Bull Of The Day: Pdd Holdings

Pinduoduo or Zacks Rank #1 (Strong Buy) stock PDD Holdings (PDD) is a Chinese e-commerce platform founded in 2015. Though PDD is much younger than its rivals like Alibaba Group (BABA) or VIP Shop Holdings (VIPS), PDD has gained significant popularity in a relatively short period, becoming one of the largest e-commerce companies in China.

Temu, an Emerging E-Commerce Juggernaut

Temu, PDD’s e-commerce website, has put PDD on the map. Temu is an online marketplace and e-commerce platform that has garnered popularity for its extensive offering of affordable products. The e-commerce platform launched in September 2022 is available in both China and the United States. The Temu app gained a massive following and a quick foothold in the United States e-commerce market after PDD management decided to purchase an expensive Super Bowl ad in 2023.

Amazon vs. Temu

Traditionally, Amazon (AMZN) has enjoyed a stranglehold on the U.S. e-commerce market and has dominated foreign and domestic. However, Temu has taken a unique approach and is catering to a growing niche. Rather than assuming customers would rather have their products shipped to them immediately, and for a slightly higher cost, Temu is catering to a small but rapidly growing segment of the market that is willing to wait for lower prices.

Instead of sourcing products from several different intermediaries, Temu operates a marketplace model that connects buyers directly with sellers and ships cheap goods directly from China. Though the products take longer to ship than Amazon goods, for example, American e-commerce customers who have been squeezed by stubborn and rampant inflation are willing to wait longer to save money.

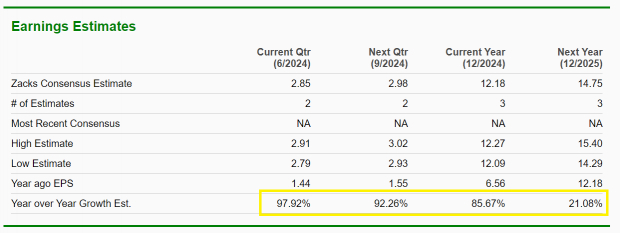

PDD Holdings: Explosive Earnings Growth

PDD is growing earnings faster than almost any public e-commerce company. Wall Street sees the rapid growth continuing and expects EPS growth of about 97% next quarter and EPS growth of 85% for the full year 2024.

Image Source: Zacks Investment Research

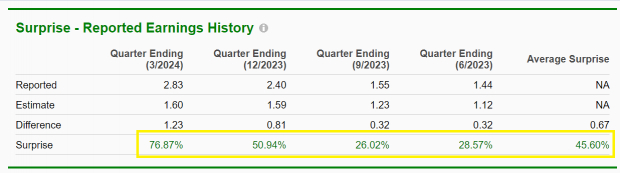

PDD’s Bullish EPS Surprise History

Though PDD’s expectations are high, the company has illustrated that it can consistently beat Wall Street’s expectations. Over the past four quarters, PDD has beat EPS expectations by an average of 45%.

Image Source: Zacks Investment Research

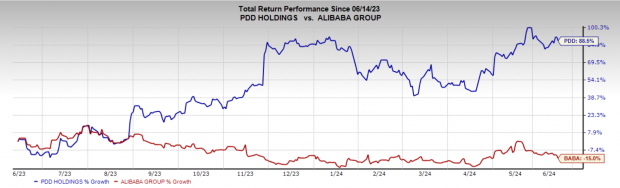

Relative Strength vs. Peers

Relative price action is one of the most straightforward and powerful indicators in the investor toolbox. PDD is up 88.5%, while industry peers like BABA lag behind (-15%).

Image Source: Zacks Investment Research

Bottom Line

PDD’s unique Temu platform is helping e-commerce shoppers fight inflation while growing the company’s earnings rapidly.

More By This Author:

Embracing Market Dynamics As Inflation Data Looms4 Factors Point To A Sunny Future In Solar

Bear of the Day: Hertz

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more