Russell 2000 And S&P 500 Successfully Test Breakout Support

Image source: Pixabay

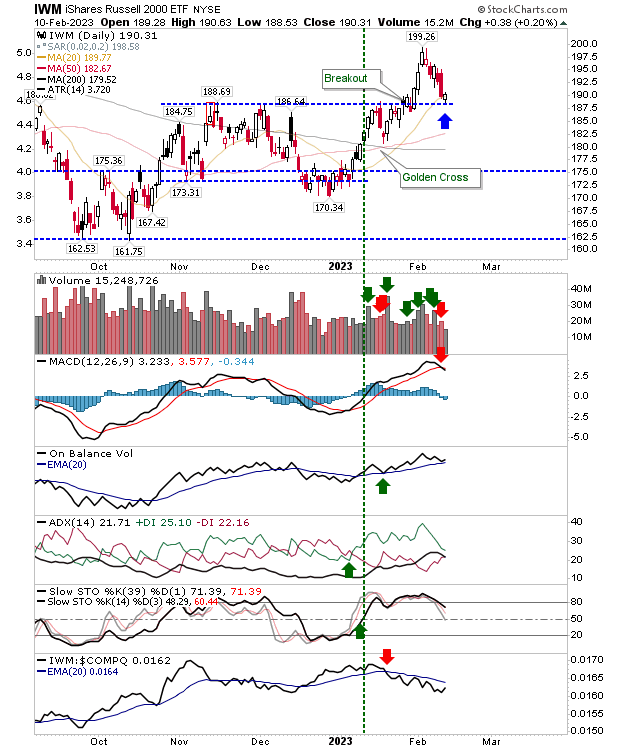

A good end-of-week finish for markets offered positive tests of support to head into next week with. The Russell 2000 tagged breakout support that was defined by November's swing high and 20-day MA. Volume steadily declined off the reversal from the $199 high -- another positive -- although the MCD trigger 'sell' was a little disappointing.

The S&P 500 had a smaller distance to test support, but it managed to repeat the action which also included a positive test of its 20-day MA. Also, like the Russell 2000, it finished the week with a MACD trigger 'sell.'

The Nasdaq hasn't retreated as far as the Russell 2000 or S&P 500, and it has yet to engage in a test of support. Because of this, it hasn't yet turned in a 'sell' trigger for its MACD, but it has for On-Balance-Volume. Friday's finish for the index was a neutral doji, a potential turning point to end the six-day decline; if not the doji, then moving averages are there to lend support.

All indices are working towards right-hand-bases, with early steps in the bullish reversal. December rallies haven't consolidated as they continue to push higher. So until this happens, we won't know for sure if we have a true bottom in place. However, I am of the opinion that the June low was the low of the decline, with a successful retest seen in October, leading into the current rally.

More By This Author:

Inside Day LossesTentative Steps Lower For Markets

The Market Surge Continues

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more