Are High-Yield Dividend Stocks Best For Income-Focused Investors?

Image Source: Pixabay

When selecting dividend-paying stocks, one of the first things that investors look at is, of course, the annual yield.

But are high-yield stocks always the best route for income-focused investors? Let’s break it down.

Are High-Yield Stocks Best?

At a quick glance, a dividend-paying stock with a steep annual yield indeed seems like a solid investment from an income-focused standpoint. This is particularly true from a shorter-term perspective, but it’s not always that simple and clear-cut.

Dividend yields fluctuate, as they are a function of share price movement. If the stock goes up, the yield goes down, and vice versa. Investors should be fully aware of ‘dividend traps,’ a situation in which an enticing annual yield has been caused by poor share performance.

The risk to the initial investment is often greater in these situations, given the already negative sentiment causing poor price action. Remember, stocks can always go lower than previously thought, and you don’t want to get trapped in bearish price action.

But for those who seek reliability, targeting companies that have a rich history of increasing payouts are prime considerations. Dividend Aristocrats reflect these companies, as companies in the club have upped their dividend payouts for a minimum of 25 consecutive years and are included in the S&P 500, owing to well-established and successful business operations.

A few companies in the elite club include Johnson & Johnson (JNJ - Free Report), Coca-Cola (KO - Free Report), and Procter & Gamble (PG - Free Report).

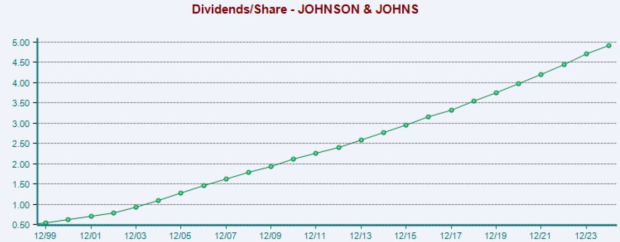

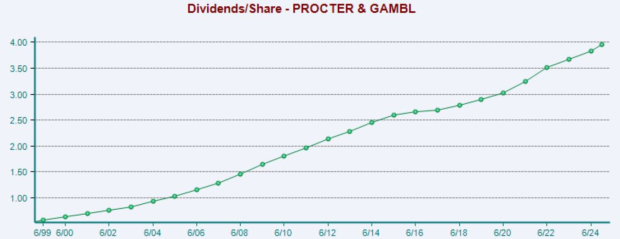

Below are charts illustrating these companies’ dividends paid on an annual basis.

Johnson & Johnson

JNJ shares currently yield 3.0% annually.

Image Source: Zacks Investment Research

Coca-Cola

KO shares currently yield 2.7% annually.

Image Source: Zacks Investment Research

Procter & Gamble

PG shares currently yield 2.3% annually.

Image Source: Zacks Investment Research

Bottom Line

Dividends come with many clear benefits, including a passive income stream and a shield against drawdowns in other positions.

And when it comes to consistency, members of the elite Dividend Aristocrat group, which includes Johnson & Johnson, Coca-Cola, and Procter & Gamble, have all delivered higher payouts for years.

More By This Author:

3 Dividend Kings Shaking Off Market Woes3 Stocks To Buy For Post-Earnings Momentum

Seeking Defense? 3 Top-Ranked Low-Beta Stocks Worth A Look

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more