Should Investors Get Into Roku Before It’s Too Late? Partnership With Amazon Could Fuel A Major Rebound

Image Source: Pexels

When it comes to connected TV and ad supported streaming, few companies are as strategically positioned as Roku, Inc (ROKU). As a pioneer in the streaming device space with a dominant approximately 40% market share in U.S. smart TVs, Roku has evolved into a full-scale advertising and content distribution platform.

With its powerful operating system embedded in millions of devices and growing international reach, Roku now sits at the intersection of entertainment, data, and targeted digital advertising.

The recent partnership with Amazon (AMZN) marks a major turning point. As advertisers increasingly shift budgets from traditional TV to connected TV (CTV), Roku gains access to Amazon’s deep ad inventory and 80M+ connected TVs, expanding its reach and improving ad performance.

This collaboration is poised to accelerate revenue growth, deepen ad integration, and solidify Roku’s lead in the digital streaming ecosystem. In an age where data and engagement are gold, Roku’s AI powered personalization tools like “Roku Experience” offer compelling value to both viewers and marketers.

Of course, Roku isn’t without risks. It no longer reports key KPIs like ARPU and active account growth, which reduces transparency. The company is still reliant on the broader ad market, which could be volatile in a weak economy. And while the Amazon partnership looks promising, it’s crucial that Roku executes well to monetize this new audience reach.

So is Roku just another streaming stock riding the cord-cutting wave, or is it quietly transforming into the advertising powerhouse of the connected TV era?

Let’s break it down using the Invest Diva Diamond Analysis (IDDA) Framework:

Capital, Intentional, Fundamental, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Before investing in Roku, ask yourself:

Do you want exposure to the growing shift from traditional TV to streaming and connected TV?

Are you bullish on the future of digital advertising and personalized content delivery?

Are you comfortable with short-term volatility and a company still on the path to profitability?

Roku is perceived to be a leader in an expanding industry with strong long term tailwinds. Its platform monetizes not only content but also ad inventory, and its razor sharp focus on viewer experience and data gives it a competitive edge. The Amazon deal supercharges this advantage, unlocking new revenue channels and broader ad reach.

However, Roku’s success is not guaranteed. Reduced KPI transparency may concern some investors, and while operating metrics are improving, profitability hasn’t yet materialized. Execution risk remains, especially in maintaining dominance as new competitors enter the space.

If you’re building a portfolio with exposure to digital transformation, media-tech disruption, and scalable ad platforms, Roku offers high-growth potential with a large addressable market.

Just know: Roku isn’t your traditional value play. It’s a bold growth story for investors who believe in the future of streaming, data driven advertising, and the shift away from legacy media.

Roku is more for forward looking investors who want to ride the wave of connected TV, with the patience to wait for profitability and the vision to see long term platform value.

IDDA Point 3: Fundamentals

Roku’s new partnership with Amazon is expected to significantly enhance its digital advertising capabilities and overall growth potential. The collaboration allows Amazon advertisers to reach over 80 million connected TV users through Roku’s platform, expanding audience targeting and boosting ad efficiency. This comes at a time when the U.S. connected TV (CTV) advertising market is projected to grow by 12% annually through 2027, positioning Roku well within a booming industry.

Financially, Roku is showing strong signs of progress. Platform revenue rose 16% year-over-year in Q1 to $1.02 billion, with gross profits growing 15% to $445 million. Losses are narrowing steadily, and the company is on track to potentially reach GAAP operating profitability by FY 2026.

Roku ended 2024 with more than $2 billion in cash and no outstanding debt, putting it in a strong financial position. The company is on the path to profitability. However, the company is still operating at a loss and isn’t yet producing meaningful free cash flow, which could constrain its ability to reinvest or navigate unexpected challenges.

That said, there are still risks. Roku has stopped reporting key performance indicators like account growth and average revenue per user (ARPU), which limits visibility into platform health. Additionally, despite improving gross profits, the company remains unprofitable on an operating basis. If Roku fails to sustain digital advertising growth or reach profitability in the near term, the investment thesis may weaken.

