Do Friendly Bears Exist?

“Never sell the bear’s skin before one has killed the beast.” - Jean de La Fontaine.

On Wall Street, bear markets represent declines of at least 20% from their highs. But on Main Street, bears are anthropomorphized as friendly. Here we look at whether bears can also be “friendly” in financial markets, looking at the S&P 500®’s bear markets to assess what periods of pessimism have told us, historically, and whether there may be glimmers of hope.

A tumultuous 2022 resulted in the S&P 500 entering a bear market and posting its worst calendar year performance since 2008, down 18%, bringing an end to its three-year winning streak. The picture could have been grimmer had it not been for an early rally in October and November; the S&P 500 was down more than 25% at its worst point.Exhibit 1 shows that the S&P 500’s reached only one all-time high during 2022 (on Jan. 3), the fewest all-time highs in a year since 2012.

Investors may be forgiven for forgetting what it feels like to be in a bear market. The S&P 500’s longest bull market, which began after 2008’s Global Financial Crisis (GFC), was followed by the shortest bear market in history. Exhibit 3 shows that the current 2022-23 bear market’s 20% decline hasn’t reached the same magnitude as the 2020 COVID-19 sell-off or 2008 GFC, which recorded declines of 34% and 57%, respectively. However, 2022’s bear market is already 11 times the length of 2020’s COVID correction.

Overall, the S&P 500’s 14 bear markets since 1928 lasted an average of 19 months and were accompanied by an average peak-to-trough performance of -38% (see Exhibit 3).

(Click on image to enlarge)

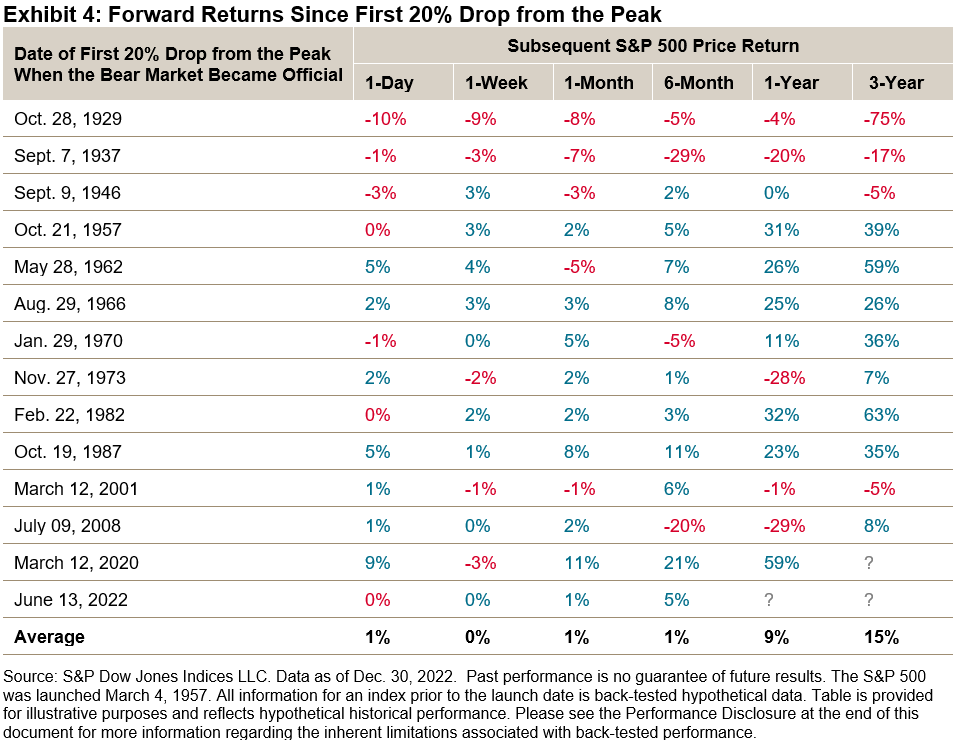

However, market participants can take one silver lining from history—the S&P 500 has typically rebounded from major drops over medium horizons. For example, Exhibit 4 shows that the S&P 500 gained an average of 15% over the three-year period following the beginning of a bear market, and the index typically exhibited a positive return. While history shows the importance of treading with caution in bear markets, a friendly reminder is that at the end of every bear market, a bull market begins and all things pass in time.

(Click on image to enlarge)

More By This Author:

Indexing’s Evolution In Indian Markets

Latin America In The Long Term: A Potential Application Of U.S. Equities

Commodities Outperform For The Second Year In A Row

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.