Elliott Wave Technical Analysis: Chainlink Crypto Price News For Thursday, June 26

Image Source: Pexels

LINKUSD Elliott Wave Technical Analysis (Daily Chart)

- Function: Counter Trend

- Mode: Corrective

- Structure: Double Corrective

- Position: Wave 2

- Invalidation Level: Not defined

Chainlink Trading Strategy:

In the previous wave I, the price formed an Expanded Diagonal pattern, peaking at $17.97. The retracement wave II formed a Double Zigzag structure, touching the 0.786 Fibonacci retracement level at $11.43.

Now, the price is bouncing back in wave (1) and may currently be in a retracement phase with wave (2) before entering an uptrend in wave (3).

The critical resistance lies around $16.00, which serves as the Bullish Confirmation Level. A break above this level could validate a mid-term upward movement.

Trading Strategy Highlights:

✅ Swing Trading (Short-term):

- Wait for the completion of the wave (2) consolidation.

- Look to enter during wave (3), which could have increased momentum.

🟥 Risk Management:

- Watch the Invalidation Level near $10.80 to manage downside risk.

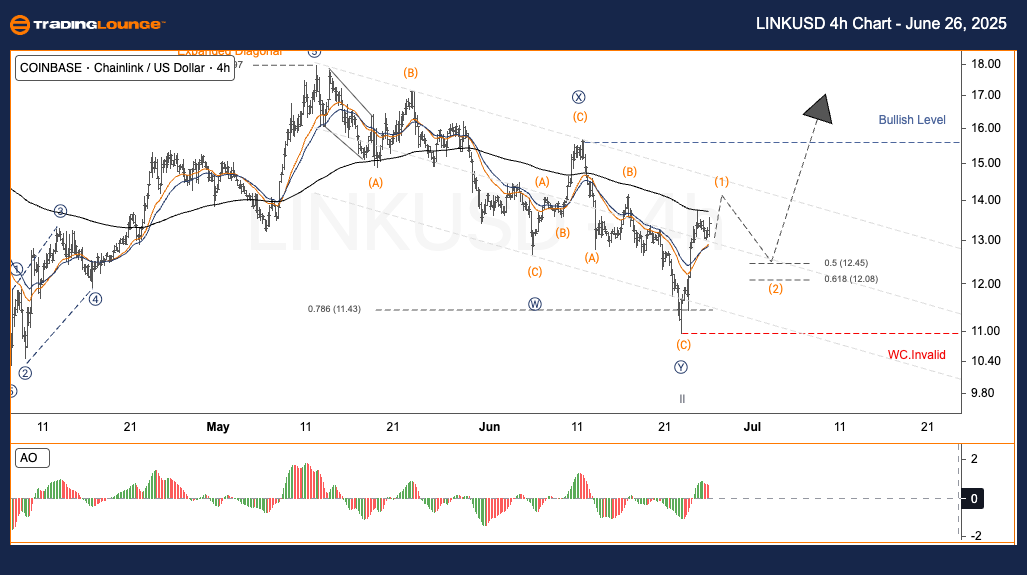

LINKUSD Elliott Wave Technical Analysis (4-Hour Chart)

- Function: Counter Trend

- Mode: Corrective

- Structure: Double Corrective

- Position: Wave 2

- Invalidation Level: Not defined

Overview:

Same as the Daily Chart – wave I topped at $17.97, wave II ended at $11.43 after a Double Zigzag correction.

Current price movement appears to be wave (1) moving upward, with a potential short-term pullback in wave (2).

Key resistance remains $16.00 – a decisive breakout here would reinforce bullish structure heading into wave (3).

✅ Swing Trade Strategy:

- Await the end of wave (2) retracement before entering into wave (3).

🟥 Invalidation Zone: Near $10.80

Technical Analyst:

Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

Unlocking ASX Trading Success - Mineral Resources Limited

Elliott Wave Technical Analysis: Dell Technologies Inc. - Wednesday, June 25

Elliott Wave Technical Analysis: Euro/British Pound - Wednesday, June 25

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more