A Boring Business With Billion-Dollar Moves? Look Closer At Rollins Stock

Image Source: Unsplash

Rollins Inc. is one of the largest pest control companies in the world. You might not hear about them in flashy headlines, but this boring business is crawling with cash. With brands like Orkin under its belt, Rollins serves millions of homes and businesses across the U.S. and internationally.

In 2025, the stock is already up 22% year-to-date. While most people see bugs, investors might see a billion-dollar opportunity hiding in plain sight. But is Rollins stock (ROL) right for you?

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess Rollins’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

In Q1 2025, Rollins reported a 9.9% jump in revenue, hitting 805 million dollars. Net income climbed almost 16%. Most of this growth came from more residential and termite services, plus new customers from recent acquisitions.

Rollins acquired Saela Holdings, a top-25 U.S. pest control company with strong presence in the Pacific Northwest and Mountain West. This expands their footprint and brings in around 65 million dollars in revenue. It also signals Rollins is serious about staying number one in a growing but fragmented industry.

Rollins recently got its first-ever investment-grade credit rating and used that to issue 500 million dollars in 10-year notes. This gives them low-cost, long-term funding. Their debt remains manageable and helps fuel more acquisitions or possible dividends.

Steady demand meets tech upgrades

Climate change is driving pest issues further north. That helps Rollins. At the same time, they’re cutting pesticide use and investing in tech like sensors and drones. This improves efficiency and supports long-term growth while staying ahead of regulation.

They recently brought in a new Chief Accounting Officer and added Paul Donahue, a seasoned exec from Genuine Parts, to the board. The company is quietly upgrading leadership to match its growth.

Fundamental Risk: Low

Rollins has steady cash flow, smart leadership, and a sticky business model. It’s not flashy, but it’s built to last.

IDDA Point 4: Sentimental

Overall sentiment is bullish for Rollins.

Strengths

Rollins stock is up 22 percent year-to-date, showing strong investor confidence

Analysts praise the company’s consistent growth and recession-proof business model

Pest control demand is steady even during downturns, which adds to investor optimism

Rollins has a track record of smart acquisitions, and the Saela deal boosted confidence

Morningstar bulls highlight Rollins’s wide moat and pricing power in a fragmented industry

Risks

Bears argue the stock is priced for perfection and may be vulnerable to any stumble

If integration of Saela or other acquisitions goes poorly, it could impact earnings

Climate shifts may eventually reduce pest levels in some regions

Regulatory risk if new rules limit chemical use or force expensive changes

Some investors see it as overvalued compared to peers, which may limit upside

Sentimental Risk: Medium

The mood is mostly positive, but expectations are high. Any slip could trigger fear-based selling.

