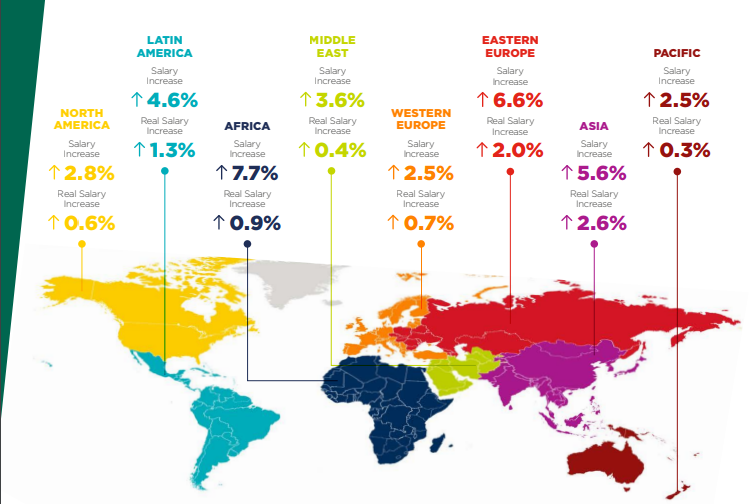

Salary Growth

*Source: KornFerry

According to KornFerry, Asia will experience one of the biggest salary growth in 2019. With a salary increase of 5.6% and a real salary increase of 2.6%.

Right now China sits at 4th place in the top 20 forecasted real salary increases in 2019 in the APAC ranking. Employees in mainland China are expected to report a real salary increase of 3.8% this year. ECA’s regional director for Asia Lee Quane said:

“Workers in mainland China are set to continue to see their salaries increase at the fastest rate in the Greater China region”

According to a research made by Robert Walters, hiring levels in China stood stable throughout 2018 supported by the maturing and continuously evolving market. Salary increments varied across different industries with an average of 10-20% for job movers. Bilingual candidates with niche skills, or those joining local companies, were offered a premium. Despite 2019 expected to be a slower recruitment growth year, technology recruitment in the Southern China region is expected to further develop. With all this being said 2019 is expected to be a year with an increase of counter-offers from companies seeking better talent by offering better and more competitive salaries. I would expect such a salary increase to further fuel the buying power of the Chinese people and thus accelerate the growth of the upper-middle class in China. This combined with faster than expected GDP growth in China could increase inbound travel and could make use of more mid-to-high-tier hotels more affordable.

Recent Acquisitions

Argyle Hotel Management Group

*Source: Argyle’s Twitter

GreenTree Group finished its acquisition of Argyle Hotel Management, at the end of March as Kevin Zhang, Argyle’s CEO remains one of the largest shareholders of Argyle. As mentioned above, the Australian hotel chain network consists of mainly midscale and upscale brands, from business to five-star luxury hotels. But the highlight of this acquisition for me wasn’t so much the high-end hotel brands as much as Argyle’s CEO. In the past Kevin Zhang has focused on opening hotels in less developed areas which are now considered to be top destinations for Chinese and tourists alike. The other highlight is that Mr. Zhang is a born Australian citizen and advises the Australian government on exports in the service sector, he is considered to be a mediator between China and Australia. In his own words in an interview on CGTN America he says:

“I try my best to promote the business between Australia and China, I think I am more in some way the messenger…”

I see this as an extremely positive M&A deal for GHG, benefits from increasing their geographical footprint, increasing high-end hotel brands and tapping into the Australian tourism market will surely have a positive effect on revenue and brand awareness.

Investment in Gingko

*Source: Gingko

On January 20th GHG closed an investment in HKSE IPO of Gingko Education (1851.HK). As mentioned above Ginkgo provides higher education services for the hospitality industry in China and is ranked as China’s number one hospitality university. The Chairman and CEO of Gingko had this to say:

“We are pleased to have GreenTree as our investor. This transaction is part of both companies’ larger plan to cultivate professional talents for the hospitality industry in China. It is a truly win-win cooperation that combines Gingko’s deep expertise in education with industry experience from GreenTree, a leading player.”

