Chipotle: A High-Growth Restaurant Chain Worth Scooping Up

Image Source: Pexels

Since opening its first store in Denver in 1993, Chipotle Mexican Grill Inc. (CMG) has developed a reputation for serving responsibly sourced, classically cooked food without artificial colors, flavors, or preservatives. The company features a menu of burritos, burrito bowls, quesadillas, tacos, and salads, highlights Doug Gerlach, editor of Investor Advisory Service.

Chipotle has since grown to over 3,500 restaurants located across the United States, Canada, the United Kingdom, France, Germany, and Kuwait. Approximately 98% of the company’s restaurants are in the US. It is the only company of similar size that owns and operates all its restaurants in North America and Europe.

The company’s core customer base tends to be younger, more affluent, and more health-focused. However, management has emphasized it also continues to see solid demand beyond its core customers. Combined with generous portion sizes, Chipotle has driven strong consumer loyalty that has resulted in 40 million members enrolling in its Chipotle Rewards program in just five years.

The company’s results are aided by its strong value proposition. Even in an environment where fast-casual and quick service restaurants are feeling pressured by inflation, Chipotle continues to produce strong results.

In the most recent quarter, the company reported over 11% growth in comparable restaurant sales driven by a nearly 9% increase in transactions. In contrast, comparable sales across quick service restaurants fell in the second quarter, as traffic was hurt by rising prices. The relative value proposition Chipotle offers has only improved as the price gap with other chains has narrowed.

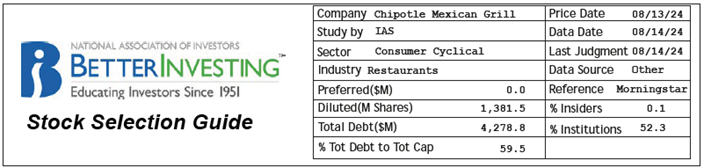

Chipotle boasts a strong balance sheet with no long-term debt, and we have a favorable view of management. However, it is worth highlighting two issues.

The first is the food safety scares that occurred in the 2015-2018 timeframe. In the wake of the scare, the company revamped many of its food-safety protocols, and food safety has taken on greater importance. The continued loyalty its customers have shown following the scare underscores the strength of the brand.

The second potential concern is the high P/E multiple shares carry. Given the attractive returns on capital combined with strong growth, the premium multiple looks to be warranted. However, if fundamentals deteriorate the multiple compression could be painful.

CEO Brian Niccol was recently poached by Starbucks Corp. (SBUX), a company with a proud history that is struggling to return to its winning ways. The news sent Chipotle shares down 8%.

But we project 13% revenue growth over the next five years based on a combination of footprint expansion and comparable sales growth. A combination of margin expansion and share repurchases leads to an average annual increase in EPS of 20%.

Applying a high P/E of 45, we get a potential high price of 114. Applying a low P/E of 35 to trailing EPS of $1.02 yields a low price of 36. Therefore, we model an upside/downside ratio of 3.9 to 1 and a potential high return of 17% annually.

My recommended action would be to consider buying shares of Chipotle Mexican Grill.

About the Author

Doug Gerlach is the senior equity analyst with Equity Research Service, a division of the National Association of Investors (NAIC), and editor-in-chief of its stock newsletters including the award-winning Investor Advisory Service, the market-beating SmallCap Informer, and a dividend-focused newsletter.

NAIC is also the home of the BetterInvesting Stock Selection Guide and other tools for stock analysis including StockCentral.com and MyStockProspector.com. Mr. Gerlach is the author of six books, including Investment Clubs for Dummies and The Armchair Millionaire.

More By This Author:

PIN: Use This ETF To Profit From Gains In Indian Stocks

Why Focusing On Policy (Rather Than Politics) Is The Smart Investor Play

WMT: A Barometer Of Consumer Health Telling An Encouraging Story

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more