Elliott Wave Technical Analysis: Euro/U.S. Dollar - Thursday, June 26

EURUSD Elliott Wave Analysis – Trading Lounge

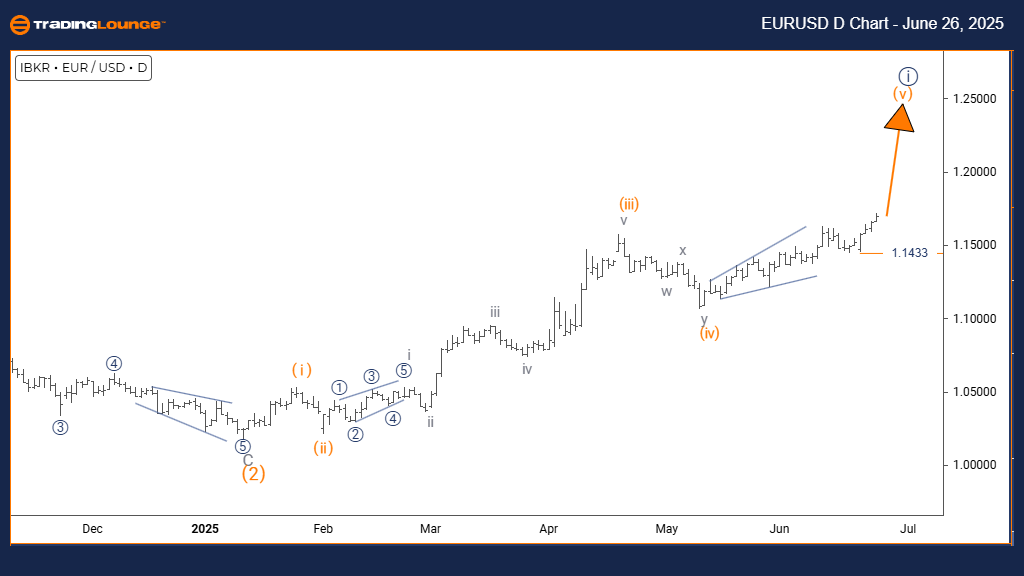

Euro/ U.S. Dollar (EURUSD) Day Chart

EURUSD Elliott Wave Technical Review

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Orange Wave 4 seems complete; Orange Wave 5 is active

Wave Cancel/Invalidation Level: 1.1433

The EURUSD daily chart analysis via Elliott Wave confirms a bullish market with impulsive momentum currently shaping price action. The active wave is identified as Orange Wave 5, forming a segment of the broader Navy Blue Wave 1 structure. This pattern signals that the market is entering the final stretch of an advancing impulse wave within a larger bullish framework.

The recent completion of Orange Wave 4 indicates the onset of Orange Wave 5, which is typically the final wave in an impulse cycle. It often features accelerated movement before a major reversal or broader correction. Once this fifth wave concludes, the expected follow-up at a smaller scale is Navy Blue Wave 2, likely presenting a correction phase.

An important level to monitor is the wave invalidation point at 1.1433. A drop below this level would nullify the current wave analysis and necessitate a new evaluation. Until such a break occurs, the pattern supports continued upward momentum.

The technical outlook suggests EURUSD may see further gains, with Orange Wave 5 now progressing. The impulsive properties hint at continued buying pressure, but traders should remain cautious for signs of wave completion as this could precede a trend shift.

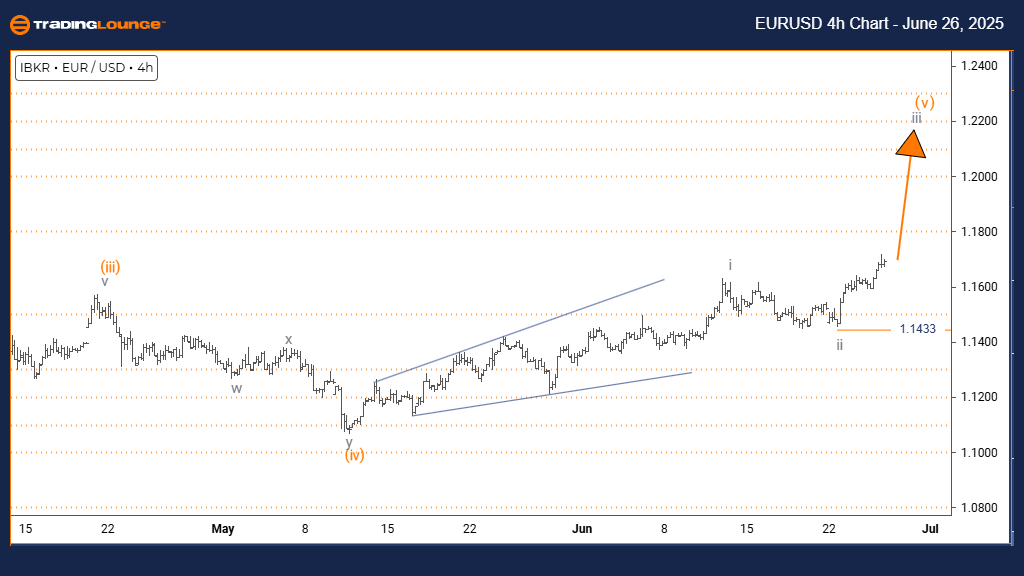

Euro/ U.S. Dollar (EURUSD) 4-Hour Chart

EURUSD Elliott Wave Technical Review

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 5

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3

DETAILS: Gray Wave 2 appears complete; Gray Wave 3 is now active

Wave Cancel/Invalidation Level: 1.1433

The EURUSD 4-hour Elliott Wave chart highlights a bullish setup, currently in impulsive mode with strong upward momentum. The dominant structure is Gray Wave 3, unfolding within the broader Orange Wave 5 formation. This suggests the pair is advancing through one of the strongest segments of the Elliott sequence.

The prior wave, Gray Wave 2, seems to have finalized its corrective role, paving the way for Gray Wave 3, often the most powerful and price-extended wave in the cycle. The active wave reflects robust market strength, expected to continue producing upward moves.

The key technical level remains the wave invalidation point at 1.1433. A price dip below this line would challenge the current wave scenario and trigger a reanalysis. As long as this level holds, the bullish projection stays valid.

Technically, EURUSD is favorably placed for further upward progress, driven by Gray Wave 3. The impulsive structure underlines sustained buying interest and signals the possibility of considerable gains ahead.

Technical Analyst: Malik Awais Source: Tradinglounge.com/discount get trial here!

More By This Author:

Elliott Wave Technical Analysis: Chainlink Crypto Price News For Thursday, June 26

Unlocking ASX Trading Success - Mineral Resources Limited

Elliott Wave Technical Analysis: Dell Technologies Inc. - Wednesday, June 25

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more