DocuSign Crushes: Buying Opportunity

DocuSign's (DOCU) stock lowered more than 10% on Friday, September 4 after the company reported spectacular earnings the day before. As of the time of this writing, DocuSign is down by 25% from its highs of the year reached only three days ago, so volatility has been truly breathtaking in the stock.

This is happening in the context of a broad market selloff which is particularly hurting growth stocks, so investors are naturally wondering if the recent pullback is creating a buying opportunity in DocuSign, or if the bullish thesis in DocuSign is now broken.

Make no mistake, the fundamentals remain intact and the bullish thesis is stronger than ever. The lower the price goes in the short term, the bigger the opportunity for long-term investors in DocuSign

The Fundamentals Remain Intact

DocuSign delivered a blowout quarter across the board: sales, earnings, and guidance exceeded expectations. The company is doing a great job of expanding into the additional areas beyond digital signatures, and management is increasingly betting on international markets for further growth.

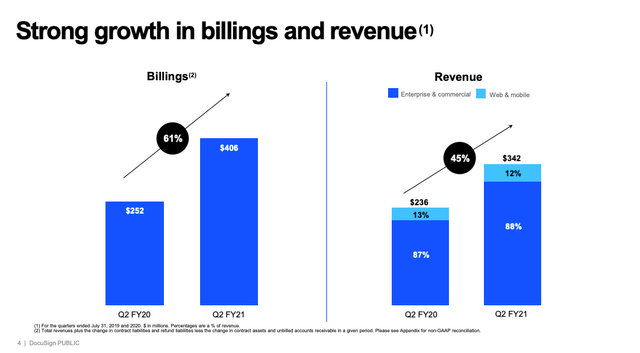

Billings grew 61% year-over-year to $406 million during the quarter, while revenue increased 45% to $342 million. The company added more than 88,000 new customers during the period. In fact, DocuSign acquired more new customers in the first half of this year than in all of last year.

Source: DocuSign

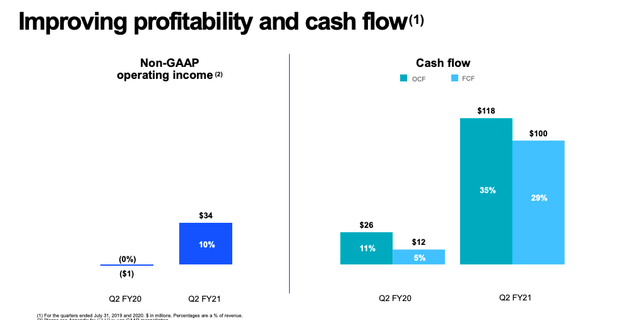

The company is making solid progress in terms of profitability, too. Adjusted operating income reached 10% of revenue last quarter, and both operating cash flow and free cash flows reached record levels during the period. Rapid revenue growth in combination with expanding profit margins could provide a double boost to earnings growth in the years ahead.

Source: DocuSign

The company is being benefited by the trend toward document management digitalization during the pandemic. But this is not a temporary phenomenon: customers who digitize their paperwork during the pandemic will not go back to paper after it is over, so demand acceleration will have a permanent impact on the business.

Management provided some examples of how this trend is playing out during the conference call:

- A large retailer with a network of healthcare clinics within its stores accelerated plans to provide telehealth services, using DocuSign eSignature to handle consent and other paperwork remotely. In the future, this client is going to use the paperless process for in-person clinic visits too, because the electronic way is simply more efficient and it provides a better experience than paper and clipboards.

- A big financial institution was already using eSignature widely, and when COVID-19 hit, it accelerated plans for further rollouts, and it activated 11 new lines of business with DocuSign.

- A major city deployed a digitized workflow to handle applications for housing assistance, and DocuSign enabled the federal agency to capture applications and distribute relief funds to healthcare providers on the front lines of coronavirus response.

DocuSign recently acquired Liveoak Technologies to accelerate the launch of DocuSign Notary, a solution for remote online notarization where signatories and the notary public are in different places. The main idea is to do with DocuSign Notary what eSignature is doing for document signing.