Fundamental Risk: Medium – High

IDDA Point 4: Sentimental

Strengths

Massive User Base – Roku’s large and growing user base makes it an attractive platform for advertisers, allowing the company to charge a premium for valuable ad space, especially on its home screen.

Advantage Through the Roku Channel – By prominently featuring its own Roku Channel, the company can drive traffic away from competing free, ad-supported platforms like Pluto TV, Tubi, and Freevee.

Platform Neutrality – Unlike Apple and Amazon, Roku isn’t tied to a major subscription streaming service. This independence allows it to promote content more neutrally, which can appeal to both consumers and smaller content providers.

Risks

Profitability Challenges – Roku continues to sell its devices at a loss to maintain its user base, a strategy that hasn’t yet led to meaningful profits or free cash flow.

Lack of Differentiation – The Roku Channel lacks unique content and is difficult to distinguish from other free streaming services. Content costs have increased losses, and Roku doesn’t have other profitable business lines to help absorb these expenses.

Hardware Obsolescence Risk – As smart TVs become the norm, demand for standalone Roku devices may decline, forcing Roku to rely more on partnerships with TV manufacturers to stay in front of consumers.

Overall sentiment toward Roku is bullish, with its new partnership with Amazon seen as a game-changing move that enhances ad reach, performance tracking, and Roku’s leadership in the connected TV space.

While concerns remain around reduced KPI transparency and ongoing unprofitability, optimism is fuelled by innovations like the AI-powered “Roku Experience” and the potential for stronger monetization.

The Amazon deal is viewed as a strategic catalyst that could accelerate revenue growth and move Roku closer to profitability, especially with the stock trading below its historical valuation multiples making it an attractive long-term growth opportunity.

