2 Big Reasons Why Atlassian Could Be A Top AI Stock In 2025 That Investors Can’t Ignore

Image Source: Pixabay

Over the past 20+ years, Atlassian (TEAM) has become one of the most widely used platforms for team collaboration and project management.

Its tools like Jira, Confluence, and Jira Service Management are trusted by over 85% of Fortune 500 companies. Now, the company is stepping into a new chapter with its AI platform, Rovo, designed to make teamwork even smarter, faster, and more efficient.

But this isn’t just about adding AI, it’s about changing how teams work. Rovo is built into Atlassian’s premium plans, and it’s already being used by 1.5 million people a month, a number that jumped 50% in just one quarter.

By making Rovo widely available first, Atlassian is focused on building trust and everyday usage before trying to make big money from it. This approach supports its steady growth, with 94% of revenue now coming from subscriptions, and 65% from cloud-based services.

That said, there are challenges. Atlassian is spending more on product development and sales, which has led to short-term losses. Its shift to large enterprise clients has also slowed some deal-making.

But despite this, the company still generated a 47% free cash flow margin, showing that it’s managing its money wisely. With only 7.4% of its $67 billion market captured and a goal of growing revenue by 20%+ each year through 2027, Atlassian is aiming big.

So is Atlassian becoming the go to platform for AI-powered teamwork, quietly turning everyday workflows into intelligent systems?

Let’s look at Atlassian using the IDDA Framework: Capital, Intentional, Fundamentals, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Before investing in Atlassian, ask yourself:

Do you want to invest in the future of AI-powered tools for teamwork, productivity, and software development?

Do you believe Atlassian can keep growing by serving more enterprise customers and making work easier through AI?

Are you okay with short term price swings in exchange for long term growth?

Atlassian isn’t just selling software, it’s building the digital backbone for how modern teams operate. With a small share of its market captured and ambitious growth plans, there’s a long runway ahead.

Still, there are risks. The stock trades at a premium, its financial results can swing from quarter to quarter, and big competitors like Microsoft are always in the race. But Atlassian’s long term focus, strong products, and growing enterprise customer base give it an edge.

IDDA Point 3: Fundamentals

Atlassian is a well-established name in the DevOps and team productivity space. Its tools, like Jira for project tracking, Confluence for team documentation, and Jira Service Management for IT support are used by millions of teams worldwide. While it originally focused on software developers, Atlassian has expanded its reach to support HR, legal, finance, and other departments across large organizations. This makes its platform more versatile and valuable for entire companies, not just tech teams.

In the third quarter of fiscal year 2025, Atlassian reported $1.36 billion in revenue, up 14% from the same time last year. This consistent growth shows the company is continuing to expand its customer base and sell more premium services. Atlassian has also fully shifted to a subscription model, meaning customers pay regularly instead of one-time license fees. This provides the company with more stable, recurring income. A growing portion of this revenue now comes from cloud-based services and large enterprise clients which are two important areas for long term success.

While younger competitor GitLab is growing faster, Atlassian remains strong and profitable. GitLab posted higher revenue growth, but Atlassian still stands out with impressive financial strength, generating a 47% free cash flow margin (meaning nearly half of its revenue turns into cash after expenses) and a solid 25.7% operating margin on a non-GAAP basis. This shows the business is running efficiently, even as it invests heavily in growth.

A big part of Atlassian’s future growth is tied to its AI product, Rovo. Rovo is designed to help users work faster and smarter by combining intelligent search, chat-based answers, and automation tools in one easy-to-use experience. It can pull information from across Atlassian’s products and even third-party platforms like Microsoft Teams and Google Docs. With over 1.5 million users already, and growing quickly, Rovo is becoming a key part of the platform and shows that Atlassian is serious about staying ahead in the AI space.

