Fundamental Analysis: Principles, Types, And How To Use It

Image Source: Unsplash

Introduction

After more than five decades in the securities industry, I can say with conviction that fundamental analysis is the bedrock of sound investing. From my earliest days on Wall Street to co-founding FAST Graphs, I’ve seen fads come and go, but one principle remains: the business behind the stock is what matters most.

In this article, I will walk you through the principles, types, and practical applications of fundamental analysis in stocks, sharing the lessons and tools that have shaped my career and helped countless investors make better decisions based on fundamental data rather than speculation.

What Is Fundamental Analysis?

Fundamental analysis is the systematic evaluation of a company’s intrinsic value by examining its financial statements, business model, industry position, and the broader economic environment. Unlike the daily noise of market prices, fundamental stock analysis focuses on the underlying business performance, or stock fundamentals, that drive long-term returns.

In my experience, understanding the business behind the ticker is the only way to invest with conviction. Successful company fundamental analysis looks beyond price fluctuations to study real-world business performance — the earnings, cash flow, and balance sheet strength that determine the fundamental value of a stock.

Understanding How Fundamental Analysis Works

The process of fundamental analysis of stocks follows a logical approach. We analyze industry-specific trends and competitive dynamics. Then we dive deep into company analysis in fundamental analysis — reviewing revenue growth, profit margins, balance sheet strength, and management quality.

