Enbridge: Stable In The Current Environment With Growth Prospects

A few weeks ago, Canadian pipeline and midstream giant Enbridge Inc. (ENB) gave a presentation to its investors. As is often the case with presentations like this, the company devoted a considerable amount of time towards discussing its current operations and making an investment case in itself. As has been the case in many recent presentations, the company also appeared to want to comfort and reassure its investors about its ability to weather the current low energy price environment. This has been something that has worried many market participants over the past few months so it is certainly comforting to see that Enbridge is well-positioned to ride it out. The company also discussed the long-term fundamentals of the energy industry, which remain quite strong.

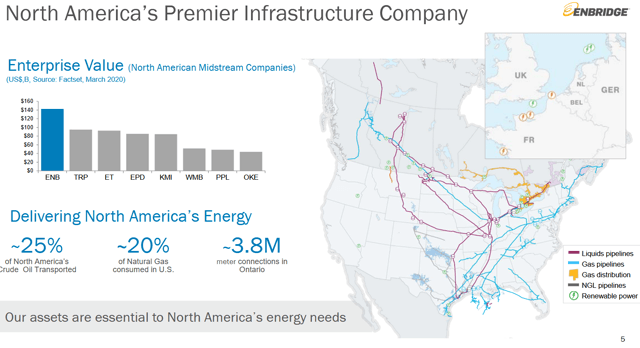

Enbridge is the largest midstream company in North America, boasting pipelines and other infrastructure spanning the United States and Canada. This expansive infrastructure allows the company to transport 25% of all of North America's crude oil and fully 20% of all of the natural gas consumed in the United States:

(Click on image to enlarge)

Source: Enbridge Inc.

As we can see, this extensive infrastructure provides Enbridge with exposure to most of the basins in which oil and natural gas is produced. This is important because each of these basins have somewhat different fundamentals. For example, some basins are cheaper to produce in than others and so are less likely to suffer a production decline when energy prices are dropping. In addition, the company's operations span conventional, shale, and even bitumen plays, which have different decline rates. This has some impact on the resource volumes moving through Enbridge's pipelines.

As already mentioned, Enbridge's infrastructure transports both natural gas and liquids:

(Click on image to enlarge)

Source: Enbridge Inc.

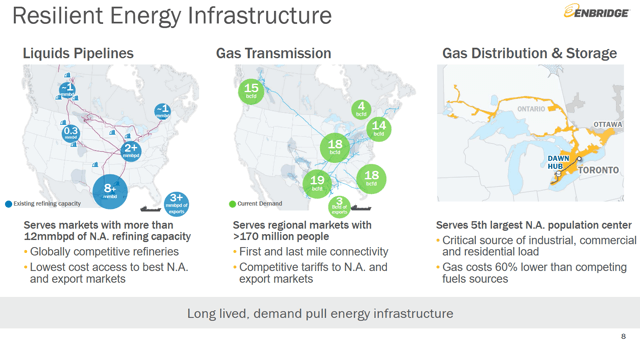

As we can see, the company serves areas where the resources that the company transports are in high demand. Its pipelines support more than twelve million barrels per day of crude oil refining capacity while its natural gas pipelines support a highly populated region with more than 170 million people. This should ensure relatively consistent demand for the company's transportation services, which provides for relatively consistent cash flows. This is the kind of thing that we like to see in a dividend investment.

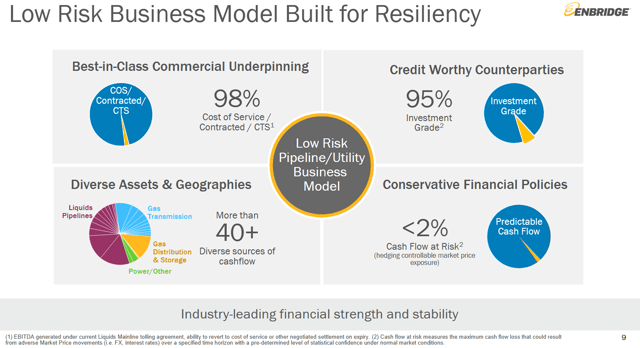

In various previous articles, I have discussed how midstream companies tend to be relatively stable entities. This is partly because they are relatively insulated from fluctuations in energy prices. Rather, they make their money off of fees charged based on the volume of resources moving through their infrastructure. The midstream company performs this service under long-term contracts with its customers that in many cases have a minimum volume guarantee, which means that the customer must move that quantity of resources through its infrastructure or pay for that quantity anyway. As we can see, fully 98% of Enbridge's revenue comes from these contracts and not from sources that are exposed to fluctuations in commodity prices:

(Click on image to enlarge)

Source: Enbridge Inc.