IDDA Point 5: Technical

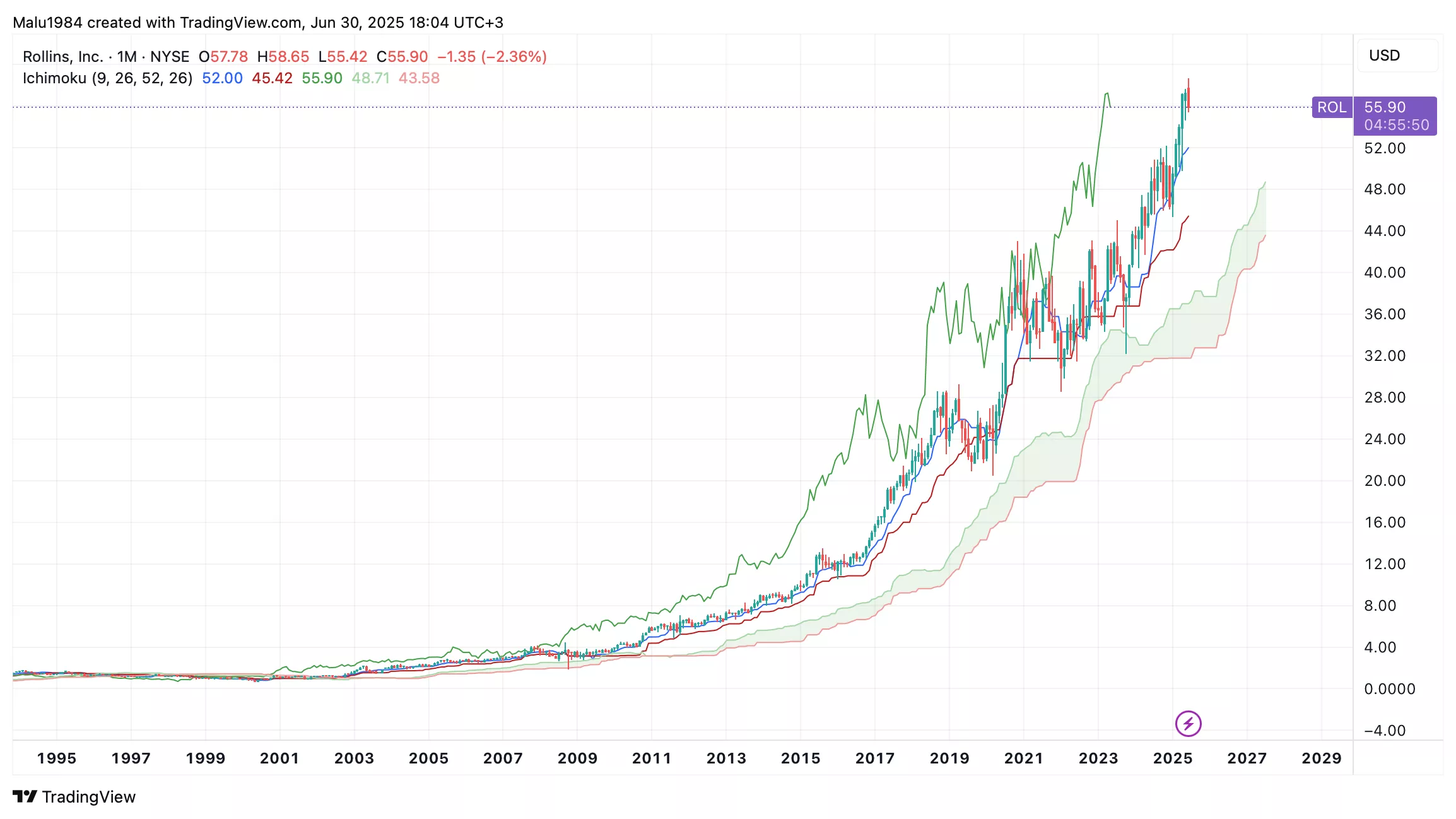

Monthly Chart

Price is well above the Ichimoku Cloud, showing long-term bullish momentum

Tenkan line is above the Kijun line, confirming a strong uptrend

Lagging span is above price and cloud, a classic bullish confirmation

(Click on image to enlarge)

