Can FedEx Deliver Long-Term Gains After Today’s Short-Term Pain?

Photo by Bannon Morrissy on Unsplash

Introduction – FedEx

FedEx (FDX) preannounced an earnings shortfall and the stock price is down more than 20%. Investors with a short-term orientation typically react badly when the stock price falls. Nevertheless, I believe a more levelheaded and thoughtful reaction is warranted. For starters, FedEx is not going out of business, nor is it going bankrupt. Furthermore, based on what we know today, shareholder-friendly actions remain intact. They recently maintain their dividend and publicly stated they were committed to the generous share buyback program in place.

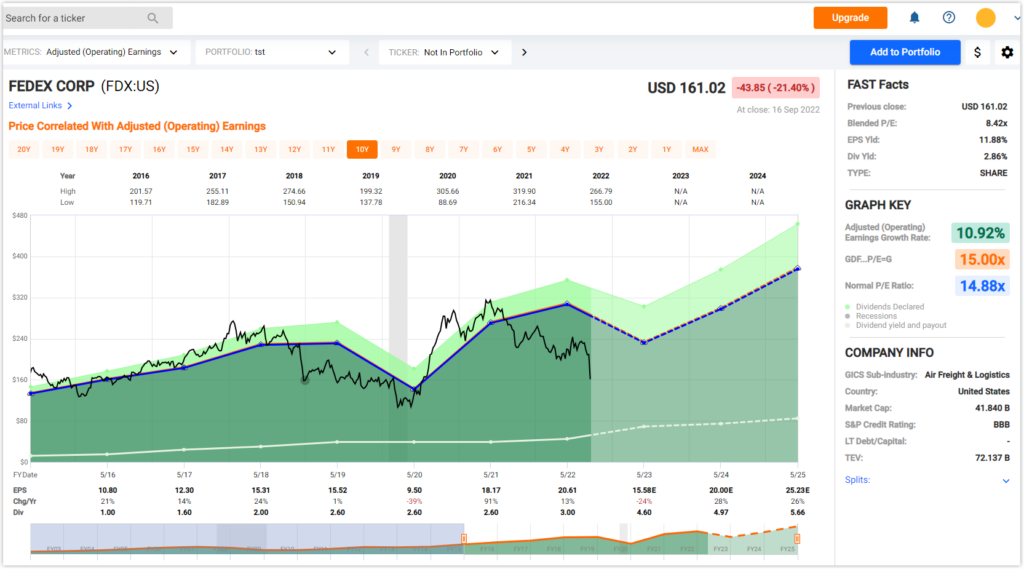

FedEx FAST Graphs

The important takeaway is for the investor to decide whether the price drop is warranted and justified by the fundamental deterioration, or if the market overreacting. From where I sit, I still believe that the long-term opportunity in front of FedEx is intact and all we are experiencing is a temporary interruption. The company has historically been well-managed and appears to have a plan in place that will enable them to prosper over the long run. In short, I believe that any risks with FedEx are currently baked into the price. This may not be the perfect time to invest, but I must believe it is a great time to invest for those with a long-term horizon and perspective.

Video Length: 00:09:37

More By This Author:

19 S&P 500 Blue Chips With A Margin Of Safety And High Dividend YieldsFor Dividend Growth HPQ Versus HPE Or Both?

The Normal P/E Ratio (The Blue Line) – What It Is And How It Works

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more