Elliott Wave Technical Forecast: Newmont Corporation - Friday, June 27

ASX: NEWMONT CORPORATION - NEM

Elliott Wave Technical Analysis

Greetings, our latest Elliott Wave analysis focuses on NEWMONT CORPORATION - NEM listed on the Australian Stock Exchange (ASX). We currently see ASX:NEM advancing in a third wave. This report outlines specific target levels and the invalidation point, helping readers understand when the trend may shift or confirm a continued bullish scenario.

ASX: NEWMONT CORPORATION - NEM

Elliott Wave Technical Analysis

ASX: NEWMONT CORPORATION - NEM

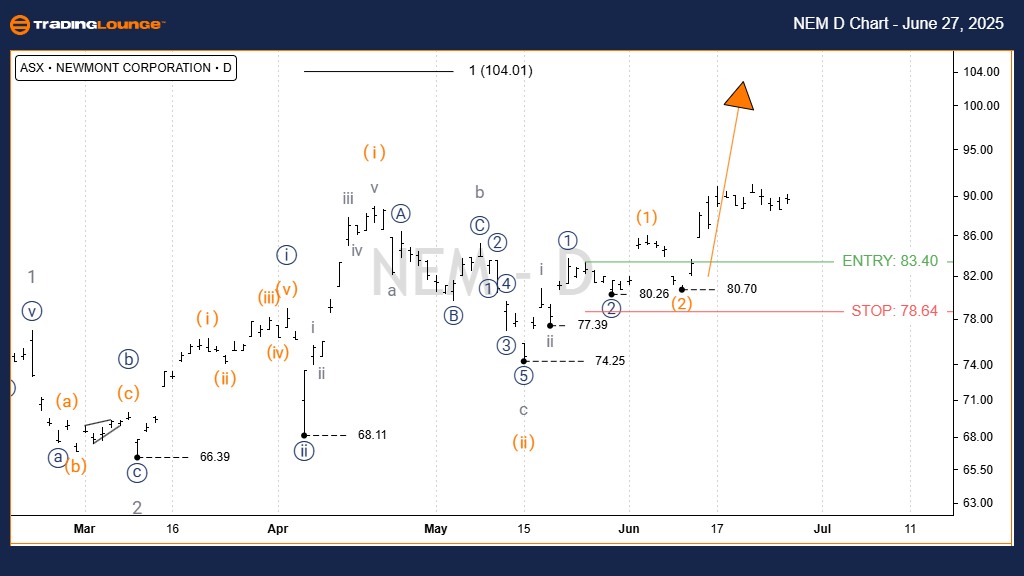

1D Chart (Semilog Scale) Analysis

- Function: Major trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave iii) - orange of Wave iii)) - navy of Wave 3 - grey

- Details:

Wave ii) - orange likely ended at the 74.25 low as a zigzag correction labeled a,b,c - grey. From that low, wave iii) - orange is progressing upwards, with a target near 100.00. - Invalidation Point: 74.25

ASX: NEWMONT CORPORATION - NEM

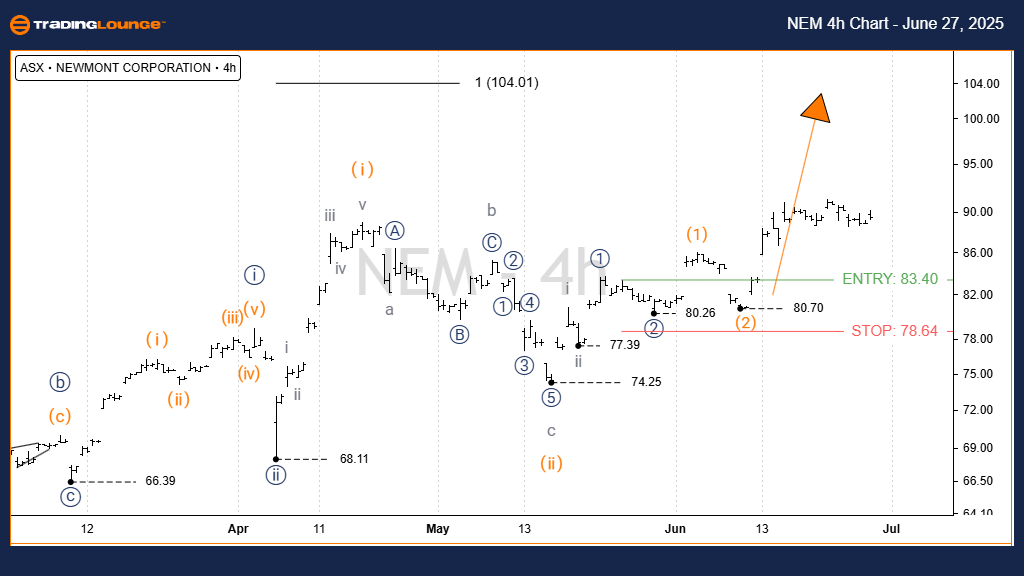

4-Hour Chart Analysis

- Function: Major trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave iii) - orange of Wave ((iii)) - navy of Wave 3 - grey

- Details:

The analysis remains consistent with the 1D chart. Wave iii) - orange continues higher, targeting 100.00. In the short term, wave iii - grey is pushing upward, aiming for a near-term goal of 90.00. - Invalidation Point: 74.25

Conclusion:

This analysis delivers a contextual and short-term outlook on ASX: NEWMONT CORPORATION - NEM. By defining specific price validation and invalidation levels, it empowers traders with actionable data. Our method combines technical clarity with professional objectivity, aimed at maximizing trading effectiveness.

Technical Analyst: Hua (Shane) Cuong, Certified Elliott Wave Analyst - Master (CEWA-M)

More By This Author:

Unlocking ASX Trading Success: Coles Group Limited - Thursday, June 26

Elliott Wave Technical Analysis: PayPal Holdings Inc. - Thursday, June 26

Elliott Wave Technical Analysis: Euro/U.S. Dollar - Thursday, June 26

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more