Naturally though, these contracts may not mean very much if the midstream company's customers cannot remain solvent. We have already seen some high profile upstream bankruptcies, such as Chesapeake Energy (CHKAQ), and as I pointed out in a previous article there is certainly the possibility that we will see more bankruptcies should energy prices remain suppressed. Thus, it is nice to see that fully 95% of Enbridge's customers are investment-grade companies. An investment-grade company typically has a much stronger balance sheet than a non-investment grade one and therefore is more likely to be able to weather the current environment and remain solvent. Thus, Enbridge's contracts should be relatively secure, ensuring that its cash flows are unlikely to go anywhere.

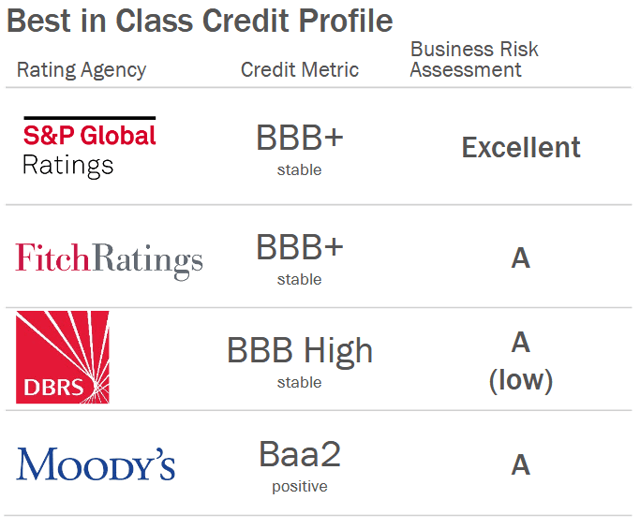

Enbridge itself also boasts a reasonably strong balance sheet. Standard & Poors and Moody's both give the company investment-grade ratings:

(Click on image to enlarge)

Source: Enbridge Inc.

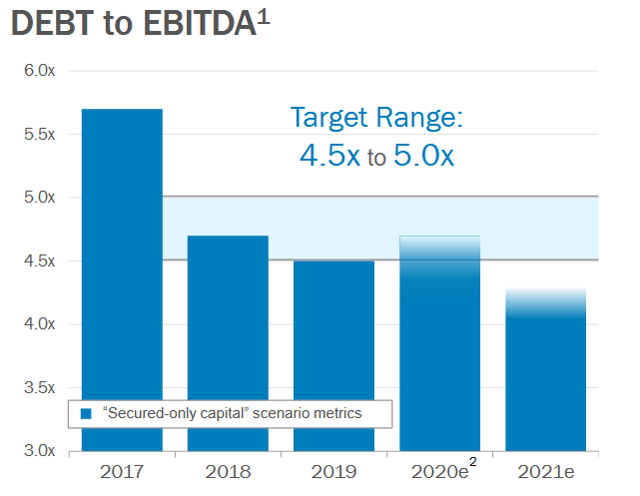

Another way we can judge the financial strength of a midstream company is a metric known as the debt-to-EBITDA ratio. This ratio essentially tells us how long it would take the company to pay off all of its debt if it dedicates all of its pre-tax cash flow to that purpose. As we can see here, Enbridge has been steadily improving this ratio over the past few years:

(Click on image to enlarge)

Source: Enbridge Inc.

The company has the long-term goal of keeping this ratio between 4.5x and 5.0x, which is what most analysts consider to be reasonable. Admittedly though, I generally like to see this ratio under 4.0x to add a certain margin of safety. This is because the lower this ratio, the more the company's cash flows can decline before it begins to have trouble servicing its debt. As we have already discussed, these companies do tend to have reasonably stable cash flows so we do not have to worry too much about this risk but it is still something that we should keep an eye on.

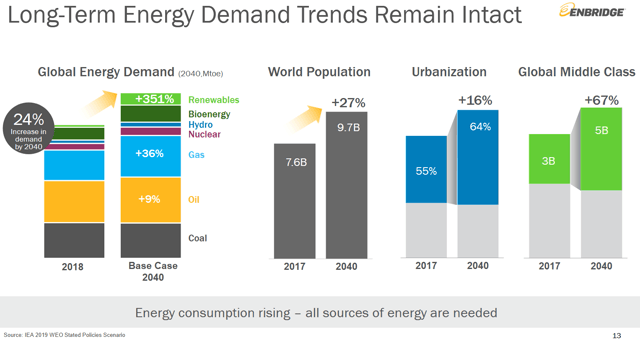

One of the biggest impacts that the COVID-19 pandemic has had is to reduce the overall demand for energy. This makes sense as governments around the world shut down their economies and restricted non-essential travel in an effort to combat the outbreak. As people were traveling less and were using less energy for industrial and commercial uses, less energy overall was consumed. The long-term trend through is for global energy use to increase. This is partly due to a still rising global population and the development of emerging economies. As I discussed in a recent article when an emerging economy grows its energy consumption will increase due to more manufacturing and commercial activity as well as newly middle-class people wanting to live more like their developed-nation counterparts. As we can see here, the global demand for energy is expected to increase by 24% over the 2018-2040 period:

(Click on image to enlarge)

Source: Enbridge Inc.