Looking ahead, Atlassian sees a huge opportunity in the market. The company estimates its serviceable market to be worth $67 billion, but it has only captured about 7.4% so far. To close that gap, management plans to grow revenue by more than 20% annually through FY27 by expanding its enterprise customer base, offering more AI driven features like Rovo, and increasing product usage across existing clients.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

Cloud & Enterprise Growth – Cloud revenue surged 30% YoY, with big clients making up 40% of total sales.

AI with Rovo – Rovo is gaining fast adoption, helping Atlassian stay ahead in AI innovation.

Analyst Support – Analysts see upside, with an average price target of $282.19, suggesting room to grow.

Risks

Short-Term Losses – High spending on AI and sales led to a $70.8M net loss last quarter.

Cautious Guidance – Conservative forecasts due to economic uncertainty have made some investors nervous.

Big Competition – Giants like Microsoft remain serious competitors in the team software space.

The current market mood around Atlassian is mixed. There’s excitement about its AI and cloud growth, but also caution due to recent volatility and profitability concerns. Investors are watching closely to see if Atlassian can balance growth and execution in a fast changing tech market.

Sentimental Risk: Medium – High

IDDA Point 5: Technical

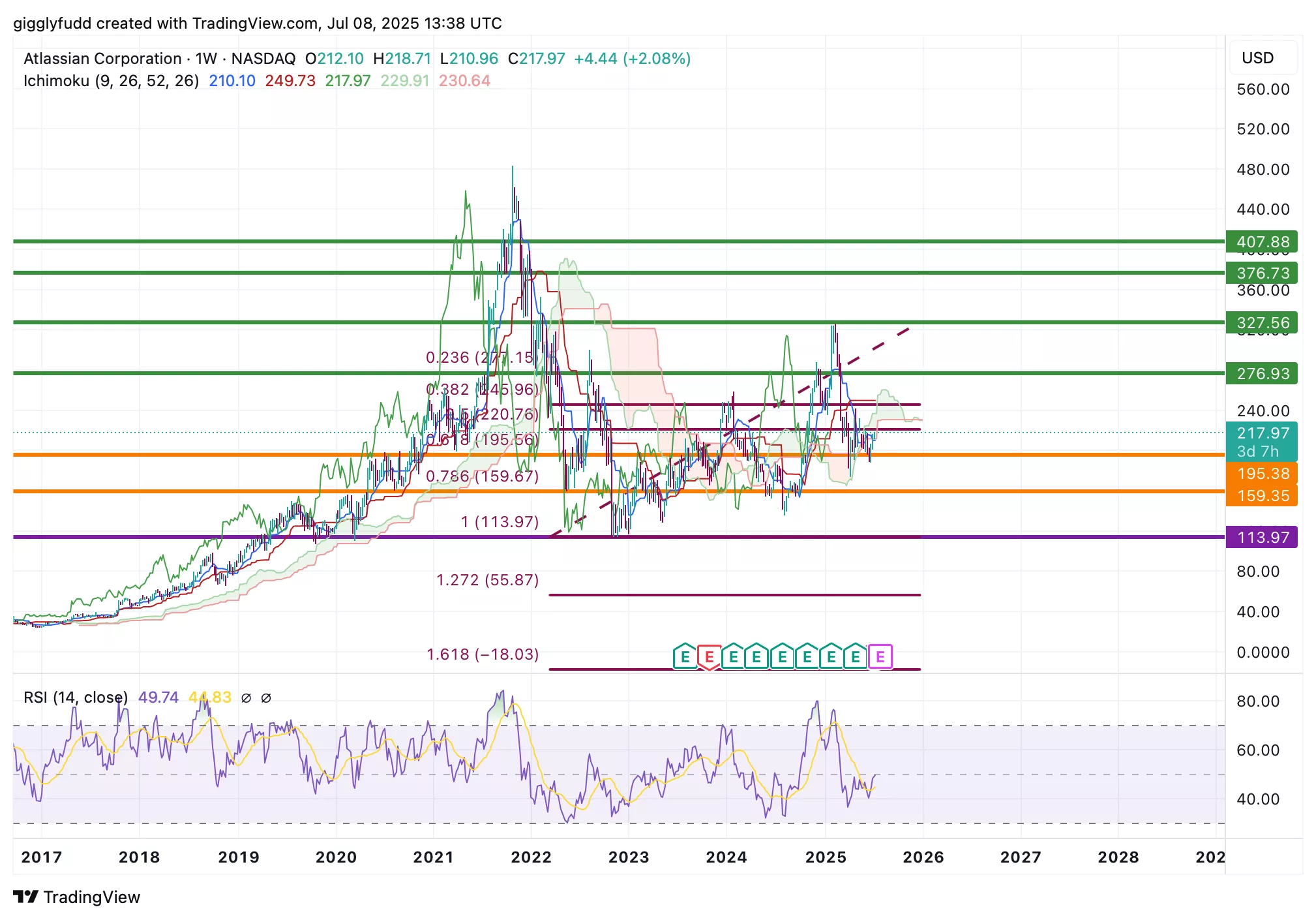

On the weekly chart:

The latest candlestick has crept inside the cloud, signaling a potential shift in trend and weakening bearish momentum.

The future cloud is thin, reflecting uncertainty and lack of strong directional bias.

The current pattern suggests the early stages of consolidation.

Atlassian (TEAM) was in a strong uptrend until October 2021, reaching a high of 483 before entering a downward phase. Since then, the stock has been on a slow, choppy recovery.

The latest candlestick has moved inside the Ichimoku cloud, signaling a potential shift in trend and weakening bearish momentum. A thin future cloud reflects uncertainty and a lack of strong directional bias, suggesting the market may be entering an early phase of consolidation.

