Buy Netflix Stock For A Rebound As Markets Stabilize?

Image: Bigstock

February’s cooler CPI print helped markets stabilize amid ongoing tariff concerns, and one stock investors may be eyeing for the potential of a rebound is Netflix (NFLX - Free Report).

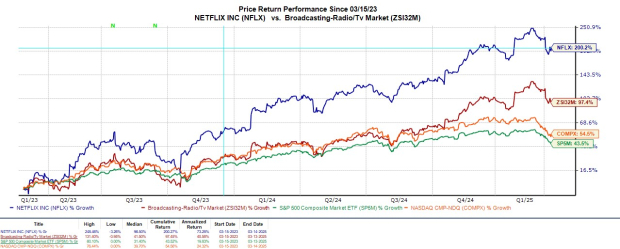

Netflix fell around 14% from a 52-week high of $1,064 a share in mid-February but is still up +2% year-to-date, which topped the S&P 500’s -6% and the Nasdaq’s -8%. Plus, over the last two years, Netflix has been one of the market’s top performers, soaring +200% to impressively outperform the broader indexes and its Zacks Broadcast Radio & Television Market’s +97%.

Image Source: Zacks Investment Research

Netflix & Market Sentiment

Despite economic uncertainty, investor sentiment has remained high for Netflix, with many analysts raising their price targets for the stock in correlation with the company’s market dominance as the leading streaming provider -- ahead of Disney (DIS - Free Report), Paramount Global (PARA - Free Report), and Amazon's (AMZN - Free Report) Prime Video.

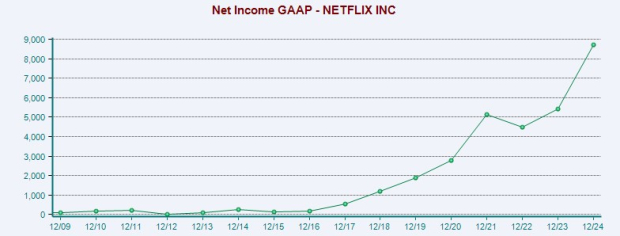

Netflix’s original content and international expansion have been the main contributors to its continued success, along with a growing ad-supported subscription plan at a reduced price to its traditional service.

During its most recent Q4 report in January, Netflix’s ad plan accounted for 55% of sign ups in countries where the service is provided, with total subscribers now over 300 million. Furthermore, Netflix added a record-breaking 19 million subscribers during Q4, which was a mind-boggling 13 million more subscribers than Wall Street expected. It’s also noteworthy that Netflix achieved over $10 billion in operating income for the first time in fiscal 2024, with GAAP net income spiking 61% to $8.71 billion.

Netflix will be reporting Q1 results on Thursday, April 17. Additionally, Netflix has exceeded the Zacks EPS Consensus in each of its last four quarterly reports with an average earnings surprise of 7.17%.

Image Source: Zacks Investment Research

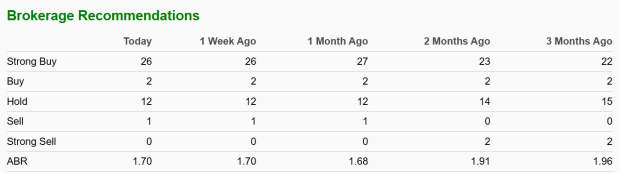

ABR & Netflix Price Target

With 41 brokerage firms covering Netflix stock and providing data to Zacks, Netflix has an average brokerage recommendation (ABR) of 1.70 on a scale of 1 to 5 (Strong Buy to Strong Sell).

Image Source: Zacks Investment Research

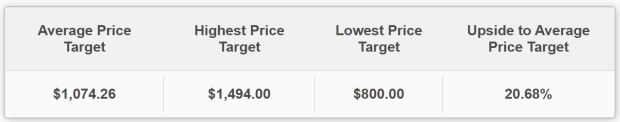

Based on short-term price targets of 38 analysts, Netflix has an Average Zacks Price Target of $1,074.26, which suggests around 20% upside from recent levels.

Image Source: Zacks Investment Research

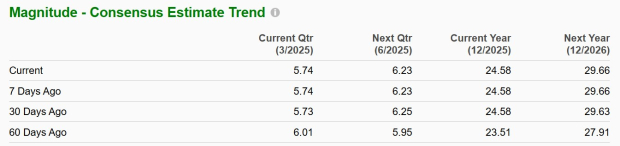

Positive EPS Revisions

Notably, earnings estimate revisions have remained higher for Netflix, with the streaming giant’s EPS expected to increase 24% in fiscal 2025 to $24.58 versus $19.83 a share last year. Plus, FY26 EPS is projected to soar another 20% to $29.66.

More intriguing, over the last 60 days, FY25 and FY26 EPS estimates have moved up 4% and 6%, respectively.

Image Source: Zacks Investment Research

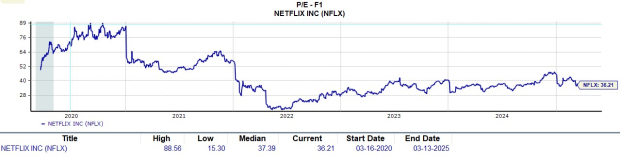

Monitoring Netflix’s P/E Valuation

Amplifying the positive EPS revisions is that Netflix has recently been trading at a 36.2X forward earnings multiple, which is well below its five-year high of 88.5X and a slight discount to the median of 37.3X during this period.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Correlating with a positive trend of earnings estimate revisions, Netflix stock sports a Zacks Rank #2 (Buy) rating. Although tariff concerns have led to recessionary fears, Netflix’s cheaper ad-service could still propel the company in the event of a potential economic downturn. This should also help sustain Netflix as the streaming king ahead of Disney, Paramount, and Amazon.

More By This Author:

Buy The Dip In Amazon Stock At Under $200 A Share?3 Mutual Funds To Buy On Steady Growth In Semiconductor Sales

3 Stocks To Watch That Declared Dividend Hikes Amid Market Volatility

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more

Bearish on $NFLX.