Bristol Myers Squibb Company: Too Cheap To Ignore

Bristol Myers Squibb

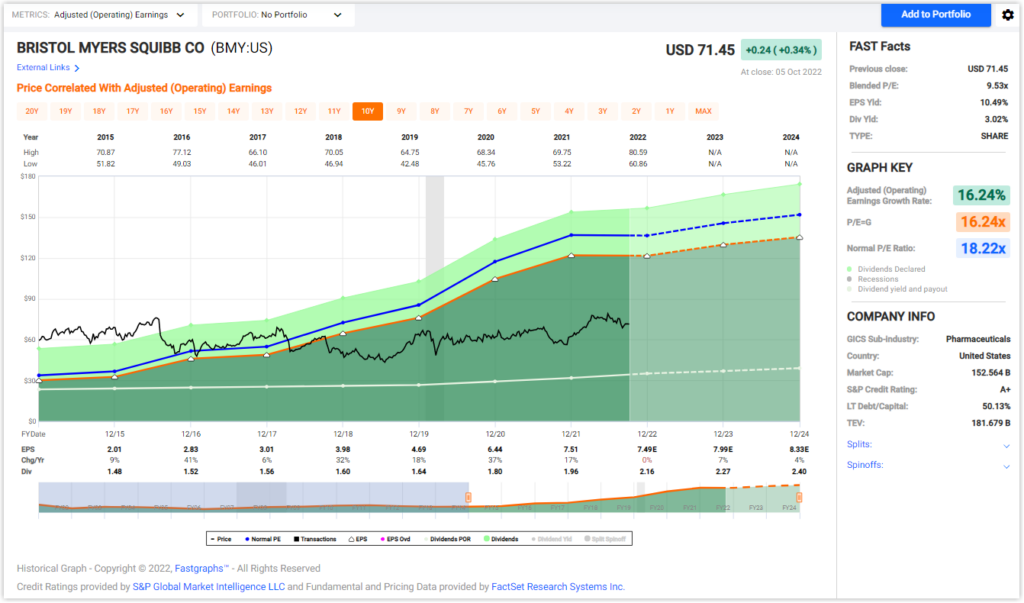

A+ rated Bristol Myers Squibb (BMY) is a blue-chip dividend growth stock offering a 3% and growing current yield. Historically, this stalwart pharmaceutical giant has commanded a premium valuation multiple by Mr. Market. However, since November 2018 Bristol Myers has been selling at a discount to not only its historical norms but historical market norms as well. Despite this low valuation, the company has outperformed the S&P 500 on both dividend income and capital appreciation. Furthermore, this low valuation also supports an opportunity for outsized future gains at below-average levels of risk. In addition to the company’s extremely high quality, the significant undervaluation provides a margin of safety as an additional layer of risk mitigation.

(Click on image to enlarge)

Bristol Myers FAST Graph

In this video, I will be running Bristol Myers Squibb by the numbers via the FAST Graphs fundamentals analyzer software tool. In addition to providing a fundamental analysis of the company, I will simultaneously be illustrating the power of the FAST Graphs research tool as well as how to use it to your maximum benefit.

Video Length: 00:31:10

More By This Author:

The Real Reason Why The Stock Market Is Falling: 6 Examples

6 Dividend Growth Stocks

Can FedEx Deliver Long-Term Gains After Today’s Short-Term Pain?

Disclosure: Long BMY at the time of writing.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or ...

more