Elliott Wave Technical Forecast: Newmont Corporation - Wednesday, May 21

ASX: NEWMONT CORPORATION – NEM

Elliott Wave Technical Analysis – TradingLounge

Today’s Elliott Wave update focuses on the Australian Stock Exchange (ASX) listed stock NEWMONT CORPORATION – NEM.

We observe ASX:NEM trending upward within wave three. This analysis outlines specific target levels and invalidation points to help determine whether the bullish trend remains valid or ends.

ASX: NEWMONT CORPORATION – NEM

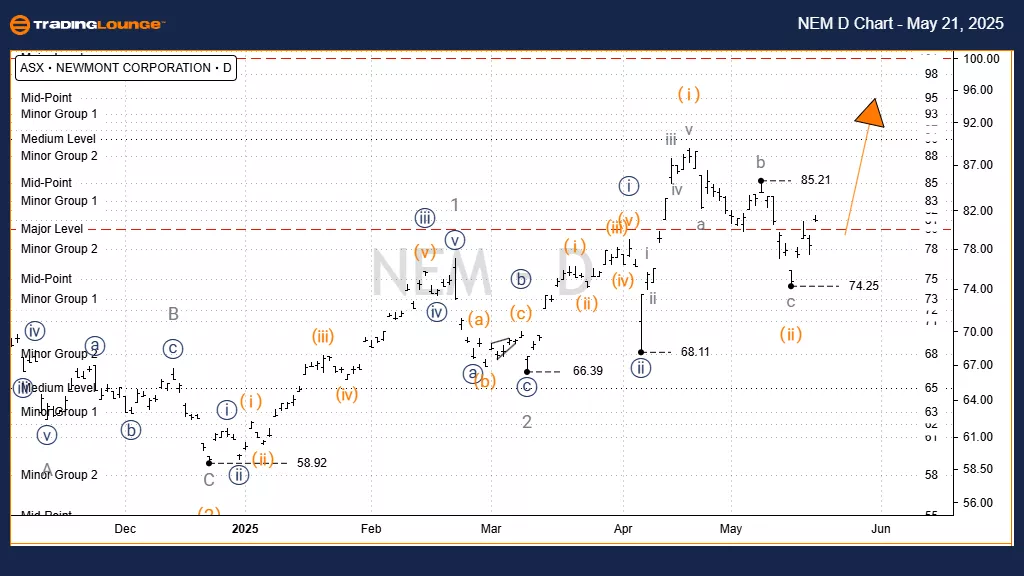

Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave iii) – orange of Wave iii)) – navy of Wave 3 – grey

Details:

The wave ii) – orange likely concluded at 74.25, forming a zigzag pattern (a, b, c – grey). From this low, wave iii) – orange has started moving up and is targeting a high near 100.00.

Invalidation Point: 74.25

ASX: NEWMONT CORPORATION – NEM

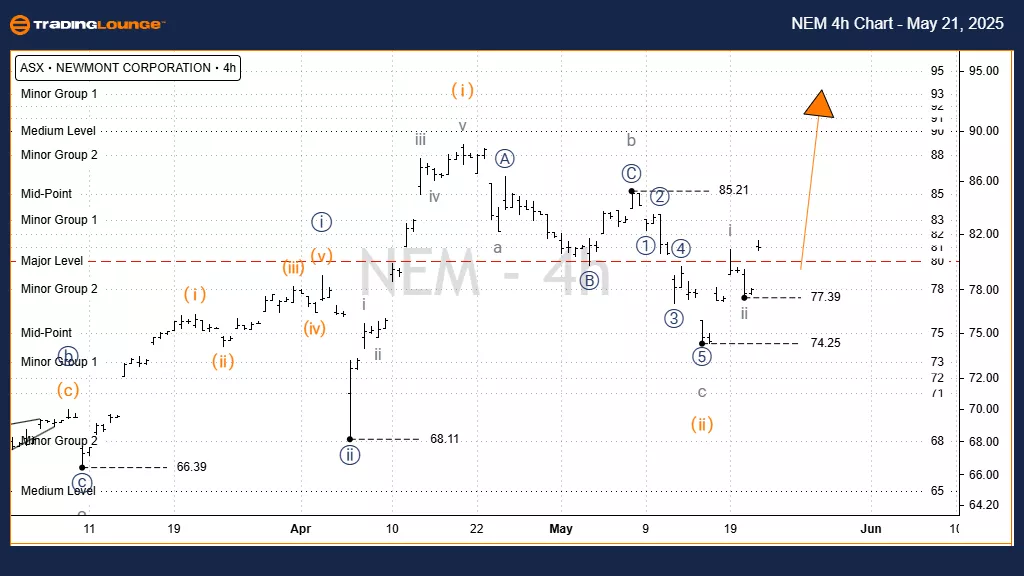

Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave iii) – orange of Wave ((iii)) – navy of Wave 3 – grey

Details:

No changes from the daily chart view: wave iii) – orange continues to climb, aiming for 100.00. In the short term, wave iii – grey is pushing higher with a nearer target of 90.00.

Invalidation Point: 77.39

Conclusion:

Our Elliott Wave analysis on ASX:NEM provides a comprehensive look into both medium and short-term market trends. We include clear price targets and invalidation levels, reinforcing our forecast’s reliability. This approach offers traders an objective and structured outlook on current market conditions.

Technical Analyst: Hua (Shane) Cuong, Certified Elliott Wave Analyst – Master (CEWA-M)

More By This Author:

Elliott Wave Technical Analysis: Bitcoin Crypto Price News For Wednesday, May 21

Elliott Wave Technical Forecast: Cochlear Limited - Tuesday, May 20

Elliott Wave Technical Analysis: Texas Instruments Inc. - Tuesday, May 20

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more