Bulls Keep Coming Back

The S&P 500 has been little changed in the past week resulting in little change to sentiment according to the latest AAII survey. 27.2% of respondents reported as bullish this week, up 1.1 percentage points versus the previous week. Albeit higher, that does not result in any sort of new high as bullish sentiment sits right in the middle of the past year’s range

Bearish sentiment likewise picked up this week rising from 34.5% to 35.1%. That is only the highest level in three weeks as bearish sentiment remains relatively muted versus the significantly elevated readings of the past year.

With that said, sentiment continued to favor bearishness with the bull-bear spread sitting at -7.9. This week marks the ninth in a row in which bearish sentiment outweighed bullish sentiment.

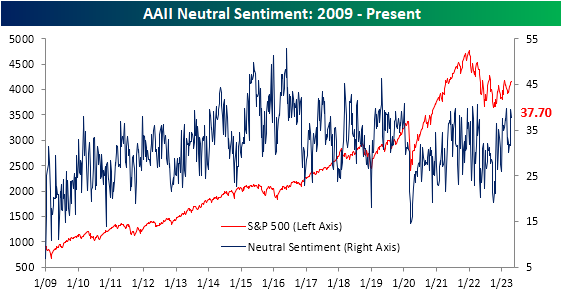

Given both bullish and bearish readings rose, each group borrowed from the neutral pool which pivoted off of a recent high of 39.5% down to a still elevated 37.7%.

Factoring in other sentiment surveys, there was more bullish tones. The NAAIM Exposure index indicated active managers added long exposure to equities and the Investors Intelligence survey showed the highest bull-bear spread since the first week of 2022. That leaves the AAII survey as the only one of the three with sentiment readings that are more bearish than historically normal.

More By This Author:

Claims High, Philly Blunted

Historic Divergence In Tech Price And Breadth

Homebuilder Sentiment And Stocks Trend In Opposite Directions

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more