Could Robinhood Stock’s 110% Ytd Gain Be Just The Tip Of The Iceberg?

Image Source: Unsplash

Robinhood (HOOD) is the app that made investing feel like scrolling TikTok. It shook up the finance world by letting people trade stocks, crypto, and options—all from their phones—with zero commissions. Since launching in 2013, it’s built a loyal (and young) fanbase, gone public in 2021, and now it’s doing a lot more than just stock trading.

In 2025, Robinhood isn’t just a trading app. It’s building AI-powered tools, buying up crypto exchanges, and going after traditional finance. With the stock up 110% year-to-date, the question is: is this momentum real—or just hype?

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess Robinhood’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Strong Revenue Growth in Q1 2025

Robinhood pulled in 927 million dollars in revenue this quarter. That’s a 50 percent jump from last year. It beat Wall Street’s expectations and showed investors that this isn’t just a meme stock moment. It’s building real momentum.

Big Profit and Buybacks

Net income more than doubled to 336 million dollars. On top of that, Robinhood approved 500 million dollars more for stock buybacks. That tells us two things. One, the company is making money. Two, it believes its stock is still undervalued.

User Growth Slows Down

Monthly active users dropped from 14.9 to 14.4 million. It’s still a big number, but Wall Street didn’t like the dip. It could mean Robinhood is reaching a growth ceiling—or it just needs better retention strategies.

New Revenue Streams Are Kicking In

Robinhood is expanding beyond stock trading. Futures contracts, advisory services, and AI investing tools are all part of its plan. And it’s working. Futures trading hit 4.5 million contracts in April. Its “Strategies” AI tool now manages over 100 million dollars.

Industry Trends Support Robinhood’s Moves

More people are managing their own money. Passive investing is still big, but active trading is making a comeback, especially with AI tools. Crypto is recovering and interest in alternatives like futures is growing. Robinhood is right in the middle of all of it.

Fundamental Risk: Medium

The company is making money and growing fast, but it’s spending a lot to do it. If the Fed cuts interest rates or user growth keeps slowing, that could hit revenue hard.

IDDA Point 4: Sentimental

Overall sentiment is bullish for Robinhood.

Strengths

Robinhood stock is up 110 percent this year, showing strong investor confidence and momentum

The company is expanding into new markets with acquisitions like Bitstamp and TradePMR, which excited long-term investors

AI-powered investing tools are positioning Robinhood as more than a trading app, aligning with broader excitement around AI

CEO Vlad Tenev has been vocal about transforming Robinhood into a full financial platform, not just a trading gateway

Retail traders continue to flock to Robinhood for its ease of use, especially as markets stay volatile

Wall Street analysts like JPMorgan and Bernstein have raised price targets in response to its profitability and global expansion

Risks

Monthly active users dropped from 14.9 to 14.4 million, sparking concern about user retention

Interest income is at risk if the Fed cuts rates in the second half of the year

Regulatory pressure is still hanging around, especially in the crypto and options trading space

Increased competition from traditional players like Morgan Stanley and Schwab who are adding crypto and mobile-first services

Crypto revenue dropped from Q4 2024 to Q1 2025, even though it’s still up year over year

Sentimental risk: Medium.

Investors are excited, but any misstep—like lower user growth or regulation—could cool things off fast.

