FedEx Gears Up To Release Q3 Earnings: What's In The Offing?

Image Source: Unspash

FedEx Corporation (FDX - Free Report) is set to release its third-quarter fiscal 2025 (ended Feb. 28, 2025) results on March 20, after market close.

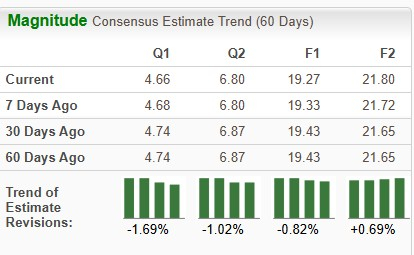

The Zacks Consensus Estimate for third-quarter fiscal 2025 earnings has been revised 1.7% downward in the past 60 days and is pegged at $4.66 per share. However, the consensus mark implies a 20.7% increase from the year-ago actual. The Zacks Consensus Estimate for third-quarter fiscal 2025 revenues is pegged at $21.88 billion, indicating a 0.8% increase from the year-ago actual.

Image Source: Zacks Investment Research

FDX has a mixed earnings surprise history, as reflected in the chart below.

FedEx Price and EPS Surprise

FedEx Corporation price-eps-surprise | FedEx Corporation Quote

Demand Erosion Likely to Dent FDX’s Q3 Results

FDX continues to struggle due to the normalization of volume and pricing trends in the post-COVID scenario. Geopolitical uncertainty and higher inflation continue to hurt consumer sentiment and growth expectations, particularly in Asia and Europe. The resultant weakness in package volumes is likely to have hurt FedEx's revenues in the to-be-reported quarter.

The performance of the Express unit, FDX's largest segment, is likely to have been hurt due to demand-induced volume weakness. We anticipate revenues from the Express unit to inch up 0.6% from third-quarter fiscal 2024 actual.

Cost Cuts to Aid FDX’s Results

Given the post-COVID adjustments in business, FedEx is realigning its costs under a companywide initiative called DRIVE. FDX’s cost-cutting efforts are likely to have aided its bottom-line performance in the quarter under discussion.

These cost-reduction initiatives include reducing flight frequencies, parking aircraft and cutting staff. We are impressed by FDX's efforts to control costs in the face of persistent revenue weakness. We anticipate expenses from salaries and benefits in third-quarter fiscal 2025 to decrease 0.8% from third-quarter fiscal 2024 actual. Adjusted operating expenses in the to-be-reported quarter are expected to inch down 0.1% from year-ago actuals.

Q3 Earnings Whispers for FDX

Our proven model does not conclusively predict an earnings beat for FDX this time. A company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), along with a positive Earnings ESP, has a higher chance of beating estimates, which is not the case here.

Earnings ESP: FedEx has an Earnings ESP of -2.66%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

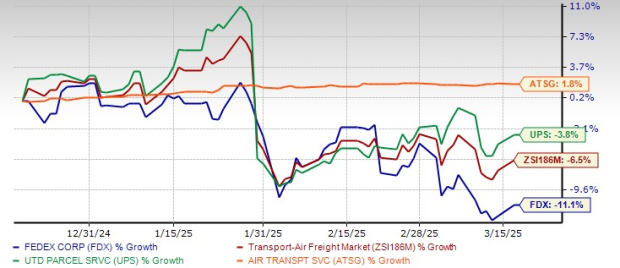

FDX Stock Underperforms Industry

Shares of FDX have declined 11.1% in the past three months against the industry’s 6.5% decline. FDX’s price performance is also worse than that of rival United Parcel Service (UPS - Free Report) and another industry player, Air Transport Services (ATSG - Free Report) .

3- Month Price Comparison

Image Source: Zacks Investment Research

More By This Author:

Buy Netflix Stock For A Rebound As Markets Stabilize?

Buy The Dip In Amazon Stock At Under $200 A Share?

3 Mutual Funds To Buy On Steady Growth In Semiconductor Sales

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more