Deere To Report Q1 Earnings: What's In The Offing?

Image: Bigstock

Deere & Company (DE - Free Report) is scheduled to report first-quarter fiscal 2023 results on Feb 17, before the opening bell.

Which Way Are the Estimates Trending?

The Zacks Consensus Estimate for Deere’s earnings per share is pegged at $5.53 for the fiscal first quarter, suggesting growth of 89.4% from the year-ago reported figure. The Zacks Consensus Estimate for total revenues is pinned at $11.3 billion, calling for a year-over-year increase of 32.5%. Earnings estimates for the fiscal first quarter have moved 0.2% north in the past 30 days.

Q4 Results

Deere’s sales and earnings surpassed the Zacks Consensus Estimate in the fourth quarter of fiscal 2022. Both bottom and top lines increased year over year. On average, the company has a trailing four-quarter earnings surprise of 7.1%.

Deere & Company Price and EPS Surprise

Deere & Company price-eps-surprise | Deere & Company Quote

What Does Our Model Indicate?

Our proven model conclusively predicts an earnings beat for Deere for first-quarter fiscal 2023. The combination of a positive Earnings ESP, and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the chances of an earnings beat.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Deere is +3.83%.

Zacks Rank: Deere currently carries a Zacks Rank of 2.

Key Factors to Consider

Favorable farm fundamentals have prompted farmers to boost spending on new agricultural equipment and replace the old ones. The preference for Deere’s products for their advanced technologies and features will likely reflect on fiscal first-quarter revenues.

Factors such as supply-chain issues; high production costs; selling, administrative and general expenses; research and development expenses; and the unfavorable effects of foreign currency exchange are likely to have impacted the company’s margin in the quarter. Nevertheless, favorable price realization and higher shipment volumes/sales mix are expected to have negated some of these headwinds, as seen in the fiscal fourth quarter.

Segmental Estimates

The Zacks Consensus Estimate for the Production & Precision Agriculture segment’s revenues is pegged at $5,367 million for the fiscal first quarter, suggesting a year-over-year increase of 59.9%. Sales are likely to have been aided by higher shipment volumes and price realization. The Zacks Consensus Estimate for the segment’s operating profit is pegged at $1,034 million, suggesting a 249.3% rise from $296 million reported in the prior-year quarter. Gains from higher shipment volumes and price realization are likely to have been somewhat offset by escalated production costs, and higher R&D and SA&G expenses.

The Zacks Consensus Estimate for the Small Agriculture & Turf segment’s revenues is pegged at $2,982 million for the fiscal first quarter, indicating 13.3% growth from the prior-year quarter. The segment’s operating profit is estimated at $454 million, suggesting 22.4% year-over-year growth. The segment’s performance is expected to have been driven by price realization and improved shipment volumes, partially offset by elevated production costs, higher R&D and SA&G expenses, and the unfavorable effects of foreign exchange.

The Construction & Forestry segment’s sales are estimated at $2,894 million for the fiscal first quarter, up 13.8% from the prior-year quarter’s reported number on strong demand. The segment’s operating profit is expected to rise 54.8% from the prior-year quarter’s reported figure to $421 million.

The Zacks Consensus Estimate for the Financial Services segment’s revenues is pegged at $923 million for the fiscal first quarter, up 6.1% from the year-ago quarter. The Zacks Consensus Estimate for the segment’s operating profit is pegged at $262 million compared with the prior-year quarter’s reported figure of $296 million.

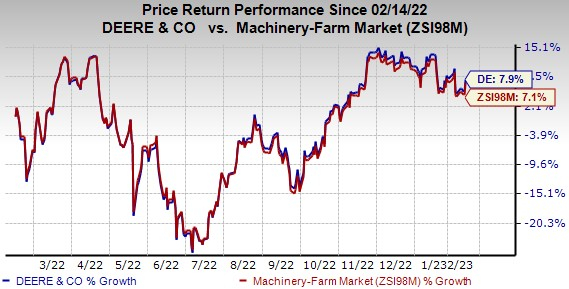

Price Performance

Deere’s shares have gained 7.9% in the past year compared with the industry’s growthof 7.1%.

Image Source: Zacks Investment Research

More By This Author:

Factors Likely To Support Coca-Cola's Earnings Beat In Q4

Time To Buy These "Unique" Top-Rated Stocks As Earnings Approach

Are These Stocks Bargains Before Earnings?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more