'Bull Flag' Breakouts Hit A Road Block

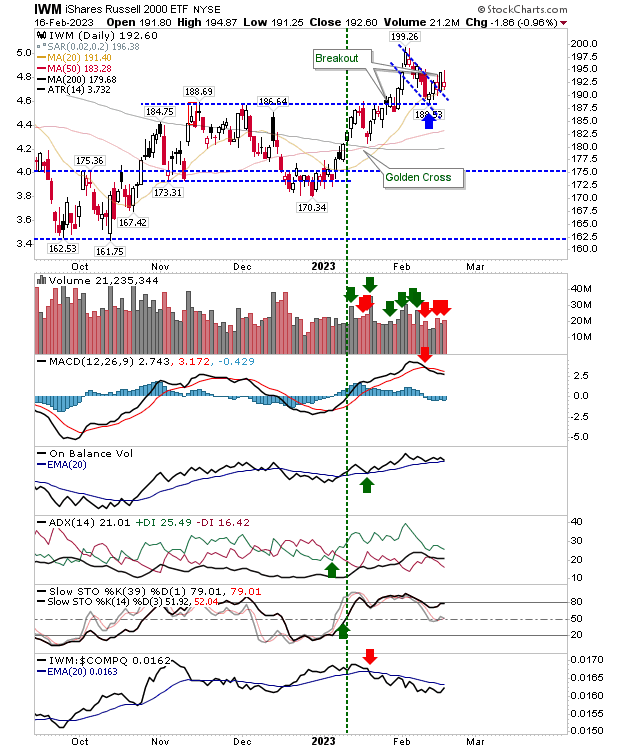

Yesterday's gains offered classic 'bull flag' breakouts, but today put a dampener on many of those market moves.

The Russell 2000 opened near the low of Wednesday, and despite an intraday surge to yesterday's highs, it found itself closing just below it's open price - registering a distribution day in the process. Technicals haven't changed, although relative performance is improving against the Nasdaq.

The Nasdaq closed near the lows of yesterday, undoing that nice, big, breakout candle. There is still the MACD trigger 'sell' (quel surprise), but other technicals are okay and there was no confirmed distribution for today's selling.

The S&P had the weakest finish. It just edged a 'bull flag' breakout yesterday and took a larger loss today. Adding to the malaise was a relative performance loss against the Russell 2000. Selling volume climbed to register as distribution too. Yuck...

The net sum of today's action was to reverse the 'bull flag' breakouts, but not undercut the more important resistance breakout. Having said that, I would view today's end-of-day close as a set-up for further losses tomorrow. While I would tolerate any intraday violation of nearby breakout support, I wouldn't want to see an end-of-day finish below these levels for any index.

More By This Author:

Nasdaq, S&P And Russell 2000 All Shape 'Bull' Flags

Russell 2000 And S&P 500 Successfully Test Breakout Support

Inside Day Losses

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more