Why Focusing On Policy (Rather Than Politics) Is The Smart Investor Play

Image Source: Pixabay

Election season can be a lot. Nobody knows what’s going on, yet everybody seems to have a strong opinion about it. I’ll give you a break from the partisan nonsense. I’m not here to talk politics. In fact, I am here to convince you to stop talking about politics, at least when it comes to your investments.

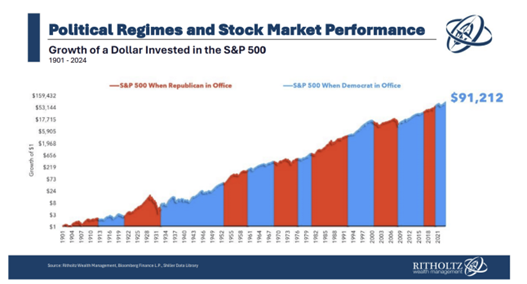

A common question I get these days is how the election could change markets and the economy. My answer? Not as satisfying as you might think. Politics don’t matter for your portfolio if you’re one of many people investing to build wealth over a long period of time.

Source: Ritholtz chart wiz Matt Cerminaro

If somebody tells you otherwise, they’re spinning a tale. The data is clear: Market crashes and economic crises have happened during Democratic and Republican administrations.

Every president since 1900 with the exception of three – Lyndon B. Johnson, Bill Clinton, and Joe Biden – has been in the Oval Office during a recession. Over that same period, every president but one – George HW Bush – has been in power during a bear market (or a market crash of 20% or more).

While politics don’t matter much in investing, policy does. This is where Congress comes in. Congress’ party lines can make or break the likelihood of new policy passing. Historically, the market has slightly preferred a split Congress – with one party controlling the House and another controlling the Senate. Since 1950, the S&P 500 has returned an average of 22% in a two-year term of a split Congress, versus an average of 14% in a unified Congress.

No matter who wins in November, we’ll ultimately have to process some degree of change. And while that change may not derail your financial goals, you may have to deal with the effects of evolving policy on your portfolio and wallet.

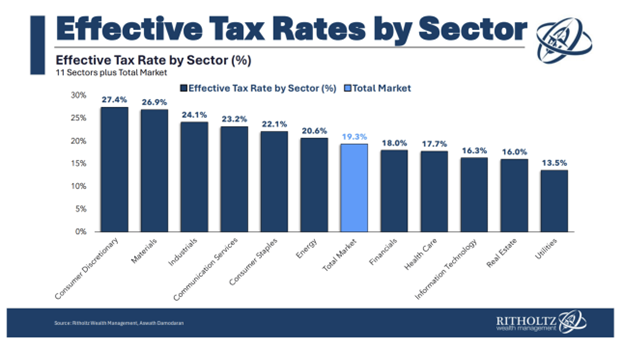

Take taxes, for example. Tax policy affects all of us, from the biggest, multinational companies to you and me. Right now, there’s a spotlight on the Tax Cuts and Jobs Act, which is set to partially expire at the end of 2025.

The biggest variable for US companies could be the corporate tax rate, which was reduced from 35% to 21% under the TCJA. The TCJA also included business-friendly provisions on capital spending tax treatments and pass-through income.

Certain industries – like retailers and manufacturers – are more tax-sensitive, so they could struggle if parts of the TCJA expire. And when profit margins and cost-cutting are in vogue, tax burdens could make a big difference.

Source: Ritholtz chart wiz Matt Cerminaro

There are also a slew of individual tax treatments and credits that are up for negotiation, and any changes could impact your portfolio and your wallet. And to that end, both candidates have talked about plans for new tax credits and cuts for Americans.

Bottom line? Policies don’t define an entire economy, but they can have far-reaching effects on your own financial situation. Politics, on the other hand, can be a dangerous distraction if you let your focus slide. Booms and busts will happen regardless of who’s in office.

More By This Author:

WMT: A Barometer Of Consumer Health Telling An Encouraging StoryBAC And JPM: Two Financial Sector Winners In A Lower-Rate Regime

Universal Health Realty: A Healthcare REIT With A Very Healthy Dividend

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more