Cheniere Energy: A High-Yielding LNG Play Set To Rally As The Fed Cuts Rates

Image source: Pixabay

What recession? After a terrible start to August, the market has completely turned around. The S&P 500 has moved around 7.5% higher since Aug. 5, and it was recently hovering near its old high. I like Cheniere Energy Partners LP (CQP) and its recent dividend yield of 7.3%, advises Tom Hutchinson, editor of Cabot Dividend Investor.

The recession fears that contributed to the worst day for the market in over a year were overblown. And numbers have come out since that indicate a recession is unlikely any time soon. But the Federal Reserve is still expected to start slashing rates next month. It looks like we will still get the rate cuts without a recession. The market loves it.

The rally appears to be back in business for now. A soft landing is still possible. AI is hot again, and technology has resumed driving the market higher. It’s good for now, but there is reason for caution. Recession may not be looming soon, but it is now on the radar. The market is also elevated and showing vulnerability to bad headlines. And who doesn’t think there will be a lot of stunning headlines in the months ahead?

Cheniere Energy Partners LP (CQP)

Plus, September is historically the worst month of the year for stocks, followed by October. Anything is possible in the near-term, and we’ll see what happens.

That said, there is some very good news for the portfolio. The revitalized market has created great covered call opportunities, and may continue to do so in the weeks ahead. Falling interest rates have also brought the previously downtrodden interest rate-sensitive stocks back to life. These stocks are cheap, high yielding, and defensive ahead of a likely slowing economy.

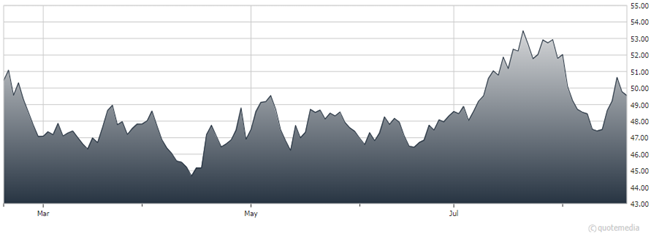

Take Cheniere Energy. The recession scare of early August knocked the wind out of most energy stocks, including this LNG exporter. But the stock has been recovering nicely as those fears have waned.

While Cheniere Energy is vulnerable to weakness in the overall energy sector in the near-term, the longer-term trajectory remains excellent. The world still needs US natural gas. Earnings were solid, and expansions are on track. Plus, that huge dividend is solid and highly attractive in a market that could sputter in the month ahead.

My recommended action would be to consider buying shares of Cheniere Energy Partners.

About the Author

Tom Hutchinson is a Wall Street veteran with experience in stock trading, mortgage banking, and commodity trading. Specializing in income investing, he has served in a financial advisory capacity for several of the nation's largest investment banks.

For more than a decade, Mr. Hutchinson created and actively managed investment portfolios for private investors, corporate clients, pension plans, and 401(k)s. He has a long track record of successfully building wealth and producing a high income for clients, while maintaining and growing principal.

More By This Author:

Options Straddles: How They Work And When To Lock In Profit

Chipotle: A High-Growth Restaurant Chain Worth Scooping Up

PIN: Use This ETF To Profit From Gains In Indian Stocks

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more