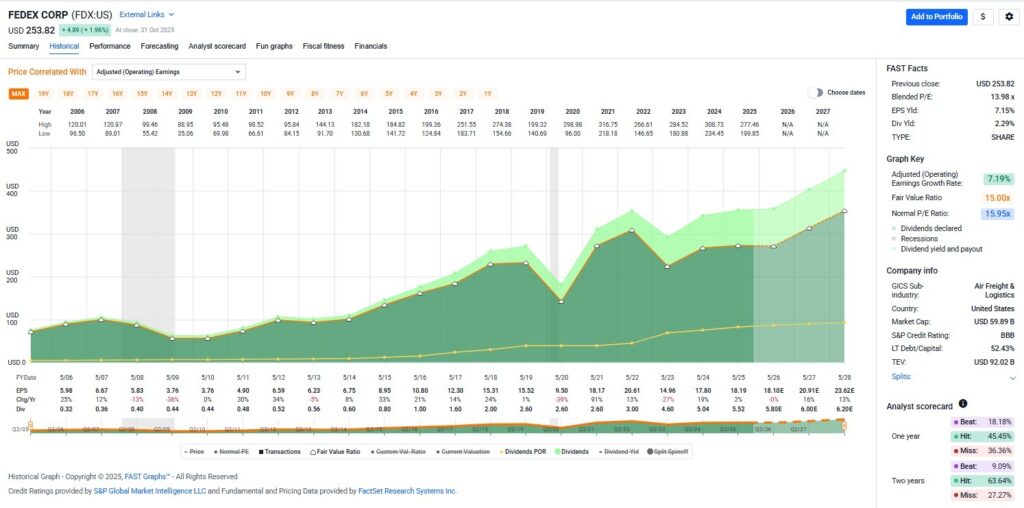

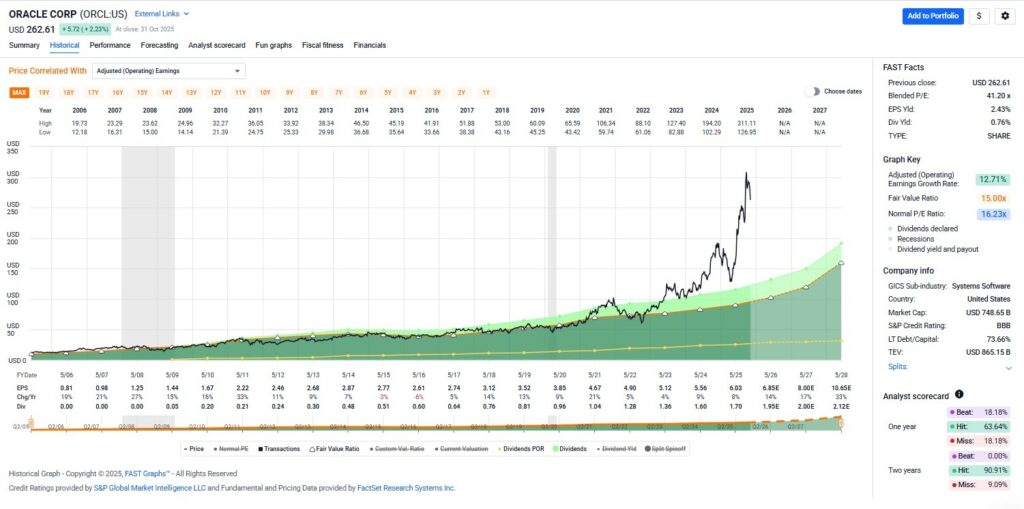

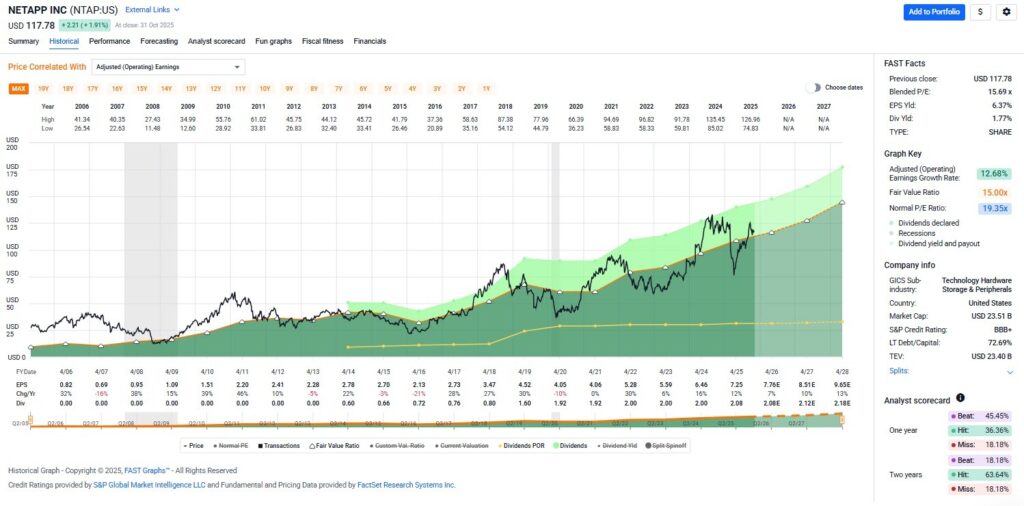

This approach allows us to determine whether a stock is trading above, below, or at its fundamental value. The “orange line” in FAST Graphs, representing intrinsic value, has always been my north star. When stock prices deviate from this line, opportunities arise for disciplined investors who understand what they’re buying.

The orange line on FAST Graphs is provided by widely accepted formulas rooted in discounted cash flow analysis, creating an intrinsic value reference line. These charts illustrate the operating history and success of the business behind the stock, showing how stock fundamental data aligns with long-term performance.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