Sentimental Risk: Medium

IDDA Point 4: Technical

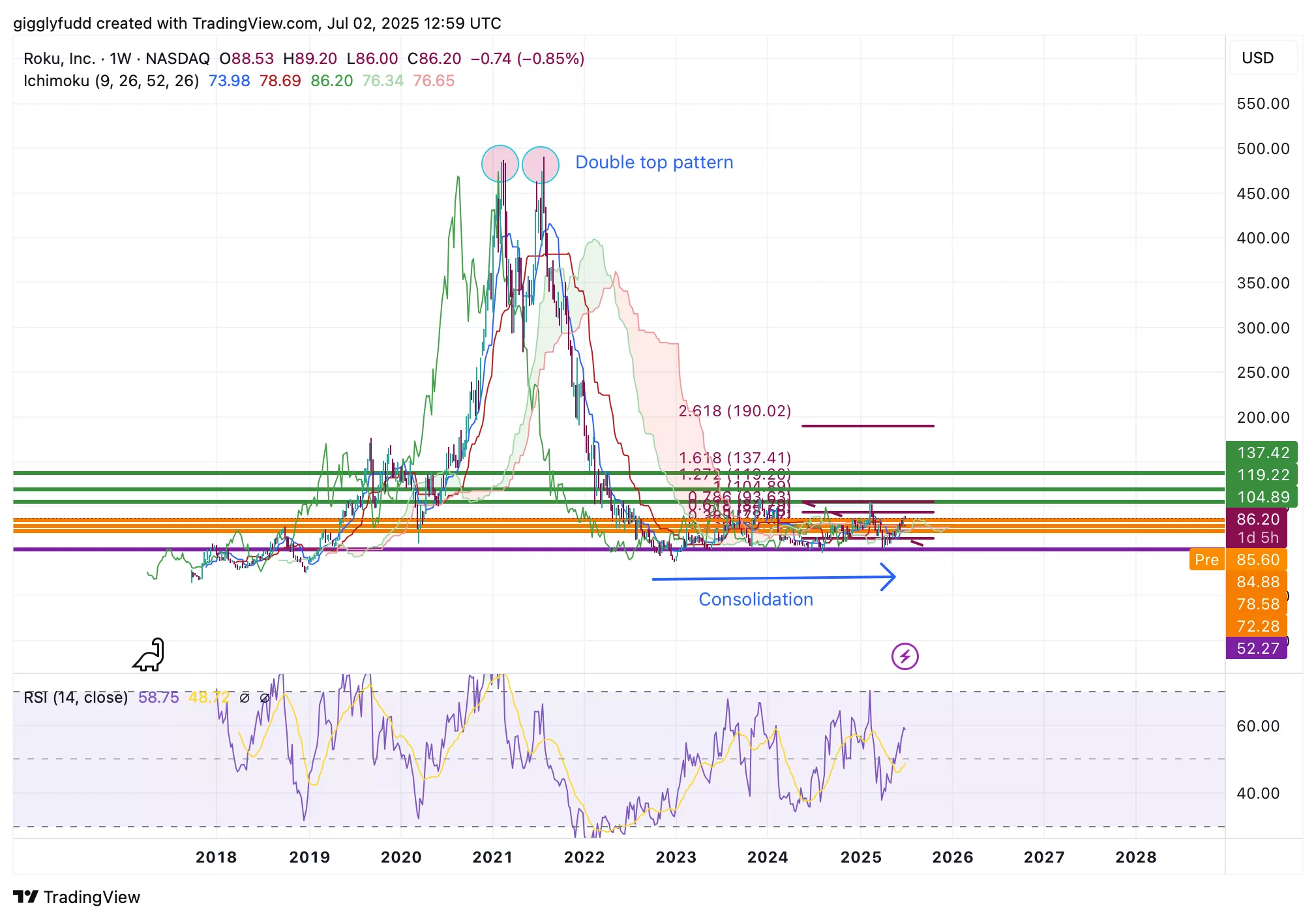

On the weekly chart:

The bearish cloud is thinning and flat, indicating the end of bearish momentum.

Candlesticks are trading above the cloud, which is now acting as a resistance zone.

The current pattern shows consolidation, signaling market indecision.

We can see that Roku performed exceptionally well during the COVID-19 pandemic, reaching highs of around $490. However, shares began plummeting in 2021, forming a double top pattern which is a classic bearish reversal. Since then, the stock has struggled to recover and has spent the last few years consolidating within a range of $50 to $104.

(Click on image to enlarge)

On the daily chart:

The future cloud is bullish, indicating potential upward momentum.

The current pattern is trending upwards, with candlesticks positioned above the cloud.

The Tenkan, Kijun, and Chikou lines are all above the cloud, further supporting a bullish outlook.

As the stock has been consolidating for the past few years, this creates potential for short-term opportunities. The current market price is $87.89 and is approaching a key resistance level at $104. A breakout above this level could trigger further bullish momentum and signal a potential recovery from the prolonged downtrend following the pandemic.

(Click on image to enlarge)

Investors looking to get in with ROKU can consider the following Buy Limit entries:

84.88 (High Risk)

75.58 (Medium Risk)

72.28 (Low Risk)

Investors looking to take profit can consider the following Sell Limit levels:

104.89 (Short term)

119.22 (Medium term)

137.42 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: High

Final Thoughts on ROKU

Roku’s recent partnership with Amazon is a potential game-changer, allowing advertisers to reach over 80 million users and positioning the company to capitalize on the rapidly growing connected TV ad market.

Financially, Roku is showing progress with rising platform revenue, narrowing losses, and a solid balance sheet backed by over $2 billion in cash and no debt.

While the company is still unprofitable and no longer reports key KPIs, investor sentiment remains optimistic, driven by innovations like the AI-powered “Roku Experience” and a strengthening technical outlook.

With shares trading near $87.89 and approaching key resistance at $104, a breakout could mark the beginning of a longer-term recovery.

Recommendation: Buy / Medium – High Risk, High Growth Stock

Roku offers strong upside potential for investors seeking exposure to the connected TV and digital ad space. Its improving financials, strategic positioning, and product innovation support a bullish long term view. For those with moderate to high risk tolerance, buying around $84 to $75 may provide attractive entry points, with potential price targets between $105 and $137 as Roku aims to regain momentum after years of consolidation.

Overall Stock Risk: Medium – High

More By This Author:

Is AMD Stock Undervalued In 2025? What Investors Should Know About Its AI And Cloud Push

A Boring Business With Billion-Dollar Moves? Look Closer At Rollins Stock

Newmont Stock Is Beating The Market By 10x But What’s Really Driving It?