How The Stock Market Works: A Guide For Long-Term Investors

Image Source: Unsplash

How Does The Stock Market Work?

Many people see the stock market as a casino, but according to Chuck Carnevale, co-founder of FAST Graphs and “Mr. Valuation,” the truth is far more rational. How does the stock market work? The market isn’t about luck — it’s a mechanism for allocating capital and rewarding disciplined investors who understand value.

If you’ve ever wondered how the stock market works or how to use it to make money intelligently, this summary breaks it down in simple, timeless terms.

The Stock Market Is Not a Casino

The stock market is a platform where ownership in real businesses is bought and sold.

It reflects investors’ collective judgment about value, opportunity, and risk—not randomness.

When optimism dominates, prices rise beyond fair value. When fear strikes, prices drop below it.

In the long run, fundamentals—not emotions—drive results.

Think of It as a Giant Auction

The market functions like an auction house guided by supply and demand:

- More buyers lead to higher prices.

- More sellers lead to lower prices.

Buying a stock means buying a real piece of a company—its assets, earnings, and cash flow.

Understanding Public Companies

Companies issue shares to raise capital for growth, innovation, or dividends.

When you buy shares, you become a partial owner—a shareholder—participating in both profits and risks.

Public companies must disclose their financials, giving investors insight into profitability, growth, and management quality.

Transparency allows for intelligent investing, grounded in facts rather than speculation.

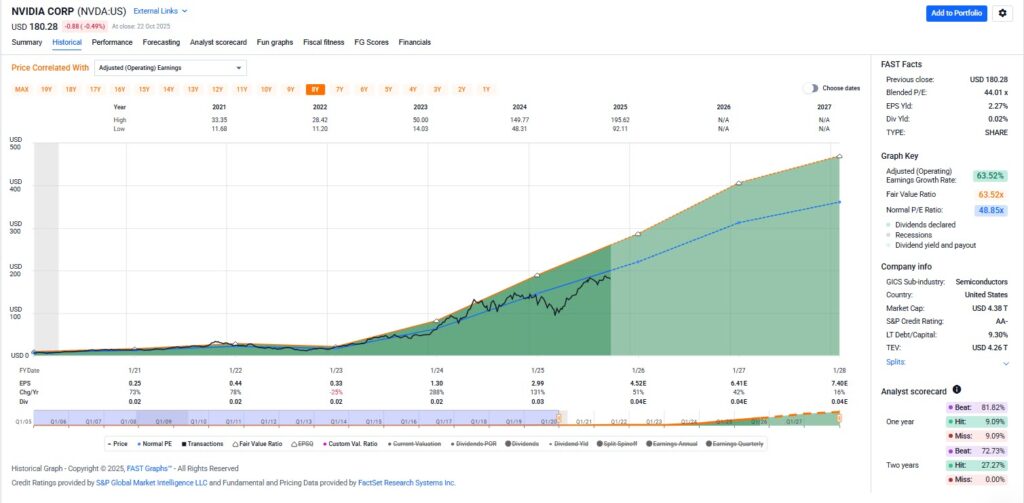

Price Always Follows Earnings

Over time, stock prices gravitate toward true business value—what Chuck calls the “orange line of intrinsic worth.”

When prices fall below this value, they tend to rebound. When they rise above it, they eventually correct.

FAST Graphs shows this visually, helping investors spot when a stock is overvalued, undervalued, or fairly valued.

Patience and discipline pay off because in the end, earnings growth drives stock performance.

Examples:

- Nvidia – A fast-growing AI company where price tracks powerful earnings expansion.

- Amazon – Long-term returns mirror operating cash flow growth.

- Utilities like American Electric Power – Slow but steady growth with reliable dividends.

(Click on image to enlarge)

The Many Faces of the Market

- Growth Stocks: High potential and volatility (e.g., Nvidia, Amazon).

- Income Stocks / Utilities: Slow, steady growers offering consistent dividends.

- REITs (Real Estate Investment Trusts): Priced on Adjusted Funds From Operations (AFFO), but still revert to fair value.

- ETFs and Mutual Funds: Pool many stocks, offering diversification (e.g., S&P 500 ETF, Russell 3000 ETF).

- ADRs: Allow U.S. investors to own foreign companies like Honda in U.S. dollars.

- Commodities: Gold, oil, and others can hedge inflation but do not produce income.

Investor vs. Trader

Investors focus on fair value and hold for the long term, letting compounding work in their favor.

Traders attempt to time market highs and lows—a nearly impossible task that often leads to losses.

As Ben Graham said and Chuck reminds us:

“In the short run, the market is a voting machine; in the long run, it’s a weighing machine.”

Successful investing means thinking like a business owner, not a speculator.

Key Lessons for Investors

- Price is what you pay; value is what you get.

- Focus on earnings, cash flow, and fundamentals—not short-term volatility.

- Undervalued stocks offer opportunity; overvalued ones carry risk.

- The market rewards knowledge, patience, and discipline—not emotion.

- Always remember: it’s a market of stocks, not a stock market.

Why It All Matters

The stock market fuels economic growth, innovation, and personal wealth creation.

For beginners and professionals alike, learning how the market works is key to long-term success.

When you use a research tool like FAST Graphs, you can see value clearly, ignore the noise, and make informed, confident decisions.

“Ignore the hype. Focus on fundamentals. Mind your own businesses.” – Chuck Carnevale

Video Length: 00:21:27

More By This Author:

Discounted Dividend Method (DDM): Formula, Variations, Examples, And How To Use It

FactSet: Evaluating The Recent Decline-Time To Buy Or Stay Away?

Comcast Stock Analysis: Is The Risk Worth The Reward?

Disclosure: Long NVDA, FI, AMZN, AMP, O

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or ...

more