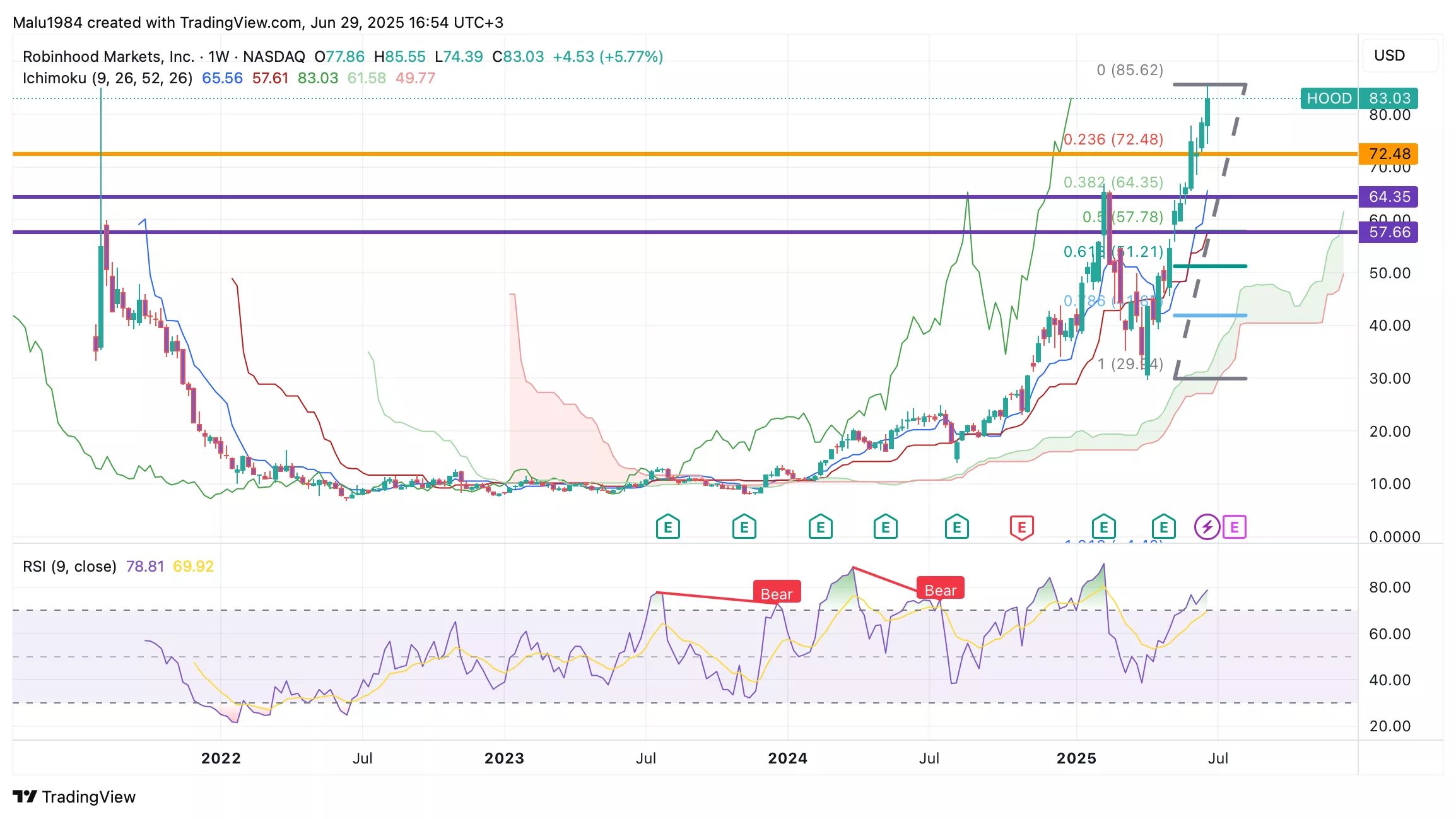

IDDA Point 5: Technical

Weekly Chart

Price is trading well above the Ichimoku Cloud, which confirms a bullish trend.

The cloud is thick and rising, showing strong support and momentum ahead.

The Tenkan line has crossed above the Kijun line, a bullish signal that suggests short-term buyers are in control.

The lagging span is above both the price and the cloud, confirming bullish confirmation from all Ichimoku elements.

RSI is at 78, which means the stock is extremely overbought. This means a pause or short-term pullback may be due.

Robinhood’s weekly chart is in a strong bullish trend, backed by clear Ichimoku signals. But with the RSI near 80, traders may want to wait for a pullback before jumping in. The long-term trend still favors the bulls. This stock is suitable for long-term investors.

(Click on image to enlarge)

Buy Limit (BL) levels:

$72.48 – High Risk

$64.35 – Moderate Risk

$57.66 – Low Risk

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: Medium to High

The trend is strong, but the RSI shows the stock is overbought. That means it could pull back soon—even if the bigger picture stays bullish.

Summary: Final Thoughts

Robinhood (HOOD) is no longer just the app that made trading feel like a game. It’s now a profitable fintech player expanding into crypto, AI investing, and even futures trading. With 110 percent YTD growth, it’s clear investors are excited—and for good reason.

Fundamentally, the company is making money, growing revenue fast, and building new income streams. But slowing user growth and dependency on interest income are worth watching.

Sentiment is bullish overall, with strong support from both retail and institutional investors. Still, regulatory pressure and rising competition could shake confidence if things shift quickly.

Technically, the chart is bullish across all major signals. But with RSI nearing 80, the stock may be due for a cooldown before its next leg up.

Robinhood is in a strong position, but it’s not risk-free. Between growth opportunities and volatility, it’s a stock for investors who are comfortable with some swings.

Overall Stock Risk: Medium

More By This Author:

Should Investors Get Into Roku Before It’s Too Late? Partnership With Amazon Could Fuel A Major Rebound

Is AMD Stock Undervalued In 2025? What Investors Should Know About Its AI And Cloud Push

A Boring Business With Billion-Dollar Moves? Look Closer At Rollins Stock