Unlocking ASX Trading Success - Mineral Resources Limited

Our Elliott Wave analysis today reviews Australian Stock Exchange (ASX) listing MINERAL RESOURCES LIMITED – MIN. We identify strong upside potential for ASX:MIN as a major fourth‑wave correction has just concluded, and we anticipate entering the fifth wave. In this analysis, we highlight target zones and key invalidation levels.

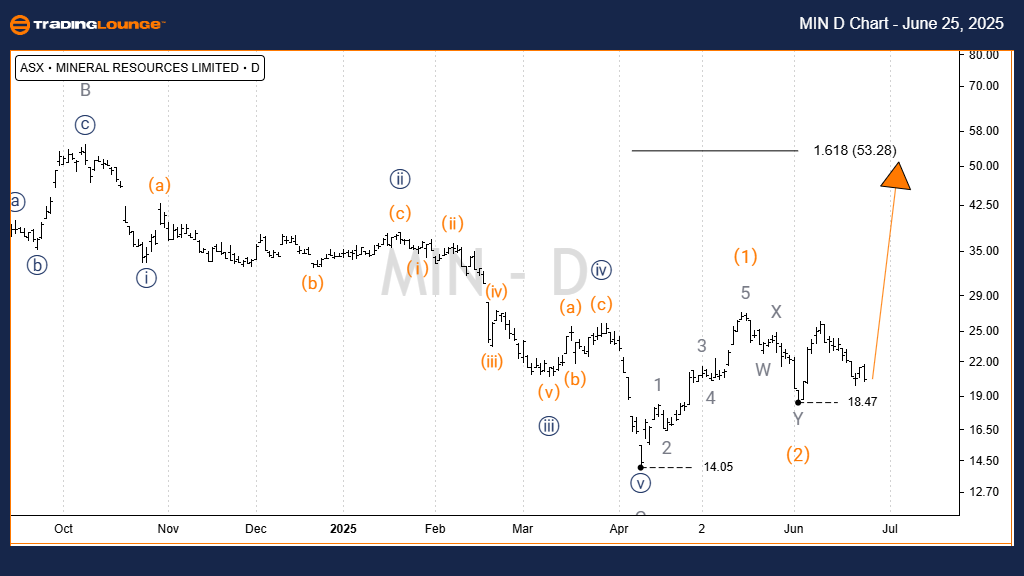

ASX: MINERAL RESOURCES LIMITED – MIN – Elliott Wave Technical Analysis (1D Chart)

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3→Wave 5 (orange→navy)

Details:

A large corrective wave appears to have ended at the 14.05 low, enabling a Motive wave shift upward. Near‑term targets lie between $50.00 and $80.00, provided price stays above 14.05 to sustain the bullish outlook. The dip below 18.47 does not negate our outlook; instead, it indicates that Wave 2 (orange) extended longer than expected, leaving room for Wave 3 (orange) to resume upward momentum.

Invalidation point: 14.05

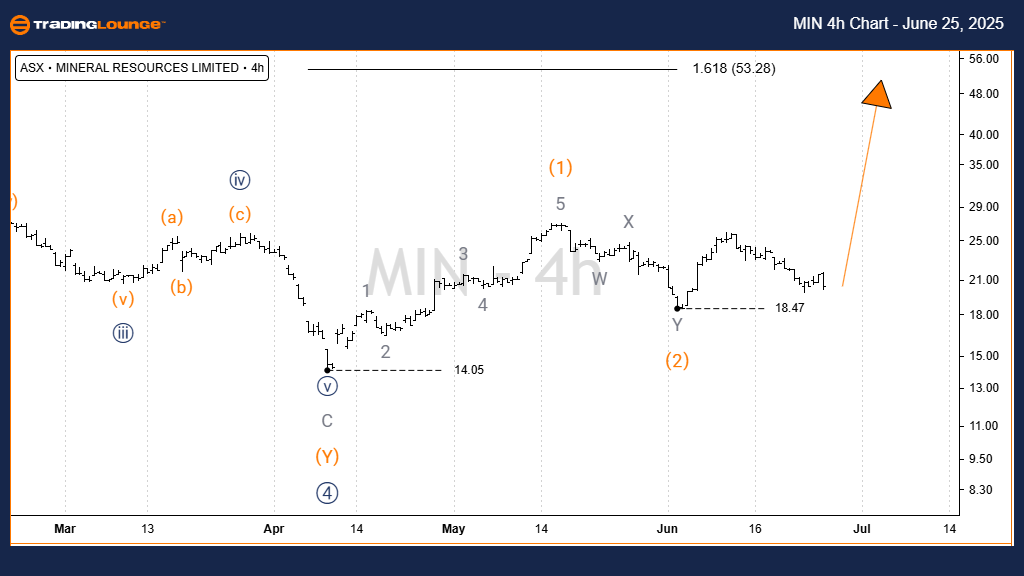

ASX: MINERAL RESOURCES LIMITED – MIN – Elliott Wave Technical Analysis (4‑Hour Chart)

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3 (orange)

Details:

Zooming in, since 14.05, Wave 1 (orange) completed its five‑wave structure, and Wave 2 (orange) finished a Double Zigzag correction at the 18.47 low. This suggests that Wave 3 (orange) has begun pushing higher from 18.47, aiming toward the 53.28 high. Again, price staying above 18.47 keeps the bullish case intact while respecting the invalidation floor at 14.05.

Conclusion:

Our analysis and forecast of ASX:MIN combine broader trend context with short‑term technical outlooks, offering specific price levels for validation and invalidation of our wave count. This approach reinforces our confidence in the bullish scenario. We aim to provide readers with objective, professional insight into current market trends and ways to capitalize effectively.

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level).

More By This Author:

Unlocking ASX Trading Success: Northern Star Resources Ltd - Tuesday, June 24

Elliott Wave Technical Analysis PepsiCo Inc.

Elliott Wave Technical Analysis: Australian Dollar/U.S. Dollar - Tuesday, June 24

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more