Fluor Stock: A Boring Business That Might Outrun The Market?

Image Source: Unsplash

Fluor Corporation (FLR) is a global engineering and construction firm that designs and builds large-scale infrastructure projects. From nuclear power plants to data centers, Fluor plays a behind-the-scenes role in shaping essential industries.

While not flashy, the company has its hands in some of the most important trends of our time—energy transition, AI-powered data growth, and critical mineral mining.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess Fluor’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Revenue growth and backlog

Fluor reported $4 billion in revenue for Q1 2025, up 7 percent year over year. Their backlog sits at $27.7 billion, showing strong demand across sectors like data centers, pharma, energy, and large international infrastructure.

Earnings and profitability

Adjusted earnings per share rose 55 percent from Q1 2024. But a $477 million non-cash loss tied to their investment in NuScale pulled their GAAP results into negative territory.

Mega projects and wins

Fluor is involved in massive global projects, including a second multi-billion dollar pharma plant in Indiana, green metal facilities in Chile and Australia, and nuclear energy development in Romania. They also maintain a significant presence in Saudi Arabia, where they support major infrastructure tied to Vision 2030, including NEOM and other Giga projects.

Sector trends

Fluor is riding long-term global demand for clean energy, mining, data centers, and advanced manufacturing. Their exposure to regions like the Middle East gives them a strong pipeline in both traditional energy and futuristic mega builds.

Risk factors

NuScale losses continue to affect reported earnings. Supply chain pressure, especially in battery and energy components, could squeeze margins. Delays or overruns on large international jobs could create volatility.

Fundamental risk: medium

IDDA Point 4: Sentimental

Overall sentiment is bullish for Fluor.

Strengths

Investors are optimistic about Fluor’s exposure to long-term infrastructure trends, including data centers, clean energy, and global mining.

Wall Street is reacting positively to recent wins in pharma and energy, especially low-risk reimbursable contracts that reduce execution risk.

Management continues to highlight strong demand pipelines, especially in Saudi Arabia, the US, and Europe.

Analysts have upgraded the stock to Buy, with some setting price targets 40 to 50 percent above current levels.

The company’s Q1 buyback program shows confidence in long-term value.

Morningstar’s bullish outlook points to a growing global need for Fluor’s services as governments and corporations ramp up large-scale projects.

Risks

Some investors remain cautious due to the $477 million unrealized loss from NuScale, which hit GAAP earnings and raised questions about investment discipline.

Rising supply chain costs, especially in electrical and battery components, could weigh on project margins.

Political risks in international markets like the Middle East and Eastern Europe could delay or derail large-scale jobs.

Market sentiment toward industrials can shift quickly if macroeconomic conditions tighten.

Morningstar bears warn that Fluor’s legacy of cost overruns and weak execution on older projects may return if discipline slips.