Since GHG invested in Gingko I suppose, GreenTree would like to see its money back, to see the university grow (in order to have easier access to personnel) and even make some more money on top, so this is why here I also did a short DCF analysis on Gingko based on the numbers from Yahoo Finance.

For the DCF analysis I have used the assumptions listed below, which got me to an equity value of HKD41.1 million and a share price of HKD0.08 per share with diluted shares outstanding of 500 million:

- A 10% WACC.

- Revenue growth for the next 5 years at an average of 13% per year and then slowly declining when reaching year 10 to the terminal growth rate of 3%.

- Operating Margin at an average of 19% in the first 5 years and then declining to the global industry average of 10.7% from year 6 to year 10, in order to be in-line with the global industry averages pre-tax operating margins.

- A ROIC at an average of 5.04%. For a terminal ROIC rate I have used 10.9%, the global industry average number.

- A sales to Capital ratio which starts from 0.35 to reaching 1.40 the global industry average for the Education industry.

According to my analysis, the company is overvalued by 2000%. Despite that, I think GHG’s benefits from this acquisition won’t be tied only to Gingko’s future market performance, but also to the underlying value the company can provide to the hotel group. By considered to be among the first in providing higher education services for the hospitality industry in China, the hotel group will have easy access to educated personnel for their constantly increasing hotel-chain.

Below you can find several company metrics (based on my calculations) and see where the company stands right now. The numbers I have used for calculating these metrics are as follows, share price of HKD2.1 per share, Enterprise Value of HKD1, 162 million and an EBIT of HKD27 million and shares outstanding of 500 million:

- P/E Ratio – 0.36 – Global industry average: 42.95x

- EV/Revenue – 7.4x – Global industry average: 2.16x

- EV/EBIT – 43x - Global industry average: 22.8x

According to my analysis, by paying HKD1.44 per share (HKD40 million investment buying 27.7 million shares), GreenTree overpaid for the company. Please keep in mind that my analysis is based only on numbers from Yahoo Finance since I could not find or read Gingko’s financial statements.

(Click on image to enlarge)

Source: Yahoo Finance numbers and author’s own estimates

Shares in New Century

On March 11th GreenTree announced that it has subscribed shares in the new upcoming Hong Kong IPO, Zhejiang New Century Hotel Management. New Century operates and manages 150 mid-to-up-scale hotels in China, ranks third in the country and has the highest market share among domestic hotel groups in terms of the operating and contracted upscale hotel rooms. I think such investments could open the door to new potential collaboration between the two companies, such a move could bring more value to both companies’ customers. New Century plans to spend about 25% of the proceeds from the IPO to develop high-end business and resort hotels.

Income Statement

Revenue

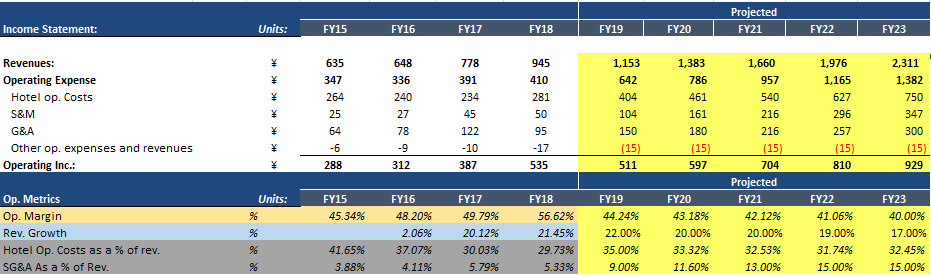

As we can see from the income statement below, revenues have increased dramatically in the last 2 years compared to 2016. These increases in revenue were mainly driven by continued growth in the hotel network, with an increase in hotel openings in 2018 compared to 2017 by 30%.

For the 5 years ahead I expect the company to grow at an average of 19.6% per year. I believe such a growth will be supported not only by GHG’s own hotel growth but the growth that comes from Argyle Group. At the same time, I am also trying to not overvalue the revenue growth in the company since the global annual average growth in the hotel industry for the last 5 years is 10.2%. I think going beyond the 22% mark will significantly overvalue the company in the future.

