3 Dividend Kings Shaking Off Market Woes

Image: Bigstock

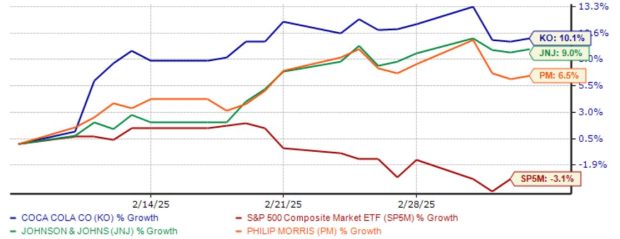

The market has thrown a tantrum over recent weeks following tariff news and other economic data pointing to a slowing consumer base. While it’s certainly been a turbulent period, several stocks, including Coca-Cola (KO - Free Report), Philip Morris (PM - Free Report), and Johnson & Johnson (JNJ - Free Report), have remained strong over the past month, as shown below.

Image Source: Zacks Investment Research

All three reflect defensive deployments, with their products able to carry steady demand through many economic backdrops. Let’s take a closer look at each for those interested in adding in an additional layer of defense.

Coca-Cola Gains Market Share

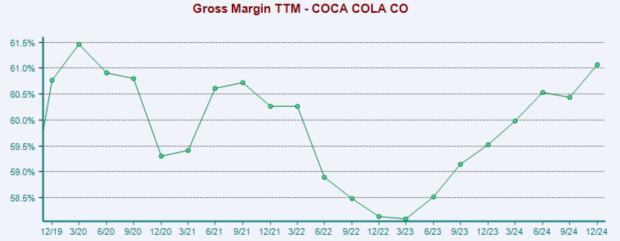

Concerning headline figures in Coca-Cola's latest release, the company exceeded both consensus EPS and sales expectations handily, reflecting growth rates of 12% and 6%, respectively. Notably, the company’s gross margin has remained constructive over recent periods, recovering nicely from early 2023 lows.

Please note that the chart tracks values on a trailing twelve-month basis.

Image Source: Zacks Investment Research

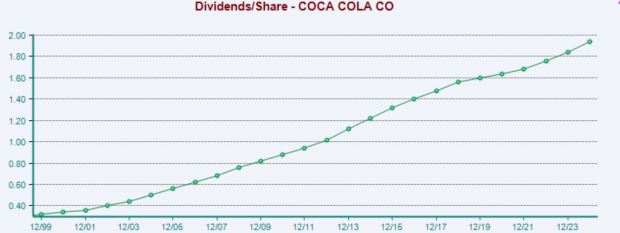

Notably, Coca-Cola gained market share in total nonalcoholic ready-to-drink beverages in North America, with its overall price/mix also increasing by an impressive 11% throughout its FY24. The stock also reflects a prime selection for those with an appetite for income, with Coca-Cola holding the elite Dividend King title.

Consistent cash flows have aided the shareholder-friendly nature, with the stock sporting a 4% five-year annualized dividend growth rate. Below is a chart illustrating the company’s dividends payouts on an annual basis.

Image Source: Zacks Investment Research

Philip Morris Innovation Paints Bright Outlook

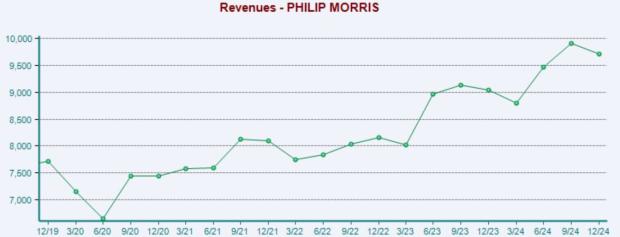

Philip Morris shares have benefited nicely from its latest set of better-than-expected results, with EPS growing 14% alongside a strong 7% move higher in sales. Demand has remained strong for the tobacco titan, with product innovations remaining key for its future.

The company's top line continues to grow at a solid pace, posting year-over-year growth rates of at least 5% over its last seven periods.

Image Source: Zacks Investment Research

Notably, smoke-free products exceeded 40 billion units for the first time throughout its FY24, with full-year net revenues for its Smoke-free Business (SFB) increasing by 14.2% alongside an 18.7% move higher in gross profit.

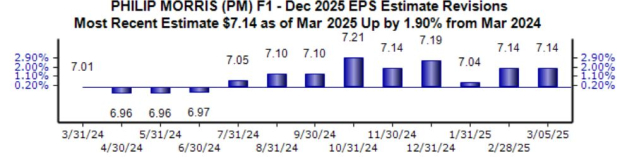

Shares may also provide a high level of passive income, currently yielding a market-beating 3.5% annually. Dividend growth has been rock-solid, with Philip Morris also holding the ranks of a Dividend King.

It’s worth noting that the company’s FY25 EPS outlook has remained constructive, with Philip Morris expected to see 8.9% year-over-year earnings growth.

Image Source: Zacks Investment Research

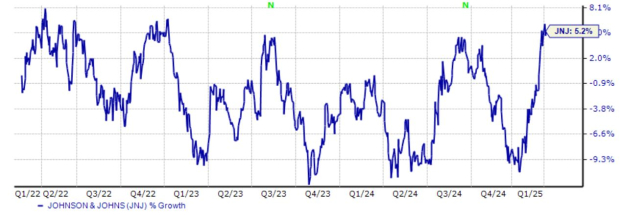

Johnson & Johnson Shares Ready to Breakout

Johnson & Johnson shares have traded primarily sideways over the past three years, up a modest 5% compared to the S&P 500’s 46% gain. While the performance has undoubtedly been ‘boring,’ the stability of the stock is a stronger takeaway here.

Shares have been looking to break out of the multi-year range, with its latest set of quarterly results sparking a positive move higher.

Image Source: Zacks Investment Research

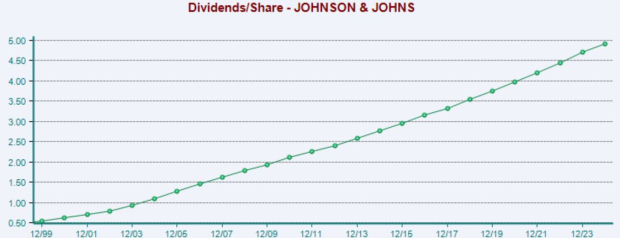

Like those above, the stock is a prime selection for those seeking a stream of income thanks to its consistent shareholder-friendly nature, as it is also in the elite Dividend King group. Shares currently yield 3.0% annually, with Johnson & Johnson sporting a 5.5% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Overall, the company’s cash-generating abilities, paired with a consistent pipeline, have positioned Johnson & Johnson shares favorably -- which could be a big reason it saw a strong post-earnings move following its latest print. The sideways action over recent years has undoubtedly forced shareholders to remain patient, and that could soon be paying off.

Bottom Line

While the market continues to throw its tariff tantrum, several long-established companies with years of operational success – Coca-Cola (KO - Free Report), Philip Morris (PM - Free Report), and Johnson & Johnson (JNJ - Free Report) – have all recently seen their shares move higher, displaying relative strength.

All three companies possess the advantageous ability to enjoy demand in many economic backdrops given their products’ ‘staple’ natures.

More By This Author:

3 Stocks To Buy For Post-Earnings MomentumSeeking Defense? 3 Top-Ranked Low-Beta Stocks Worth A Look

Mag 7 Members Are Shattering Quarterly Records

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more