Dividend Watch: 2 Top Ranked Companies Boosting Payouts

Image: Bigstock

Key Takeaways

- Several companies have recently announced higher quarterly dividend payouts, which can be taken as a positive sign.

- Both Pearson and American Express carry favorable Zacks Ranks at the moment, indicating upward trending earnings estimate revisions.

Everybody loves dividends, as they often provide a passive income stream, limit drawdowns in other positions, and provide more than one way to profit from an investment. And when considering dividend-paying stocks, those with a history of boosting their payout are prime considerations, reflecting their commitment to increasingly rewarding shareholders.

In addition, consistent dividend hikes reflect the company’s successful nature, opting to share profits with shareholders.

For those seeking companies that have recently boosted payouts, two favorably ranked considerations, American Express (AXP - Free Report) and Pearson plc (PSO - Free Report), fit the criteria. Let’s take a closer look at each.

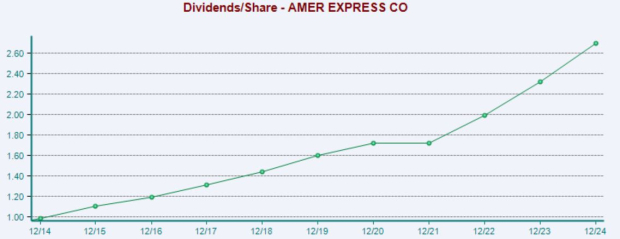

American Express Keeps Paying Investors

American Express has long been recognized as a strong income-focused play thanks to consistent payouts over the years, with the company sporting a shareholder-friendly 12.5% five-year annualized dividend growth rate. Provided below is a chart illustrating the company’s dividends/share on an annual basis.

Image Source: Zacks Investment Research

In addition, analysts have become bullish on the company’s current year EPS outlook, with the $15.31 per share estimate up 4% over the last year and suggesting 15% year-over-year growth. The stock sports a Zacks Rank #3 (Hold) rating.

Image Source: Zacks Investment Research

American Express recently upped its quarterly payout by 17%, bringing the quarterly total to $0.82 per share. Shares yield 1.1% annually compared to a 1.3% annual yield from the S&P 500.

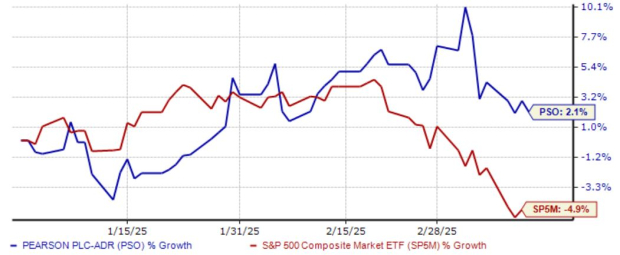

Pearson Shares Show Relative Strength

Pearson shares have demonstrated a nice level of relative strength in 2025, gaining 2% compared to a 5% decline from the S&P 500. The company unveiled a massive 120% boost to its quarterly payout in late February, with the quarterly payout now totaling $0.21 per share.

Image Source: Zacks Investment Research

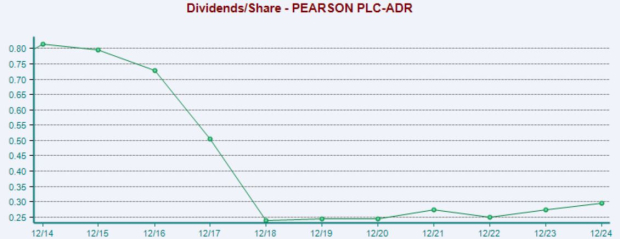

As shown below, the company is slowly returning to a more shareholder-friendly nature over recent years, following payout cuts throughout the 2015-2019 period.

Image Source: Zacks Investment Research

Like American Express, Pearson has enjoyed positive earnings estimate revisions for its current fiscal year, helping land the stock into a favorable Zacks Rank #1 (Strong Buy) rating. The $0.88 Zacks Consensus EPS estimate suggests 13% growth year-over-year.

Bottom Line

Dividends bring about many great perks to investors, such as passive income and the ability to achieve maximum returns through dividend reinvestment.

Companies boost payouts when business is fruitful, overall sending a positive message concerning the longer-term picture. In addition, consistently higher payouts owe to a company’s cash-generating abilities, undoubtedly a huge positive.

And for those seeking companies looking to pay their shareholders a higher paycheck, both companies discussed above – American Express (AXP - Free Report) and Pearson (PSO - Free Report) – fit the criteria.

More By This Author:

Are Stock Splits Buy Signals?

Are High-Yield Dividend Stocks Best For Income-Focused Investors?

3 Dividend Kings Shaking Off Market Woes

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more