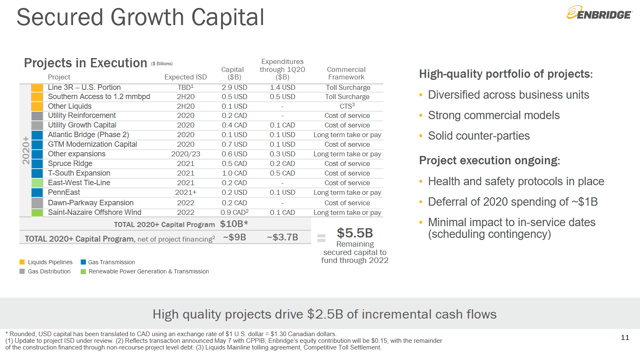

This creates an opportunity for growth for Enbridge. This is because North America is one of the few regions of the world that can significantly increase its production of oil and natural gas and companies like Enbridge will be needed to bring these incremental resources to market. In order to take advantage of this, Enbridge has embarked on a rather ambitious growth program. The company currently has CAD$10 billion (US$7.37 billion) worth of new infrastructure under development:

(Click on image to enlarge)

Source: Enbridge Inc.

One of the nice things about these projects is that Enbridge has already secured contracts from its customers for their use. This has a few advantages for Enbridge. One of them is that it ensures that the company is not spending a great deal of money to construct infrastructure that nobody wants to use. It also effectively guarantees that Enbridge will generate a positive return off of its invested capital. This is a much better situation than if the company was speculatively constructing infrastructure with the hope that it would later be able to find a customer.

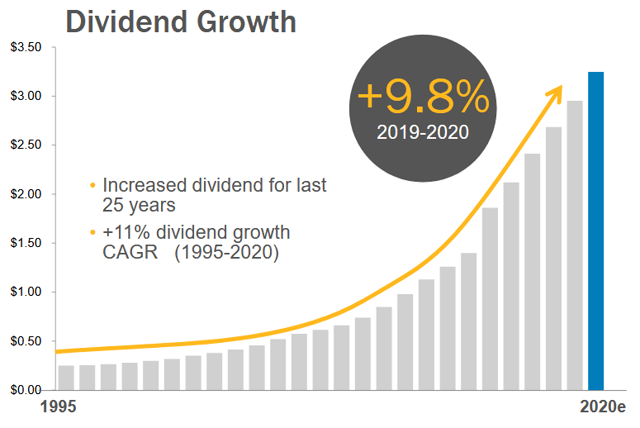

One of the main reasons why people invest in midstream companies is the high dividend yields that they tend to have. Enbridge is certainly no slouch here as the stock yields 7.54% as of the time of writing. This is the result of years of consistent dividend growth. As we can see here, Enbridge has grown its dividend at an 11% compound annual growth rate over the past 25 years:

(Click on image to enlarge)

Source: Enbridge Inc.

The nice thing about consistent dividend growth is that it helps to overcome one of the biggest problems facing retirees and others that depend on their portfolios for income. That problem is the compounding effect of inflation. If a stock simply kept its dividends steady then the purchasing power of those dividends will decline over time due to inflation. However, if the company is able to consistently grow its dividends at a rate higher than inflation then the purchasing power of those dividends will actually increase over time. As Enbridge has a number of growth projects under construction as already discussed, it should be able to continue this track record of dividend growth going forward.

In conclusion, Enbridge is the largest midstream company in North America and this puts its services in high demand. The company transports resources to some of the most densely populated areas of the United States and Canada ensuring that consumers and businesses can obtain the resources that they need for their daily lives. The company also boasts reasonably stable cash flows and a strong balance sheet. Its track record of dividend growth looks likely to continue going forward and this is something that should appeal to anyone that derives income off of their portfolio. Overall, Enbridge is a company well worth considering an investment in.

Disclosure: I have no positions in any company mentioned in this article nor do I intend to take a position within 72 hours.

Disclaimer: All information provided in this article is for ...

more

Definitely the Enbridge organization is profitable today, and has been profitable in the past. Of course part of that profitability has come from taking shortcuts on responsibility regarding safety, primarily environmental safety. So while folks can profit very well with this company there may be a time when an unfortunate accident of some kind will result in a penalty adequate to remove that profitability.

My hope is that before that can happen the top management at Enbridge will decide that it is better to prevent the disaster than to have to repent after it happens.

$ENB sounds like a great buy. Hard to find companies like this these days...