Despite Short-Term Challenges, Disney Appears To Be Moving In The Right Direction

Photo by Travis Gergen on Unsplash

Next year, The Walt Disney Company (DIS) will celebrate its 100th anniversary, and the company is no longer the traditional entertainment giant it used to be. Pandemic-induced challenges are expected to continue this year, even though the financial situation of the company is much more stable and strong. At a time when other businesses were struggling to stay afloat, the media conglomerate made a smart move to enter the streaming market. Disney+ was a big success for the company, gaining more than 100 million users in less than a year. The success was partly due to its existing robust content catalog that includes well-known titles from Pixar, Marvel, the Star Wars empire, the X-Men, Fantastic Four, and Deadpool franchises, as well as other animated feature films. Disney also owns the streaming services ESPN+ and Hulu, and as of Q4 2021, the company had 179 million total subscribers across platforms. However, in the most recent quarter, the streaming services segment experienced slow growth. The reason for this decelerating growth had nothing to do with its content library, but rather because of the reopening of the economy, fewer work-from-home opportunities, and the rebounding travel industry. This may affect Disney's goal of achieving 230 to 260 million subscribers by 2024, but the company's non-streaming revenue is expected to surge in the coming quarters. A careful evaluation of the company’s prospects suggests the recent decline in Disney stock presents a good opportunity for growth-oriented investors.

The outlook for the streaming segment

There's no doubt that high-quality content is key for a streaming business to expand, and Disney is investing heavily in the creation of original local and regional content for its streaming services, with more than 340 titles in various stages of development and production. The company is establishing a new hub for international content creation under the direction of Rebecca Campbell, who was appointed Chairman, International Content and Operations on January 19, to support the ongoing expansion of the company's direct-to-consumer (DTC) business around the world and to fuel the growing pipeline of local and regional content for its streaming services.

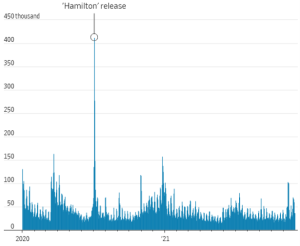

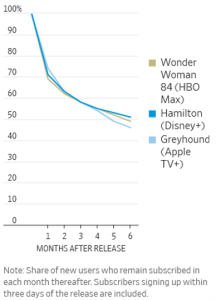

Despite these investments and the addition of new and original content, according to the Wall Street Journal, almost half of U.S. viewers who subscribed to streaming media after the premiere of must-watch content like the musical 'Hamilton' and HBO Max's 'Wonder Woman 1984' were gone within six months.

Exhibit 1: Disney+ daily U.S. sign-ups

Source: The Wall Street Journal

The concept on which streaming media depends worked during the pandemic as people looked for entertainment options while they were stuck in their houses. Now, to grow the subscriber base of streaming services, companies either must continue investing and launching new content frequently or must find other ways to reduce subscriber churn.

Exhibit 2: The retention of U.S. subscribers who signed up after a major release

Source: The Wall Street Journal

Given the launch of much-awaited shows can result in subscriber growth of over 0.4 million, on average, around the launch day, and companies having an average of 6 months to retain those subscribers, Disney+ Q1 subscribers growth could be around 8.5% to 9% to 128 million, as data shows the company gets 0.085 million subscribers per day on average. Since Encanto - Disney's best-animated film of 2021 - debuted very recently on Disney+ on December 24, the streaming platform’s subscriber growth in fiscal Q1 is likely to be better than the previous quarter. According to Diesel Labs, Encanto saw a surge in engagement when it premiered on Disney+ a month later and has maintained that engagement level throughout. Encanto was watched for 2.2 billion minutes in its first full week, from December 27, 2021, to January 2, 2022. However, not every animated film can have the same fate. Raya and Luca, for example, saw a spike in engagement when they first launched on Disney+, but that quickly faded as shown in the chart below.

Source: Diesel Labs

In addition, engagement for these films was almost twice as high in theatres as it was on Disney+ when they first premiered, but engagement for all of them declined dramatically following their initial releases. But Encanto after its theatrical run received a significant boost when it was made available on Disney+, and it has been able to maintain that level to date. As shown earlier, subscribers can be won by launching new content, but the company must strategically plan the date of content release to keep these new subscribers.

