Desperately Seeking Plunge Protection

Image Source: Pexels

Investors scrambled into damage control mode on Thursday as stocks took a brutal beating. The sell-off was driven by weak economic data and another sharp decline in chip stocks, spreading losses across all three major indexes. This plunge came just a day after the Federal Reserve decided to hold rates steady, to a growing chorus cat call claiming the Fed is falling behind the curve. Hat tips for a 50 basis point cut in September are echoing through global markets this afternoon.

The S&P 500 dropped nearly 1.5%, while the tech-heavy Nasdaq Composite (^IXIC) reversed earlier gains to plunge almost 2.5% after a strong close on Wednesday. The Dow Jones Industrial Average (^DJI) fell almost 600 points, or 1.4%.

Perhaps more ominously, the 2-year yields seem to be headed towards sub 4%, while the global benchmark 10-year US Treasury yield dipped below 4%. Typically, falling yields in anticipation of Fed cuts aren't a bad omen for stocks. However, when recession warnings start flashing through the bond markets, it sends stock pickers running for cover.

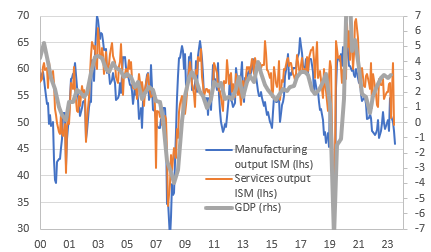

So, what sparked the panic? The key gauge of US factory activity came in with a dismal reading. A headline figure of 46.8 fell significantly short of the consensus expectation of 49, missing by what economists would call a "country mile." This reading marks the lowest level for ISM manufacturing since November. Indeed the data painted a uniformly bleak picture with the factory hiring gauge sinking to its lowest level in four years.

ISM reports suggests the risk of a rapid slowdown

Thursday's market action was another rollercoaster ride, showcasing the extreme volatility we've been experiencing. Investors were darting in and out of asset classes and sectors with the speed of a day trader on espresso, opting for Treasuries and even the US dollar as the latest safe havens. The Nasdaq 100 endured its sharpest one-day reversal since May 2020.

These wild market swings highlight the challenge of making sense of economic data and earnings reports, especially when the Fed’s stance seems to flip-flop between being stimulative one day and signalling growth concerns the next. This brings us to the pressing question: if the Non-Farm Payroll (NFP) report indicates weakness in the job market, will we need to price in four rate cuts in 2024, totalling 175 basis points by July 2024. or more?

In the lead-up to the US jobs report, data showed unemployment claims hitting their highest level in almost a year. If the NFP echoes this sentiment, we could be in for a wild ride. Stock valuations aren't exactly priced for perfection—one analyst on Bloomberg quipped . Rather US stock market are irrationally exuberant as they were at the end of 2021. And we all remember how that exuberance set the stage for the 2022 meltdown.

With market positioning seemingly as frothy as a barista’s cappuccino, traders might want to brace themselves. If the jobs report disappoints, we could see a swift and sharp recalibration across the board.

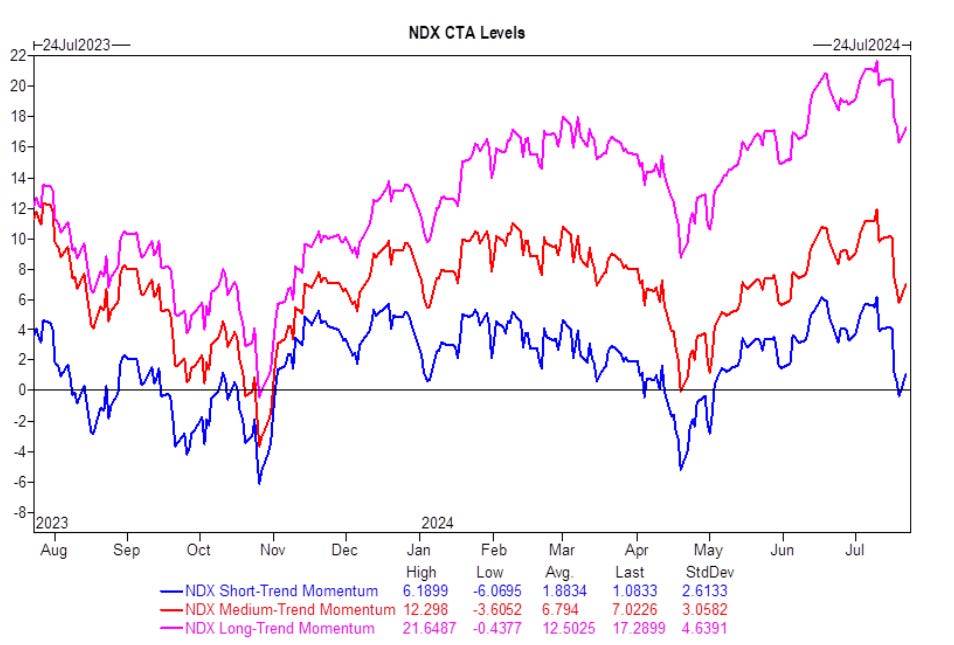

(Click on image to enlarge)

Goldman Sachs FICC and Equities Futures Markets Strats team, as of 7/24/24Source: Goldman Sachs FICC and Equities Futures Markets Strats team, as of 7/24/24

If stocks continue their downward spiral, rules-based traders might unwind $32.9 billion in global equities, with $7.9 billion exiting the US market, according to an analysis from Goldman Sachs high frequency trading desk. Even if the market stages a comeback, Commodity Trading Advisors (CTAs) are still set to sell $902 millions of US stocks.

Should the bears take charge and the slide extends through the fist full trading week of August , momentum traders could withdraw as much as $219 billion from global stocks, with $67.1 billion coming out of the US market. This potential exodus underscores the precariousness of the current market landscape.

Adding to the mix, we're entering the dog days of summer when Wall Street's vacation schedules kick in, thinning out market liquidity. As seasoned traders know, lower liquidity often results in more volatile markets, causing prices to swing wildly like a pendulum. In such an environment, it's crucial to stay nimble.

The VIX, the market's go-to fear gauge, is flashing warning signals once again. A break above 20 usually heralds a systematic house cleaning of risk assets, suggesting we may soon see more plunge protection trades layered across various markets. The uptick in the VIX is definitely causing a serious case of indigestion for global markets.

(Click on image to enlarge)

More By This Author:

Forex: Overshoots And Undershoots

Knocking On September’s Rate Cut Door

Inline Earnings Simply Isn't Good Enough & Look Out Below Say's This Yen Trader