Elliott Wave Technical Analysis: Bitcoin Crypto Price News For Wednesday, May 21

Image Source: Unsplash

Elliott Wave Analysis – TradingLounge Daily Chart | Bitcoin / U.S. Dollar (BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave C

Next Higher Degree Direction: Wave (b)

Wave Cancellation Level: N/A

Analysis Summary:

Bitcoin is currently advancing toward the completion of wave ⑤, marking the conclusion of the larger wave V cycle.

BTCUSD Trading Strategy – Daily Chart

Following a rebound from $74,322.85 in April, Bitcoin has shown a strong upward move aligned with a classic impulse wave structure. It is now nearing the final phase of wave ⑤, signaling the end of a primary wave V. Wave (4) appears to have completed an A-B-C corrective pattern, and the current movement suggests a final push upward in sub-wave (5). Key Fibonacci target:

🎯 Target: $118,187.22 – Represents a 100% Fibonacci extension of wave 1.

Trading Strategies

Approach:

Short-term Strategy (Swing Trading):

Long traders should consider locking in profits incrementally as the price nears the $117k–$118k zone.

Traders expecting a trend reversal may prepare for short positions in wave A once wave ⑤ ends, looking for Bearish Engulfing patterns or RSI divergence.

Risk Management:

Status: Not Available

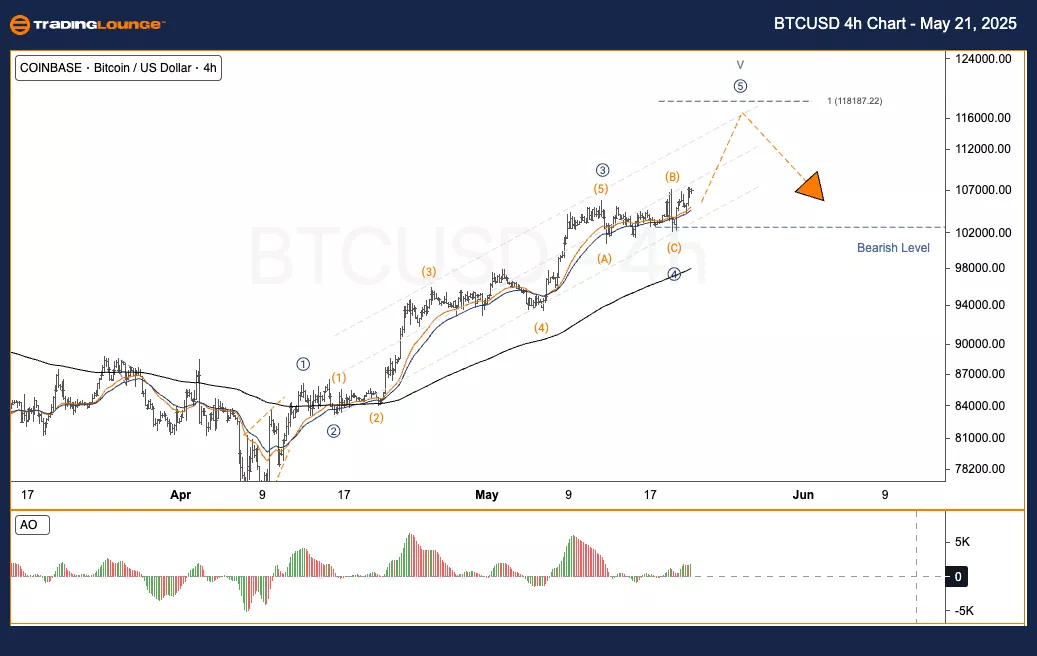

Elliott Wave Analysis – TradingLounge H4 Chart | Bitcoin / U.S. Dollar (BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave C

Next Higher Degree Direction: Wave (b)

Wave Cancellation Level: N/A

Analysis Summary:

Bitcoin is progressing toward the end of wave ⑤, signaling the final phase of the broader wave V cycle.

BTCUSD Trading Strategy – H4 Chart

Bitcoin rebounded from $74,322.85 in April and has since moved steadily upward in a typical impulse formation. It is now entering the last stretch of wave ⑤, completing the larger wave V. The previous wave (4) followed a simple A-B-C correction, and sub-wave (5) appears to be targeting a Fibonacci projection of:

🎯 Target: $118,187.22 – A 100% extension of wave 1.

Trading Strategies

Approach:

Short-term Strategy (Swing Trading):

Long traders are advised to secure profits in stages around the $117k–$118k range.

Potential reversal traders should monitor for bearish signals like RSI divergence or candlestick patterns to short wave A after wave ⑤ completes.

Risk Management:

Status: Not Available

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Elliott Wave Technical Forecast: Cochlear Limited - Tuesday, May 20

Elliott Wave Technical Analysis: Texas Instruments Inc. - Tuesday, May 20

Elliott Wave Technical Analysis: Australian Dollar/U.S. Dollar - Tuesday, May 20

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more