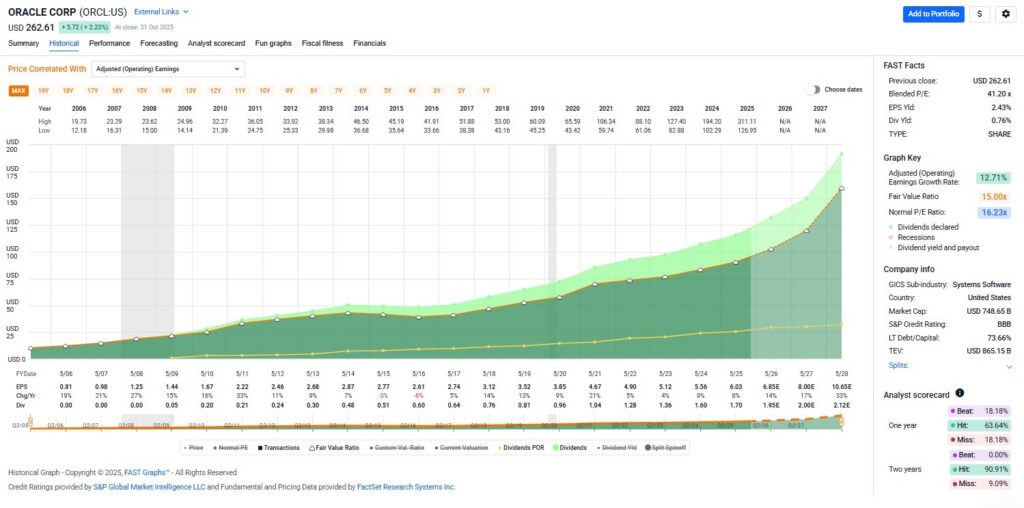

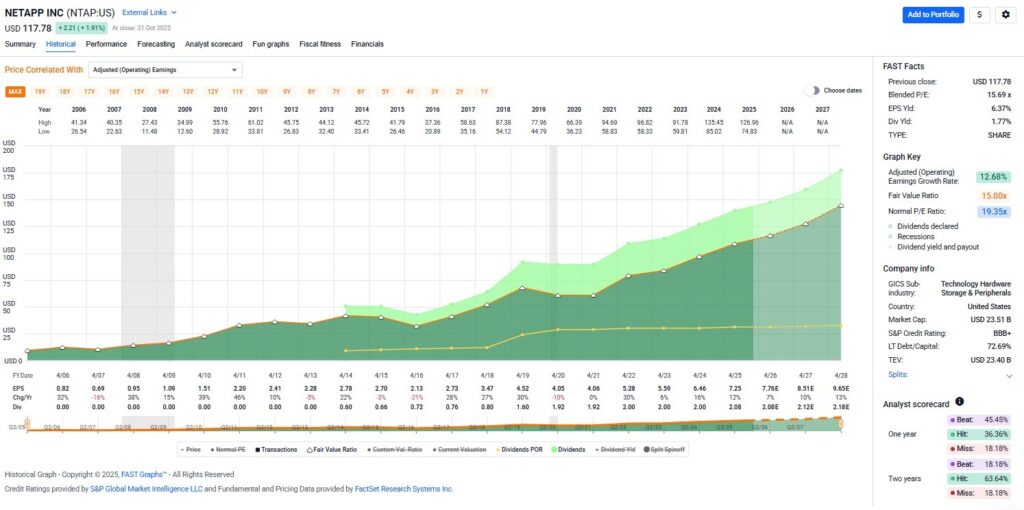

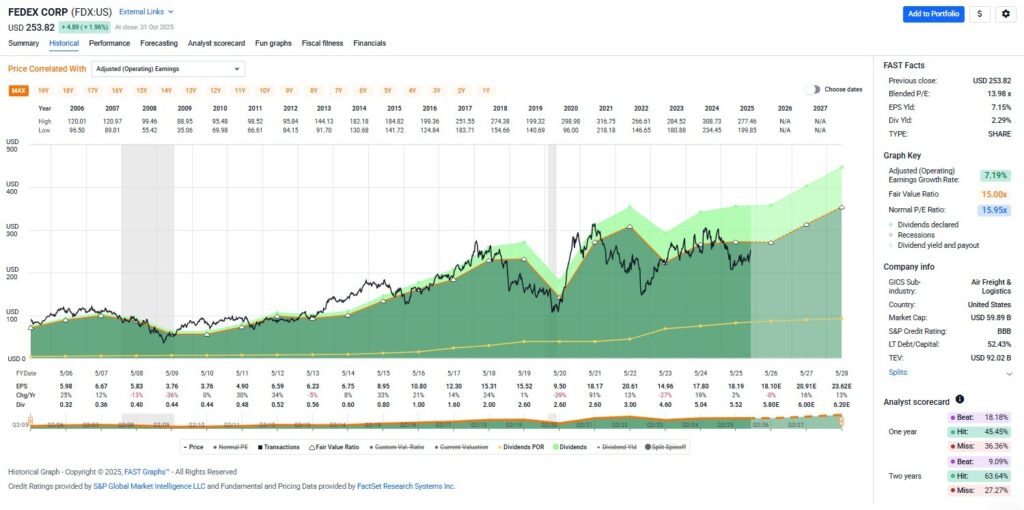

When stock prices are added to the graphs, the correlation between price and earnings becomes clearly apparent. This provides long-term proof of the importance of the intrinsic value reference line. In the long run, stock prices go where earnings go, and when they temporarily disconnect, they inevitably move back into alignment with their true fundamental worth.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Why Is Fundamental Analysis Important?

Over the years, I’ve seen investors chase hot tips and market fads, often to their detriment. Fundamental analysis in stocks provides the antidote to emotional investing by grounding decisions in objective, measurable data. When you understand the fundamental value of a stock, you protect yourself from overpaying during market euphoria and position yourself to capitalize when quality businesses trade at discounts.

Long-term wealth creation is driven by consistent earnings growth. Companies that grow earnings, maintain competitive advantages, and operate with financial discipline reward patient investors over time. Fundamental research gives you the confidence to hold through volatility, knowing your decisions are based on facts, not speculation.

As I always say, “Ignore the hype. Focus on fundamentals. Mind your owned businesses.”

