Elliott Wave Technical Analysis: Australian Dollar/U.S. Dollar - Tuesday, May 20

AUDUSD Elliott Wave Analysis – Trading Lounge

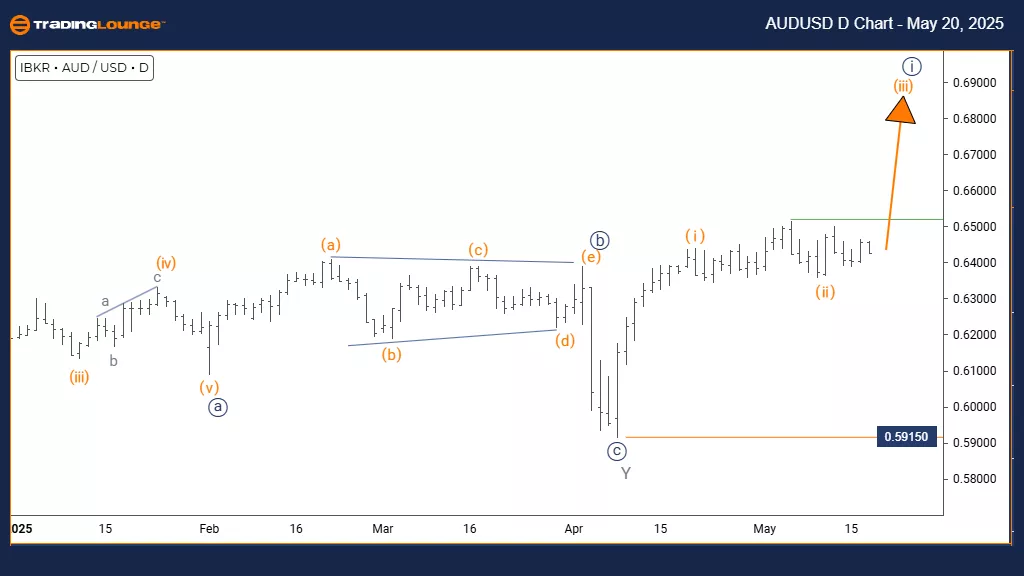

Australian Dollar/U.S. Dollar (AUDUSD) – Daily Chart

Technical Overview: Elliott Wave Perspective

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

NEXT LOWER DEGREE DIRECTION: Orange Wave 4

DETAILS: Orange wave 2 appears complete; orange wave 3 is progressing.

WAVE CANCEL/INVALID LEVEL: 0.59150

The daily chart analysis shows a bullish outlook for AUDUSD, supported by upward price momentum in the current wave formation. The chart identifies orange wave 3 unfolding within a broader uptrend defined as navy blue wave 1. This indicates the pair has ended its corrective orange wave 2 and entered an impulsive phase, generally known for its strength.

Analysis confirms orange wave 2 has finished, with orange wave 3 gaining momentum. The structure indicates consistent buying strength. The daily timeframe suggests this phase could extend. A key invalidation level is set at 0.59150 — breaking this would challenge the current count and may hint at a deeper correction or trend shift.

This setup provides useful insight into AUDUSD's place in the broader bullish cycle. The ongoing wave 3 hints at potential continued upward movement before a correction in wave 4 appears. Traders should anticipate orange wave 4 as the next sequence, expected to follow wave 3's completion.

Traders should watch closely for signs of wave 3’s extension and any movements around the 0.59150 invalidation point. This level is essential for confirming the bullish trend. Current analysis indicates that AUDUSD remains favorably positioned for further upward movement. The daily chart highlights strong momentum and potential longevity in the bullish phase.

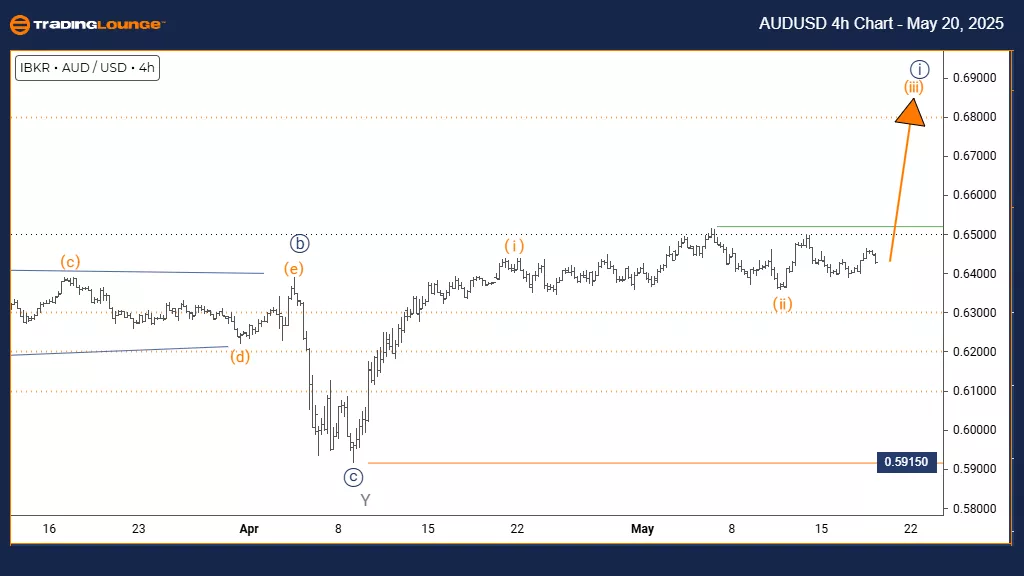

Australian Dollar/U.S. Dollar (AUDUSD) – 4H Chart

Technical Overview: Elliott Wave Perspective

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

NEXT HIGHER DEGREE DIRECTION: Orange Wave 3 (Initiated)

DETAILS: Orange wave 2 seems complete; orange wave 3 has commenced.

WAVE CANCEL/INVALID LEVEL: 0.59150

The 4-hour chart shows that AUDUSD is trending upwards with strong buying momentum. The structure highlights orange wave 3 forming within the broader navy blue wave 1. This indicates that the correction in orange wave 2 has likely ended, and the pair has moved into the next advancing phase, which tends to be the most forceful segment in an Elliott Wave pattern.

The conclusion of orange wave 2 transitions into a strong orange wave 3. This wave is defined by significant upward force, confirming a bullish sentiment within the ongoing sequence. The invalidation point is marked at 0.59150. If breached, it may suggest a deeper correction or trend reversal is underway.

This chart setup helps traders evaluate long opportunities with appropriate risk management. The development of orange wave 3 supports the view of further price increases. As this wave typically shows the strongest momentum, it can present substantial trading opportunities. Price action should be watched closely for confirmation or signs of weakening that may indicate this wave is nearing completion.

Traders can use this analysis to monitor key levels for trend confirmation and invalidation. The current bullish outlook is valid as long as the pair holds above the 0.59150 level. This technical interpretation aids in managing position size and defining risk through the potential continuation of this impulse-driven upward cycle.

Technical Analyst: Malik Awais

More By This Author:

Unlocking ASX Trading Success: Car Group Limited - Monday, May 19

Ripple Crypto Price News Today

Elliott Wave Technical Analysis: U.S. Dollar/Swiss Franc - Monday, May 19

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more