Buy The Dip In Amazon Stock At Under $200 A Share?

Image Source: Unsplash

Down 11% this year, Amazon (AMZN - Free Report) stock has fallen to under $200 a share again, presenting a more attractive entry point for investors.

Although the broader market has continued a sharp selloff on Monday, it’s certainly a worthy topic of whether now is a good time to invest in the tech conglomerate at a more affordable stock price and valuation.

Image Source: Zacks Investment Research

Market Sentiment & Amazon

Trading 20% beneath its 52-week high of $242 a share, Amazon’s stock hasn’t been immune to recent market volatility but investor sentiment had been high for AMZN before the surge in economic uncertainties.

To that point, Amazon reported record revenue of $637.96 billion last year, with its top line projected to increase over 9% in fiscal 2025 and FY26. Edging toward annual sales of over $700 billion, Amazon’s market dominance as the leading e-commerce and cloud provider (AWS) is even more appealing thanks to the company’s AI initiatives.

Releasing the second generation of its Trainium AI chips in December, the Trainium 2 is designed to enhance the performance and efficiency of machine learning tasks. Furthermore, the Trainium 2 has put Amazon in a position to compete with Nvidia (NVDA - Free Report), AMD (AMD - Free Report), and other chip leaders by providing cost-effective and scalable solutions for AI workloads.

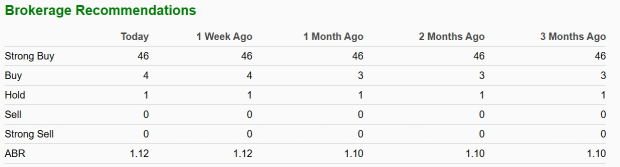

ABR & Price Target

With 51 brokerage firms covering Amazon stock and providing data to Zacks, AMZN currently has an average brokerage recommendation (ABR) of 1.12 on a scale of 1 to 5 (Strong Buy to Strong Sell).

Image Source: Zacks Investment Research

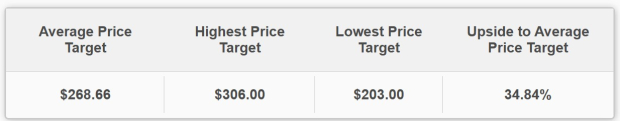

Based on short-term price targets of 50 analysts, AMZN has an Average Zacks Price Target of $268.66, which suggests more than 30% upside from current levels.

Image Source: Zacks Investment Research

Amazon’s More Reasonable Valuation

Given Amazon’s appealing growth trajectory, investors are certainly eying the recent dip in AMZN for a better buying opportunity. Optimistically, AMZN is at its cheapest levels in terms of P/E valuation.

Plus, at 31.5X forward earnings, AMZN has moved closer to the benchmark S&P 500’s P/E multiple and trades well below its five-year high of 161.3X while offering a steep discount to its median of 65.1X during this period.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

While there could still be better buying opportunities for Amazon stock amid recent market volatility, AMZN currently lands a Zacks Rank #3 (Hold). Buying or holding AMZN may be perplexing as the tech-centric Nasdaq continues to decline, but long-term investors should certainly be rewarded given Amazon’s attractive outlook and artificial intelligence expansion.

More By This Author:

3 Mutual Funds To Buy On Steady Growth In Semiconductor Sales3 Stocks To Watch That Declared Dividend Hikes Amid Market Volatility

Big Tech Discounts Investors Can Buy Now (Alphabet, Amazon, Meta Platforms)

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more