Sentimental risk: medium

IDDA Point 5: Technical

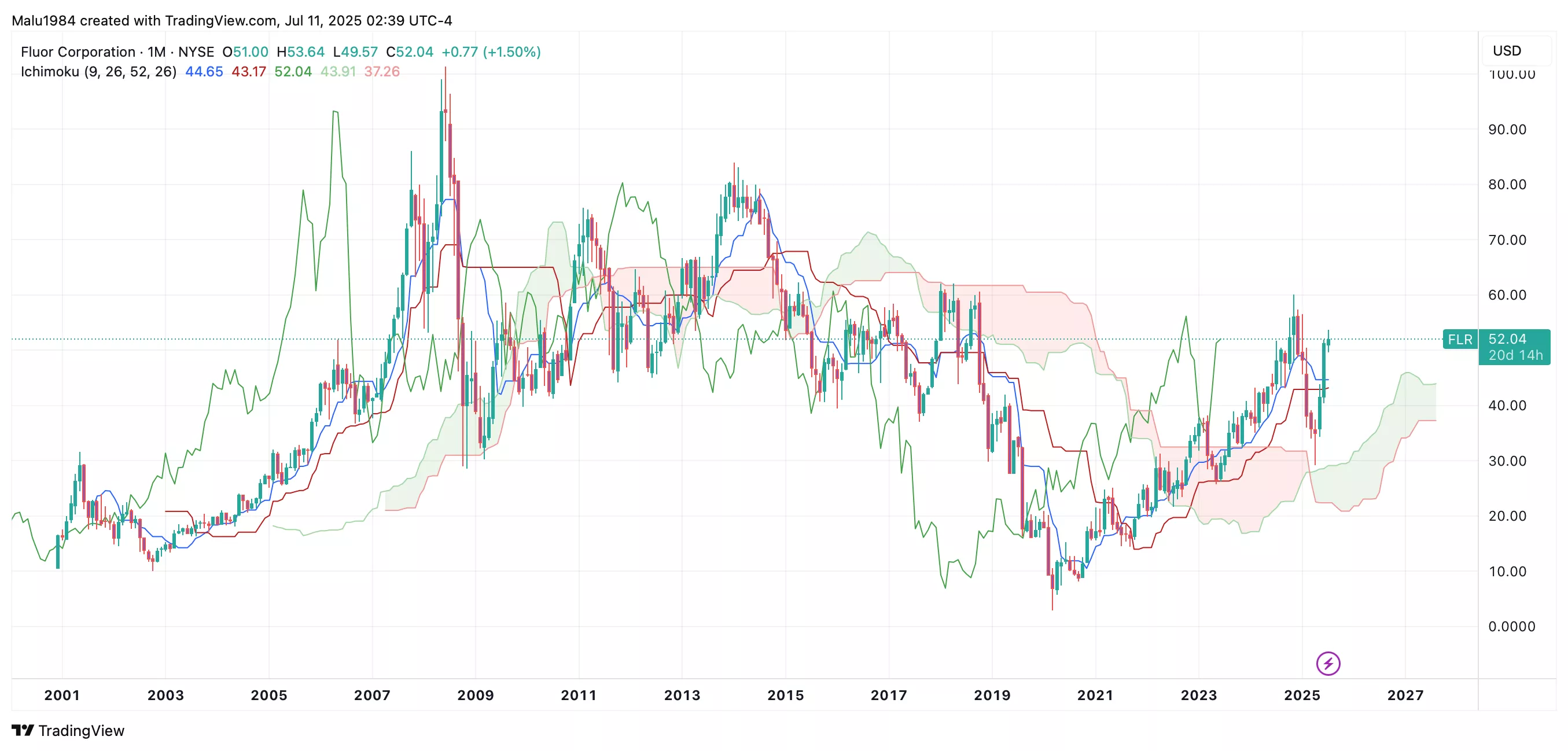

Monthly Chart

The long-term trend has been positive since 2020, despite choppy price action over the years.

The Ichimoku Cloud is bullish and price action is staying above it.

The stock dropped during March and April due to the Trump tariff-related market selloff but has since recovered.

Price is now just 13 percent below its pre-tariff peak and pushing upward again.

(Click on image to enlarge)

Weekly Chart

The Ichimoku Cloud is currently red, which is bearish, but it’s thinning out.

Recent candles are breaking out of the cloud, with the last candle sitting right on top. If this breakout holds, it may confirm a bullish trend.

The conversion line (Tenkan) has crossed above the baseline (Kijun), which is a golden cross—a bullish signal.

RSI is at 74, which is in overbought territory, meaning a short-term pullback is possible. This could happen without breaking the broader upward trend.

(Click on image to enlarge)

Fluor’s technicals show a strong recovery with bullish signals forming, especially if the price holds above the weekly cloud. While a short-term dip is possible due to overbought RSI, the setup supports continuation of the longer-term uptrend.

This stock is suitable for long term investors.

Buy Limit (BL) levels:

$46.82 – High Risk

$42.81 – Moderate Risk

$38.80 – Low Risk

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: medium

The long-term chart looks bullish, but the weekly cloud still shows some resistance. With RSI in overbought territory, a short-term pullback is likely before any strong breakout continues.

Summary: Final Thoughts

Fluor isn’t flashy, but it’s quietly building the future—literally. The company’s strong backlog, wins in pharma, mining, and nuclear, and major exposure to Saudi Arabia and clean energy make it a serious player in global infrastructure.

On the fundamental side, Fluor is growing revenue and signing huge contracts, but the NuScale loss and potential cost overruns on big projects still hang over its head. Sentiment is mostly positive, with analysts and investors leaning bullish thanks to strategic wins and strong guidance. But there’s caution too, especially around political risks and Fluor’s past execution issues.

Technically, the long-term trend is up and momentum is building. If price stays above the weekly cloud, we could see a breakout—though a short-term pullback wouldn’t be surprising given the RSI levels.

Overall, Fluor offers long-term potential with a few bumps in the short term. For patient investors who believe in global infrastructure and energy transformation, this might be a stock to watch.

Overall risk: medium

More By This Author:

Tesla $75b Robotaxi Dream Meets ‘America Party’ Reality

2 Big Reasons Why Atlassian Could Be A Top AI Stock In 2025 That Investors Can’t Ignore

Amazon Stock Bold Yet Quiet Robotics Expansion: Why Investors Should Pay Attention Now