Elliott Wave Technical Analysis: U.S. Dollar/Swiss Franc - Monday, May 19

USDCHF Elliott Wave Analysis Trading Lounge

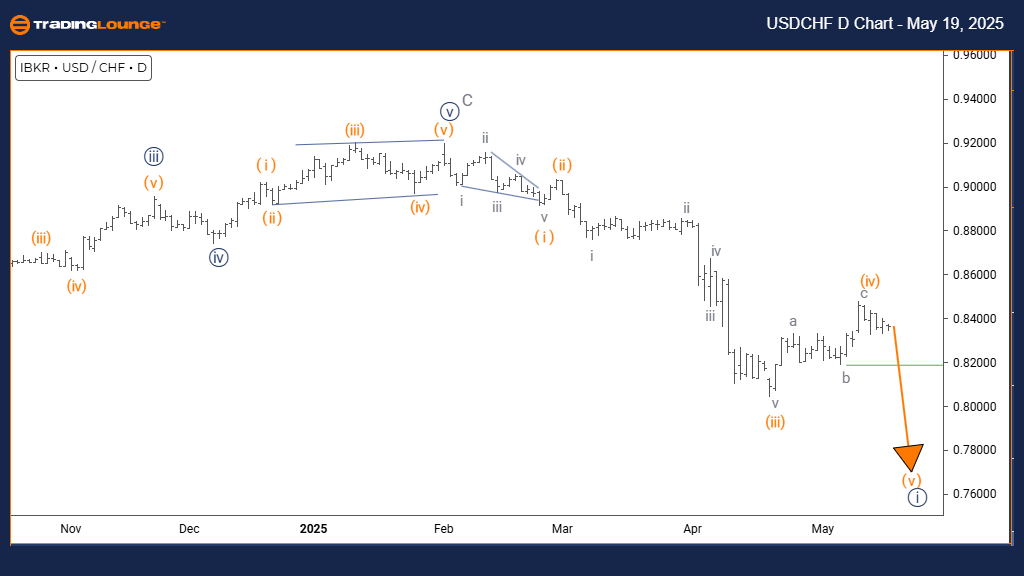

U.S. Dollar /Swiss Franc (USDCHF) Day Chart

USDCHF Elliott Wave Technical Analysis

FUNCTION: Bearish Trend

MODE: Impulsive

STRUCTURE: Navy blue wave 1

POSITION: Gray wave 1

DIRECTION NEXT HIGHER DEGREES: Navy blue wave 2

DETAILS: Navy blue wave 1 within gray wave 1 remains active and appears close to completion.

The USDCHF daily chart indicates a bearish structure, with clear downward pressure in the current wave pattern. The chart identifies navy blue wave one forming inside a broader bearish sequence—gray wave one—signaling an early phase in what could become a deeper decline. This structure suggests the initial drop is likely just the start of a potentially extended bearish move.

Analysis continues to support that navy blue wave one of gray wave one is not yet complete but may be nearing its end. The wave's impulsive nature underscores the strength of the selling activity. On the daily chart, this suggests a shift could soon occur, moving into a corrective navy blue wave two phase after this initial downtrend completes.

This wave-based framework helps traders understand where USDCHF sits in its longer-term bearish trend. The structure implies a possible brief pullback may occur following this downward impulse. Traders should watch for signals showing wave one losing momentum, which may mark the beginning of wave two’s corrective phase.

The analysis supports effective risk management in this critical period, noting the dual possibility of further losses in wave one or a corrective bounce in wave two. It's crucial for traders to identify chart signals confirming the wave shift while remembering that any correction could be short-term in an overall bearish setup.

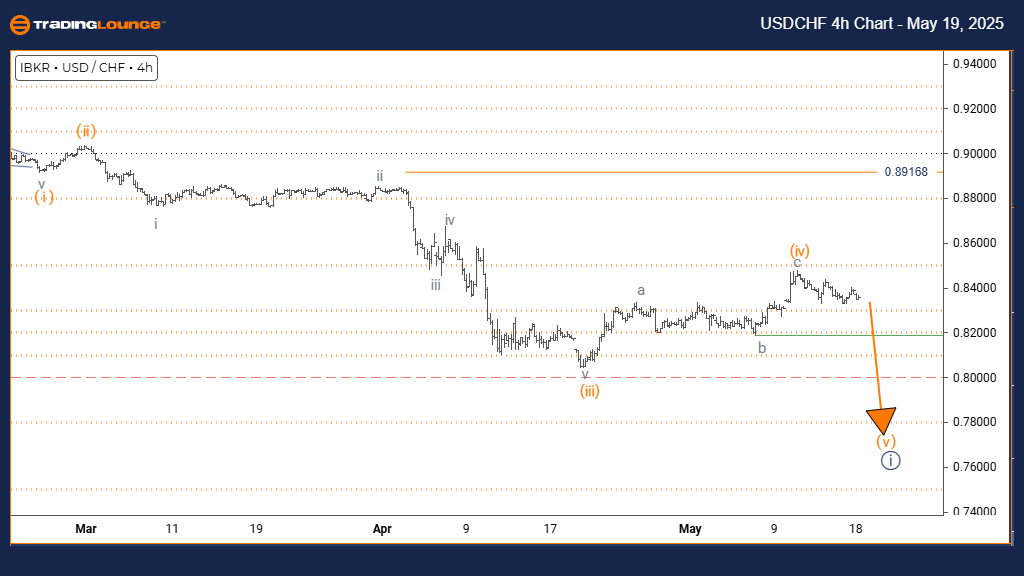

U.S. Dollar /Swiss Franc (USDCHF) 4 Hour Chart

USDCHF Elliott Wave Technical Analysis

FUNCTION: Bearish Trend

MODE: Impulsive

STRUCTURE: Orange wave 5

POSITION: Navy blue wave 1

DIRECTION NEXT LOWER DEGREES: Orange wave 5 (started)

DETAILS: Orange wave 4 appears complete; orange wave 5 is now underway.

Wave Cancel Invalid Level: 0.89168

The 4-hour chart reveals a consistent bearish movement in USDCHF with evident downward pressure. The wave pattern shows orange wave five developing within navy blue wave one, indicating orange wave four has finished and a new bearish leg has begun. This setup usually signals the last move before a potential reversal or loss of momentum.

The analysis supports the view that orange wave four has concluded, giving way to the active phase of orange wave five. The impulsive wave pattern indicates firm selling strength, and its place within navy blue wave one suggests this decline may still have room to run. If the price surpasses 0.89168, it would invalidate this wave count and suggest the need for a revised analysis.

This wave configuration provides traders with clear criteria to evaluate short trade setups while managing exposure. The active orange wave five is expected to extend the downward move until exhaustion. Traders should watch for signs that this wave is concluding, potentially offering an entry point for a reversal.

The analysis supports recognizing remaining downside possibilities while highlighting important levels that could either validate or break the current bearish view. As long as the price stays below the invalidation mark, the bearish wave outlook remains intact. This wave-based framework assists traders with sizing positions and controlling risk in this phase.

Technical Analyst: Malik Awais

More By This Author:

Trading Strategies For Tech Stocks & Bitcoin

Unlocking ASX Trading Success: Insurance Australia Group Limited - Friday, May 16

Elliott Wave Technical Analysis: British Pound/ U.S. Dollar - Friday, May 16

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more