Bear Of The Day: Hertz

Company Overview

Zacks Rank #5 (Strong Sell) stock Hertz Global Holdings (HTZ) is one of the largest and most well-known global car rental brands. Hertz predominantly offers short-term vehicle rental services to individuals and businesses through the Hertz brand and other brands under the Hertz “umbrella” such as Dollar Rent-A-Car, Firefly Car Rental, and Thrifty Car Rental.

Competition is Heating Up in the Short-Term

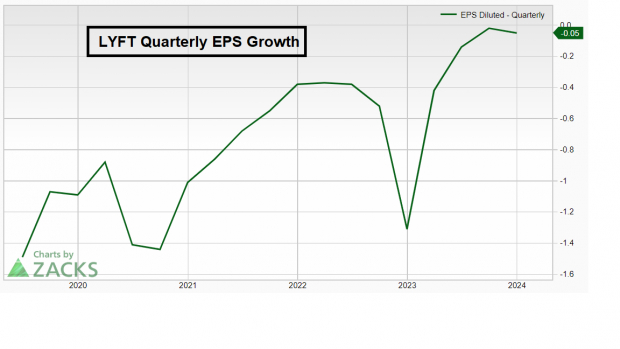

With the advent of smartphones and other modern luxuries, it is becoming increasingly more apparent that the modern consumer is looking for speed and convenience in all aspects of life. For example, when a traveler lands at an airport in a city that isn’t their own, they are more often opting for ride-sharing services than waiting in long lines and paying sky-high prices for short-term rental services like Hertz. Investors don’t have to look far for evidence of this momentous trend. While HTZ is in the process of printing its third consecutive year of slower annual earnings-per-share (EPS) growth, ride-sharing providers such as Uber (UBER) and Lyft (LYFT) are experiencing higher earnings growth.

Image Source: Zacks Investment Research

Meanwhile, new, innovative entrants such as Turo are upending the short-term vehicle rental market. Turo is becoming the Airbnb ((ABNB Quick QuoteABNB - Free Report) ) of vehicle rentals. The company allows clients to “skip the car rental counter and rent anything from daily drivers to pick up trucks, from trusted, local hosts on the Turo car rental marketplace.”

Robotaxis are a Long-Term Threat

Imagine a world where a driverless car can be summoned within minutes, allowing passengers to get from point A to point B safer than ever before. Investors may not have to imagine this world for much longer. Alphabet (GOOGL) subsidiary Waymo and Tesla (TSLA) are going “all in” on the idea. In fact, in Tesla’s recent earnings call, CEO Elon Musk underscored the importance of autonomy and robotaxis for the company by stating, “If somebody doesn’t believe Tesla’s going to solve autonomy, I think they should not be an investor in the company. We will, and we are.”

Though robotaxis may seem like a pipe dream, they are closer than most investors probably anticipate. In fact, robotaxis are live in several U.S. cities already. Also, TSLA is jumping today on news that the company’s FSD will go live in China in the near future as well.

Relative Weakness + Opportunity Cost

Hertz has underperformed the general market dramatically over the past year, dropping 70.9% versus the S&P 500’s 25.5% gain. Studies show that 75% of stocks follow the market’s direction. Because HTZ is one of the few stocks dropping precipitously and underperforming, it raises a red flag for investors.

Image Source: Zacks Investment Research

Beyond the problematic price action, options traders seem to believe there is much further to drop. Over the past few weeks, options traders have plunked down millions in bearish bets against the troubled company.

Bottom Line

Hertz faces several bearish headwinds, such as an antiquated service, more competition, slowing growth, and relative weakness. For these reasons, HTZ is an avoid for the foreseeable future.

More By This Author:

Bull Of The Day: Coinbase Global2 Top Biotech Buyout Candidates

Bear of the Day: Herbalife

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more