One of the trends that are worrying the company is that family films are struggling to perform in theatres because the pandemic fears remain, but the same films have performed better on Disney+. Considering this trend, Disney has decided to launch its next Pixar movie “Turning Red” exclusively on Disney+ in March. Animated feature films have been a huge success, and they will continue to add value as the company begins a new era of its business. However, continuing to add new content to the library will not be enough to meet the 230 million subscribers target, and profitability will be weighed down by rising costs as Disney continues to expand its subscription services into new countries.

Overall, the long-term outlook for the streaming business remains promising, but the company and its investors will have to stomach some short-term pain as the pandemic boost is slowly but surely beginning to fade. The increasing internet penetration rate in populous regions such as Latin America and Asia, the cord-cutting movement that is gaining traction in every corner of the world, and Disney’s strong brand assets will help the streaming business add new subscribers at a healthy pace for many years to come.

The outlook for cruise lines and theme parks

Due to pandemic-related restrictions, Disney's theme park operations and cruise lines have been one of the company's weakest areas in recent years, but theme park revenue increased by 300% YoY in Q4, totaling $1.15 billion, which sends a clear message this business segment is finally getting on the right track. However, the Omicron variant continues to affect this business, which is something investors need to keep an eye on. Disney is investing billions of dollars in building the Toy Story Land, Avengers Campus, and Star Wars: Galaxy's Edge, while upgrading its existing theme parks, and this long-term focused strategy could yield handsome returns once normalcy prevails in the next couple of years.

Last October, Disney announced the launch date of Star Wars: Galactic Starcruiser, a Star Wars-themed luxury hotel, which has already received a great response from consumers and a large number of reservations. However, following the release of the promo video, fans slammed the company for high prices, resulting in some reservation cancellations. The hotel is expected to open for guests on March 01, and this will give investors a hint as to the success of themed hotels in comparison to the massive success of Star Wars movies and related merchandise. If the idea of themed hotels shows some early success, there’s every reason to believe that the market will react positively to this development.

The company’s cruises began fully operational in August 2021 but started to face challenges due to the Omicron variant. The Disney Wish, Disney's newest cruise ship, was supposed to debut on June 9, but the sailing was canceled, along with the remaining 11 scheduled sailings for other ships. The company stated the postponement on February 08, after the shipyard had informed Disney Cruise Line that, despite their best efforts, they would require more time to complete the ship, owing in part to the pandemic and the arrival of the Omicron variant in Germany. The company also mentioned that guests who had been booked on the debut trip will be switched to the new date at a 50% discount and other passengers on affected cruises have the option of receiving a full refund or a 50% discount on a future trip departing by December 31, 2023. Although this delay might not be a major issue in the long run, it can still impact short-term operations.

Overall, the cruise business and the theme parks business seem well-positioned to stage a strong recovery this year, but a full recovery is unlikely as pandemic-related challenges continue to create challenges for the company. That being said, a partial recovery in these two important business segments could more than offset the expected deceleration of growth in the DTC business, which suggests stellar earnings growth is on the cards for this year.

Conclusion

Disney's stock has struggled since the beginning of the year, but the company’s prospects appear to be promising, and in the long run, the company is set to create substantial value for shareholders. Growth-oriented investors focused on opportunities in large-cap consumer discretionary businesses should find Disney stock an appealing bet under current market circumstances.

Disclosure: The author had a long position on The Walt Disney Company (DIS) shares at the time of publication.

Good read.

Covid has been challenging for Disney in some ways (amusement parks) and a boon in others (Disney+ streaming). Once Omicron burns out, I think $DIS will explode. For most families I know, a Disney park will be their first stop!

Mike Nolan, I couldn't agree more.

I totally agree with you. In a few years when we look back, the pandemic could prove to be a turning point in the company's history. The major change in business strategy announced in October 2020 to pivot towards a digital streaming business will open many doors for the company in the long run. All this while, the traditional entertainment business will continue to thrive too, so Disney is going to come out of this pandemic stronger than it used to be.

I agree. The company has adapted in many ways. I've been rather careful during the pandemic, but I have many friends who would never have dreamed of going to an amusement park one year ago. But between a milder variant, better procedures at Disney, and a general "we're sick of staying home" attitude, many are already flocking to the parks.