Building A Sustainable Passive Income Stream With Dividend Growth Stocks

Image Source: Pixabay

Future retirees who have been building a passive income stream with dividend growth stocks have continued to do well. The primary goal is to generate sufficient income to match or exceed expenses. Because retirement is in the future, this activity is based on estimations of future spending, dividend income, retirement plans, Social Security, inflation, and dividend growth rates.

Dividend Growth Should Mirror Earnings Growth

On average, dividend growth will match earnings growth rates over time. Exceptions occur, especially when a company initiates a dividend. However, growth rates typically slow once the payout ratio reaches about 40% to 50%. In general, higher payout ratios lead to lower growth.

Currently, the Dividend Kings, stocks with 50+ years of increases, have a five-year earnings growth rate of 6.0%, while the dividends have risen at an average of 6.18% over the same period. The Kings are usually mature companies that are growing slowly but steadily.

On the other hand, the Dividend Contenders, equities with 10-24 years of increases, have grown earnings at about 7.5% annually while earnings have climbed at 8.8% in the past five years. The Contenders are often younger companies, or have only recently commenced paying dividends.

Notably, the median payout ratio for the Dividend Kings is ~49%, while for the Dividend Contenders, it is ~39%. A company’s starting payout ratio influences the dividend growth rate. A high value will result in lower annual increases, while a low value will often lead to high increases.

Reinvest Dividends to Leverage the Power of Compounding

The yearly payout doubles relatively quickly when the dividend grows at a 6% rate. Even a stock with a modest dividend growth rate like Coca-Cola (KO), a Dividend King, will create substantial passive income if held long enough.

Checking the dividend charts, the firm paid $1.22 per share in 2014, which increased to $1.84 by 2023. But go back to 2010, and the payout was $0.88 per share, meaning the annual dividend multiplied by more than two in 13 years. In fact, the Rule of 72 predicts that the dividend distribution will double every 12 years at a 6% growth rate. The actual value is a little bit lower at 11.9 years.

However, if the dividends were reinvested, the income stream would increase more rapidly because the reinvested cash purchases more shares that pay dividends. This action is the power of compounding. Investors can select a dividend reinvestment plan (DRIP) directly with a company, through a brokerage, or manually.

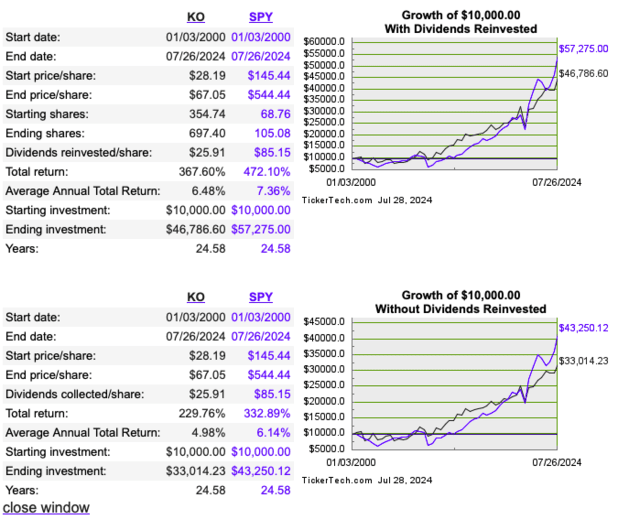

This action also enhances total returns. For example, according to Dividend Channel, Coca-Cola’s returns are almost 1.5% higher with reinvested dividends in the trailing 24 and a half years. That said, some investors will rightly point out that the S&P 500 Index outperformed Coca-Cola. However, the equity would be part of a diversified portfolio, with each dividend stock contributing to the total passive income stream.

Source: Dividend Channel

Diversified Portfolios Reduce Risk

The aim is to build a diversified portfolio of dividend growth stocks and hold them until retirement. Diversification reduces the risk of severe losses and dividend cuts impacting future income. This point is crucial because our analysis of historical dividend trends shows that cuts and omissions spike during times of economic stress. It happened during the Great Recession, and again during the COVID-19 economic slowdown.

Consequently, investors should spread their risk across 20 to 30 equities. They should consider different sectors and industries. In the past, some sectors and industries struggled with dividend cuts in large numbers. Many Real Estate Investment Trusts (REITs) cut dividends during the Great Recession and again because of the impact of the COVID-19 pandemic. Similarly, banks and other financial institutions cut or froze dividends during the Great Recession.

More recently, three Dividend Kings cut their dividends. It is a rare event for one to do so, but three in one year is unprecedented. Leggett & Platt (LEG) slashed its dividend after 53 years. The dividend cut for Telephone and Data Systems (TDS) removed it from the Dividend King list. Lastly, 3M Company (MMM) reduced its dividend after 66 years, one of the longest streaks.

Limit Dividend Cuts

The aim is to avoid dividend cuts entirely and have stable growth. Companies typically provide warning signs about impending cuts, such as high debt, elevated payout ratio, outdated products and technology, legal challenges, and too aggressive M&A.

However, it is difficult to avoid cuts completely. Portfolio diversification and limiting correlation reduce the risk of multiple dividend cuts or freezes. Investors should also consider regular portfolio reviews and thoroughly researching companies. If a cut occurs, it can often be a reason to sell a dividend stock.

Tax Implications of Dividend Growth Stocks

Relying on dividends for all or a part of a passive income stream has tax implications. Dividends are taxed differently than ordinary income but the same as capital gains. In the United States, qualified dividends are taxed at a lower rate than ordinary income, making them more tax-efficient.

The benefit is more remarkable for high tax brackets. For instance, a married couple filing jointly with $500,000 in net income pays 35% on ordinary income but 15% on qualified dividends.

The Bottom Line About Passive Income with Dividend Growth Stocks

Dividend growth stocks can be a component of a passive income strategy. Depending on when you start and your success, they may also be the main effort. However, Social Security, certificates of deposit (CDs), rental real estate, and other assets may all contribute to the total passive income stream.

A last consideration is valuation. A stock with excellent dividend growth but low initial yield and high valuation will probably not generate the expected returns.

More By This Author:

Top Dividend Aristocrat Picks In July 2024The Stock Market This Week: The Unstoppable U.S. Stock Market

3 Unloved And Undervalued Dividend Stocks To Snap Up Now

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this site. Please consult with ...

more