For agreements that would normally require people to be together in person, Liveoak enables the transaction to be done remotely via video conferencing. The company's platform includes several other technologies specific to remote agreements too, such as video identity verification, collaborative form filling, integration with DocuSign eSignature, and a detailed audit trail.

On the international front, Chief Financial Officer Mike Sheridan was promoted to the role of President of International at DocuSign. International markets are still a huge opportunity for the company, with total international revenue growing 59% year-over-year and reaching $67 million last quarter.

The numbers for the quarter were very strong on all fronts: revenue, billings, customers, and margins. Besides, the company is successfully expanding into new products and services, and international markets are offering promising potential for growth in the years ahead.

Price Trend And Valuation

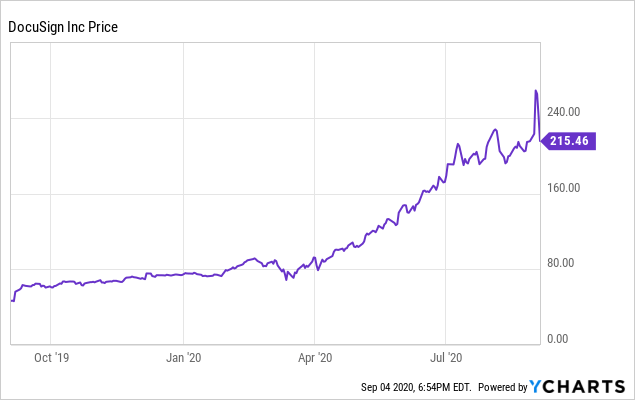

Depending on your time frame, you can have a very different perspective on DocuSign's stock. Yes, the stock is down by 25% in a few days, but it has also produced massive returns over the past year. Stock prices do not move in a straight line, and corrections are perfectly normal and even to be expected.

It is easy to see that the price chart was getting rather parabolic before the earnings report, and parabolic increases in stock prices generally precede sharp corrections. The recent price behavior in DocuSign is no exception to this general rule.

Chart by YCharts

DocuSign's stock is still not cheap in terms of valuation. The market is expecting strong growth from the business and these demanding expectations are reflected on the stock price. However, valuation is now more reasonable after the recent pullback.

We can compare growth rates and EV to Sales ratios for DocuSign versus Zscaler (ZS) and nCino (NCNO). These three companies are obviously very different and they operate in different segments, but their growth rates are roughly in the same ballpark, so the comparison could provide some perspective.

Roughly speaking, DocuSign doesn't look excessively valued in comparison to other software stocks with similar growth rates.

| DOCU | ZS | NCNO | |

| Sales Growth TTM | 40.59% | 43.45% | 49.61% |

| Sales Growth Projected | 28.80% | 31.33% | 25.52% |

| EPS Growth Projected | 70.84% | 33.33% | 24.78% |

| Enterprise Value to Sales | 38.16 | 46.87 | 50.34 |

We could argue that the sector as a whole is overvalued, so a relative comparison is misleading. That would be a fair point, but we also need to understand that the true value of the business will depend on the cash flows that this business is going to produce in the long term, as opposed to current sales and earnings.

DocuSign is delivering outstanding growth and planting the seeds for sustained growth over the years ahead, so it is unreasonable to expect a company of this quality to trade at subpar valuation levels. Wall Street analysts currently have an average price target of $250 for DocuSign, and the highest price target among the analysts following the stock stands at $300. These valuation ratios represent an upside potential of 16% for the average price target and 40% for the most optimistic target.

DocuSign is still priced for demanding growth expectations, and the company needs to deliver in order to justify current price levels. At these levels, valuations don't leave any margin for error.

That being acknowledged, the stock is not necessarily overvalued if management keeps executing well and building new growth engines for the company in the years ahead.

The Takeaway

DocuSign is still no bargain at these prices, but it is an excellent company delivering rock-solid performance and pulling back while still in a long-term uptrend. Management is executing well and positioning the company for sustained growth over the years ahead.

After the recent earnings report, which validates the long-term bullish thesis for DocuSign, any pullbacks down the road should be considered buying opportunities in a high-quality growth stock.

Disclosure: I am/we are long DOCU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company ...

more

An Interesting AND educational post. Thanks for sharing it.