Currently, the price sits just below the 50% Fibonacci retracement level, indicating a continued consolidation phase is likely.

(Click on image to enlarge)

Investors looking to add TEAM to their portfolio can consider the following Buy Limit Entries:

Current market price 216.05 (High Risk – FOMO entry)

195.38 (High Risk)

159.35 (Medium Risk)

113.97 (Low Risk)

Investors looking to take profit can consider these Sell Limit levels:

276.93 (Short term)

327.56 (Medium term)

376.73 (Long term)

407.88 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: High

Final Thoughts on Atlassian (TEAM)

Atlassian (TEAM) is emerging as a top AI stock in 2025 for two powerful reasons investors can’t ignore. First, its new AI platform, Rovo, has seen explosive adoption, reaching over 1.5 million monthly users and growing 50% in just one quarter.

By integrating Rovo directly into enterprise subscriptions, Atlassian is building long-term value and positioning itself as a core AI productivity tool across global teams. Second, unlike many AI-focused peers, Atlassian pairs innovation with financial strength.

In Q3 FY25, it posted a 47% free cash flow margin, with 94% of its revenue coming from subscriptions and a clear path to 20%+ annual growth through FY27, giving it both the momentum and resilience to lead in the AI-powered workplace revolution.

Its AI-powered evolution is quietly transforming how modern teams collaborate and deliver work. With strong subscription growth, a sticky customer base, and a growing enterprise presence, Atlassian is no longer just a tools company, it’s becoming a core platform for the future of work. Its AI-driven approach and long-term strategy make it one to watch.

Recommendation: Buy / Medium – High Risk – High Reward, Long-Term Growth Play

Atlassian is ideal for growth investors who are comfortable with short term ups and downs. If you believe in AI powered productivity and enterprise software, TEAM could be a strong long-term addition to your portfolio.

Overall Stock Risk: Medium – High

More By This Author:

Amazon Stock Bold Yet Quiet Robotics Expansion: Why Investors Should Pay Attention Now

BigBear.ai Stock: Missed Palantir? This Might Be Your Second Shot

Nvidia Stock: Why This May (Or May Not) Be The Best Time To Invest