Bulls Back Above 30%

While the rally has paused today, the S&P 500 has continued to press higher in the past week and is currently hovering near resistance at the late May/early June highs. In response to those moves, investor sentiment has improved with the weekly survey from the AAII showing over 30% of respondents reporting as bullish. That is the highest reading since the first week of June when the S&P 500 was at similar levels to now.

Bearish sentiment is a similar story in hitting the lowest level since the first week of June as it has fallen back below 40%. The further 1.2 percentage point drop marks the fourth week in a row that bearish sentiment has fallen, and the full decline since the recent high of 59.3% on June 23rd now sits at over 20 percentage points.

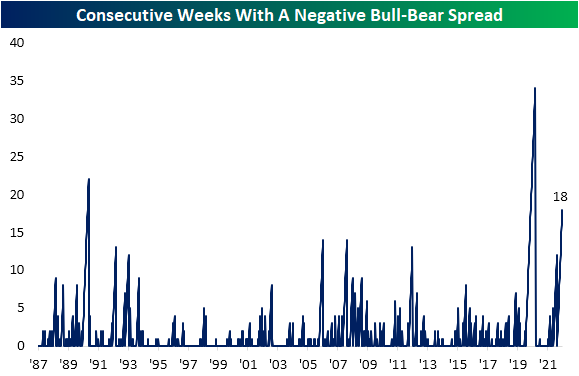

In spite of those further improvements, there continues to be more bears than bulls as the spread remains in negative territory. As shown in the second chart below, the bull-bear spread has now been negative for 18 weeks in a row.

In addition to the drop in bearish sentiment, neutral sentiment was also lower falling 1.6 percentage points down to 30.6%. That is the first time neutral sentiment matched bullish sentiment since May of last year.

More By This Author:

Initial Claims Back To The Highs

Big Moves In Treasuries

Rotating In August

Click here to learn more about Bespoke’s premium stock market research service.