Where to Find Fundamentals for a Company

Naturally, as cofounder of FAST Graphs, that is my go-to source to examine fundamental data. FAST Graphs gathers, organizes, and presents essential stock fundamentals at a glance. I know of no better way to examine the important fundamentals of an operating business than by using this powerful fundamentals analyzer software tool.

Thanks to FAST Graphs, reliable fundamental stock data has never been easier to analyze or evaluate — but knowing where to look is crucial. Here’s where I go in FAST Graphs for comprehensive company fundamental analysis:

Financials, FUN Graphs, and Fiscal Fitness sections

(Click on image to enlarge)

Additionally, FAST Graphs provides an “external links” drop-down that takes you to the company’s website and other financial sites that provide research and insights, for deeper fundamental research.

How to Read a Company’s Annual Report

Mastering the annual report is fundamental to successful equity fundamental analysis. Here’s my step-by-step approach:

- Letter to Shareholders: A broad overview from management outlining results, market position, and strategy.

- Management Discussion and Analysis (MD&A): The heart of qualitative company analysis — understanding the “why” behind the numbers.

- Financial Statements (provided in FAST Graphs):

- Income Statement: Focus on revenue growth, margin trends, and earnings quality.

- Balance Sheet: Examine debt, working capital, and asset utilization.

- Cash Flow Statement: Free cash flow is key for dividends, buybacks, and reinvestment.

- Notes to the Financial Statements: These footnotes reveal crucial fundamental indicators for stocks, such as liabilities or accounting policies.

- Risk Factors: Identify emerging threats or opportunities.

- Auditor’s Report: A clean opinion provides confidence; a qualified one is a red flag.

Key Finding:

The annual report isn’t just numbers — it’s the story of a business. Read it with a critical, inquisitive eye.

Quantitative and Qualitative Fundamental Analysis

Effective equity fundamental analysis balances hard numbers with soft insights.

Quantitative Analysis

This is the realm of measurable metrics:

- Earnings Per Share (EPS)

- Return on Equity (ROE)

- Debt-to-Equity Ratio

- Free Cash Flow

- Price-to-Earnings (P/E) Ratio

These fundamental indicators for stocks provide objective benchmarks. Tools like FAST Graphs visualize these relationships, making it easier to spot undervalued opportunities.

Qualitative Analysis

Numbers alone don’t tell the whole story. Assess:

- Management quality: Are they good stewards of capital?

- Competitive advantages: Does the company have a durable moat?

- Industry trends: Is the business model sustainable?

- Corporate governance: Are incentives aligned with shareholders?

Key Takeaway:

Quantitative analysis tells you what’s happening; qualitative analysis tells you why — and whether it’s sustainable.

Fundamental Analysis vs. Technical Analysis

The debate between fundamental analysis of stocks and technical analysis is as old as the market itself.

Fundamental Analysis

- Focuses on intrinsic value — what a stock should be worth based on business performance.

- Relies on stock fundamental data: earnings, cash flows, and balance sheet strength.

- Best for long-term investors seeking to build wealth over time.

Technical Analysis

- Studies price movements and trading patterns.

- Assumes all information is reflected in the price — an assumption I disagree with.

- Offers little guidance on what you’re actually buying.

I reject technical analysis as a timing tool because it can’t answer the most important question: What am I buying, and why? In my experience, fundamental stock analysis is the only way to invest with conviction and discipline.

Limitations of Fundamental Analysis

No approach is perfect. Here are the main limitations:

- Time Lag: Financial statements are historical.

- Market Timing: Stocks can remain mispriced for years, but they inevitably revert to intrinsic value.

- Information Quality: Some companies disclose poorly, though regulations help ensure transparency.

- Qualitative Uncertainty: Leadership changes and disruption can alter outcomes.

Summary Box:

Fundamental analysis is powerful, but not infallible. Use it as your compass, but stay humble and adaptable.

Conclusion

In my five decades as “Mr. Valuation,” I’ve seen that fundamental analysis is the surest path to long-term investment success. By focusing on earnings, valuation, and business quality, you can navigate market cycles with confidence.

Remember: Earnings drive long-term stock prices. Do your homework, trust the fundamentals, and invest with discipline.

Final Thought:

Valuation matters, and it matters a lot. Invest smarter by focusing on the fundamentals and letting the market’s short-term noise become your long-term opportunity.

More By This Author:

What Is Stock Valuation?

How The Stock Market Works: A Guide For Long-Term Investors

Discounted Dividend Method (DDM): Formula, Variations, Examples, And How To Use It

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more