(Click on image to enlarge)

Source: Company filings and author’s own estimates

Hotel Op. Costs

Hotel operating costs have increased by 20% in 2018 compared to 2017, fueled mainly by the increasing number and higher salary of general managers in the hotel network and the higher operating costs for four newly added L&O hotels. Despite this increase, operating costs have consistently fallen as a % of Revenue, although I have not seen the company address this in their Q4 earnings call, I think this fall is attributable to the increasing number of the economy hotel segment in the portfolio.

As the business-to mid-to-up-scale hotel portfolio increases, I anticipate an increase in operating costs as a % of revenue. With Argyle’s main focus ranging from business to five-star luxury hotels, I expect operating costs as a percent of revenue to increase, mainly due to higher salaries and higher personnel number.

Catalysts

Catalysts in the next 12-24 months for the price to increase include:

Increasing Tourism in China

(Click on image to enlarge)

*Source: Weforum

According to the report in Weforum, travel across Asia is taking off, with both inbound and outbound trips on the increase, supported by sporting events like the Winter Games in Beijing in 2022 and the Tokyo Olympics in 2020. Within Asia, China is seeing the biggest tourist growth, as the inbound market supported by both domestic and outside tourism is set to become the biggest in the world by 2030. Domestic trips are expected to reach 6.7 billion by 2023, an increase from 4.7 billion in 2018. Wouter Geerts said:

“Tourism is a key pillar of the Chinese economy, and much investment has been made to improve infrastructure and standards, in addition to tourism-friendly policies and initiatives.”

Valuation

DCF Analysis

The analysis I have done here is a base case scenario built on GHG’s current and expected future performance in the market.

For the DCF analysis I have used the assumptions listed below, which got me to an equity value of ¥12,726 million and a share price of ¥125.26 or $18.12 per share with diluted shares outstanding of 101.6:

- A 7.3% average discount rate.

- Revenue growth for the next 5 years at an average of 19.6% per year and then slowly declining when reaching year 10 to the terminal growth rate of 3%.

- Operating Margin at an average of around 40% for the next 10 years.

- A tax rate at an average of 25% for the next 10 years.

- An ROIC at 28% at year 1 and slowly decreasing throughout the years until reaching 26% at year 10 and getting closer to industry averages. For a terminal ROIC rate, I have used 10.2%, the global industry average number.

Please take into consideration that the scenario I have used in the above section in the analysis is pretty easily achievable with the underlying value the company has, combined with the management’s views for the foreseeable future.

Risks

Salary Increases

According to Salaryexplorer, salaries in China are on the rise in the year 2019 based on recent submitted salaries and reports. As salaries increase and GHG continues to increase the number of managers in hotels we could see a drop in margins in the years ahead.

Key Takeaways

In considering all catalysts and risks, I think there is a high possibility that GHG’s stock price will experience a significant increase. With GHG’s diversified investments across the hospitality industry from economic to luxury hotels and education, the company has positioned itself well in the Chinese hospitality industry.

Disclaimer:

Why is the stock declining?

Good question.

Must be related to geopolitical risk (e.g., trade war), governance risk, FX risk, lack of trust around accurate accounting and reporting? Hopefully the auditors can at least confirm the cash balances though, which seem to be growing even with significant investment.

$GHG has been up today. How do you feel about it now?

I think the multiple is far too low considering how much cash and growth they are generating. We'll see.

I would be careful with the trade war. You have to be patient with this one.

This is a domestic player within China, not a global player. They're less exposed to cross-border risk compared to say semi-conductors, or many large global players. Who knows how the cards shake out, and if anything I feel like it is a good hedge against a larger global or US centric portfolio. They're may be some currency risk on the exchange rate, or risk if the gov't decides to somehow impact corp governance, but I feel there is plenty of upside as well. I also think Trump is too focused on the economy (seems to be his #1 priority) to push the trade war too far - he is just negotiating.

I do aggree tat does make sense, but 2 things. First they are opening hotels in the US and are also looking into other options. Second altough this makes full sense the market loves to overreact, just look at cannabis stocks

@[Will Master](user:103240), very thoughtfull response.

Agreed. Lot's of uncertainty.

An impressive thorough analysis as usual. $GHG.

Yes but not great timing as $GHG is down at the moment.

Great to see such a thorough analysis of $GHG. Not sure why more people aren't covering this stock.

Lol, I was just about to say the same thing. Great minds think alike.