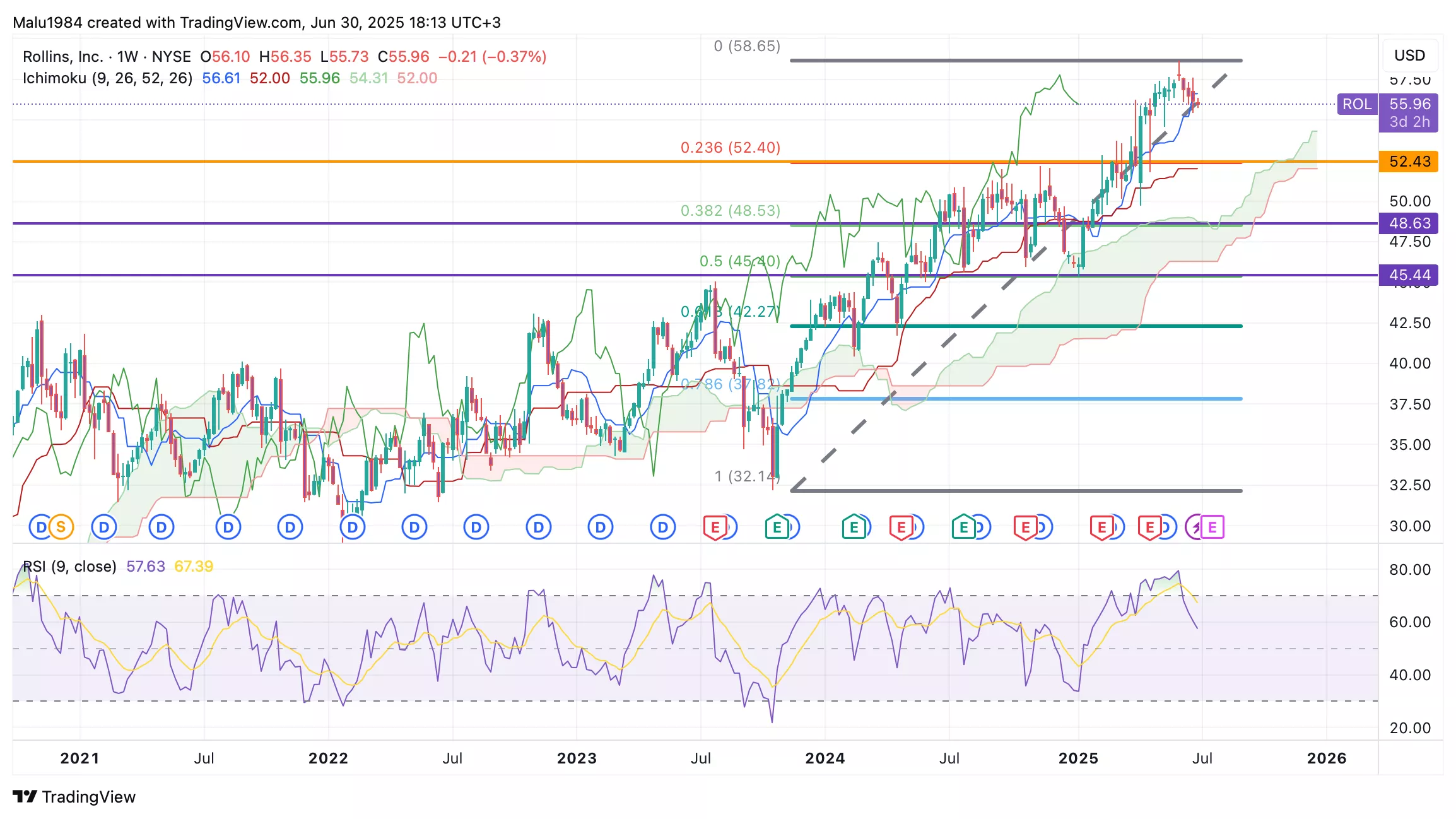

Weekly Chart

Price remains above the cloud, even after a short-term pullback

RSI is at 57, so there’s room for the stock to pull back before buyers step in

Overall trend is bullish.

Rollins stock still looks bullish on the charts. Even with short-term dips, the overall trend is strong. As long as the price stays above the cloud, bulls are in control. This stock is suitable for long-term investors.

Buy Limit (BL) levels:

$52.43 – High Risk

$48.63 – Moderate Risk

$45.44 – Low Risk

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Low to Medium

The long-term trend is strong and supported by bullish Ichimoku signals. But short-term pullbacks are possible, especially with RSI not yet oversold.

Summary: Final Thoughts

Rollins may not be a flashy tech stock, but it’s a cash machine wrapped in bug spray. The company keeps growing, with steady revenue, smart acquisitions like Saela, and a debt strategy that opens the door for more moves. Their push into tech and eco-friendly pest control gives them an edge in a space most investors overlook.

Sentiment is mostly bullish, but not euphoric. Analysts like the stability, but some worry the stock is priced too high and vulnerable to stumbles. Any failed acquisition or regulatory hit could rattle confidence.

Technically, the stock is in a strong uptrend. Both weekly and monthly charts show bullish signals, even after recent pullbacks. There’s room for dips, but the trend still favors buyers.

Overall Risk: Medium

Rollins is a solid pick for long-term investors who want steady growth without wild swings. Just make sure the price matches your plan before jumping in.

More By This Author:

Newmont Stock Is Beating The Market By 10x But What’s Really Driving It?Oklo Stock: Is This A Government-Fueled Growth Engine Or A Risky Bet?

Is RTX Stock A Buy In 2025? Why This Aerospace & Defense Giant Is Back On Investors’ Radars Amid Middle East Tensions