Elliott Wave Technical Analysis: Texas Instruments Inc. - Tuesday, May 20

TXN Elliott Wave Analysis Trading Lounge

Texas Instruments Inc. (TXN) – Daily Chart

TXN Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave (C) of B

DIRECTION: Upside in wave (C)

DETAILS: This analysis outlines a bearish scenario with a completed three-wave move forming Primary wave A to the downside, followed by an upward correction forming Primary wave B.

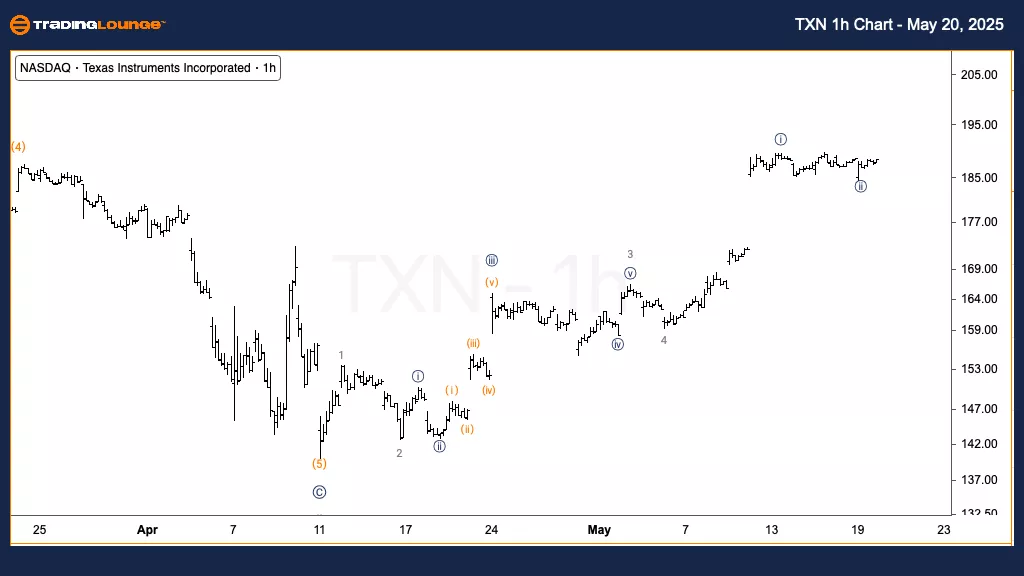

Texas Instruments Inc. (TXN) – 1H Chart

TXN Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave {iii} of 5

DIRECTION: Upside in wave {iii}

DETAILS: The bullish count highlights an ongoing move in Minor wave 5, with price currently pushing higher in wave {iii}, approaching the resistance near Trading Level 2 at $200.

In this Elliott Wave update for Texas Instruments Inc. (TXN), both daily and hourly charts offer insights into the current technical setup and potential price direction.

TXN Elliott Wave Technical Analysis – Daily Chart

The daily structure points to a corrective wave count. After completing a three-part decline forming Primary wave A, TXN appears to be entering Primary wave B. This phase is developing through an upward movement in Intermediate wave (C), aligning with a flat corrective formation.

TXN Elliott Wave Technical Analysis – 1H Chart

On the 1-hour chart, the bullish narrative dominates. Minor wave 5 is underway, with wave {iii} driving the current trend higher. Traders should watch closely as price nears the $200 resistance at TradingLevel2, which may serve as a short-term technical ceiling.

Technical Analyst: Alessio Barretta

More By This Author:

Unlocking ASX Trading Success: Car Group Limited - Monday, May 19

Ripple Crypto Price News Today

Elliott Wave Technical Analysis: U.S. Dollar/Swiss Franc - Monday, May 19

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more