PIN: Use This ETF To Profit From Gains In Indian Stocks

Image Source: Pixabay

A margin of safety policy can often pay off. Most of our investments handled early August’s market meltdown better than the major stock market indexes. In market drops, they’ll hold up better than the major indexes while earning solid returns during high-spirited markets. Meanwhile, I recommend the Invesco India ETF (PIN), advises Bob Carlson, editor of Retirement Watch.

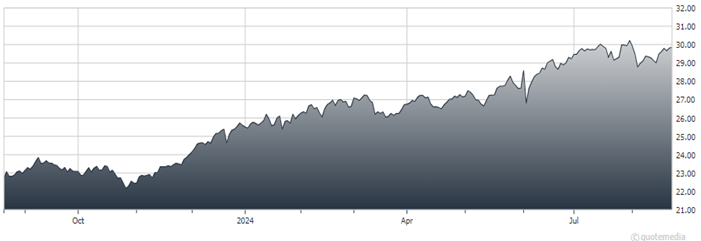

Taking advantage of the market volatility to move some money from principal-protected investments to a couple of international stock funds makes sense. India is one of the world’s fastest-growing economies and top-performing stock markets. It is less correlated with many global equity markets. It held up well in the recent decline, and it was a strong performer before then.

Invesco India ETF (PIN)

India is taking some of the business that are moving from China. A risk is it seems there’s often political uncertainty in India, and that can lead to fluctuations in the economy and stock market. But the PIN ETF tracks the FTSE India Quality and Yield Select Index, has very low expenses, and has generated solid long-term performance.

The fund recently held about 190 securities, with 36% of the fund in the 10 largest positions. The fund was down 1.4% in a recent four-week period. It gained 9.6% over three months, 14.5% for the year-to-date, and 28.4% over 12 months.

My recommended action would be to consider buying PIN.

About the Author

Robert Carlson is editor of the monthly newsletter and website, Retirement Watch. He is chairman of the board of trustees of the Fairfax County Employees' Retirement System, which has over $3 billion in assets, and was a member of the board of trustees of the Virginia Retirement System, which oversaw $42 billion in assets, from 2001-2005.

He co-authored Personal Finance After 50 for Dummies (with Eric Tyson). Previous books include Invest Like a Fox...Not Like a Hedgehog and The New Rules of Retirement.

More By This Author:

Why Focusing On Policy (Rather Than Politics) Is The Smart Investor PlayWMT: A Barometer Of Consumer Health Telling An Encouraging Story

BAC And JPM: Two Financial Sector Winners In A Lower-Rate Regime

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more