Boom In Growth Stocks Can’t Last Forever

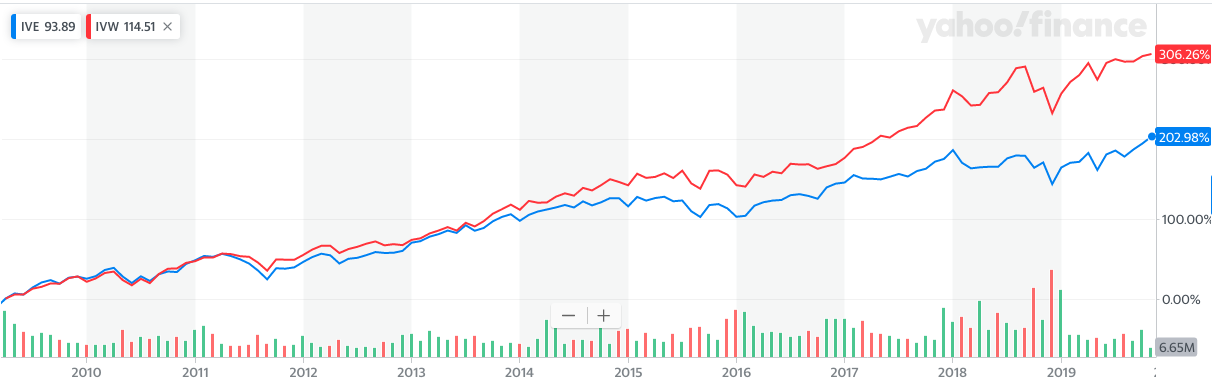

Since the beginning of the bull market in March 2009, growth stocks have by far outperformed value stocks, as reflected by the iShares S&P 500 Growth ETF (IVW) versus the iShares S&P 500 Value ETF (IVE) chart below (306.26% vs. 202.98%, respectively). However, over the past two-three months, value stocks have begun outperforming growth stocks, and many believe this trend is likely to continue for the foreseeable future, given the relatively stretched valuations of the growth securities. In fact, the eventual bursting of the bond bubble is also likely to further induce out-performance of the value stocks relative to growth stocks amid rising yields.

(Click on image to enlarge)

Source: Yahoo Finance

Unconventional Metrics

Tech stocks are the largest constituents of the growth sector, even making up 27.16% of the IVW ETF. In a previous article, it had been revealed that the ‘forward multiple’ gap between growth and value stocks are nowhere near the levels witnessed during the peak of the dotcom bubble. However, that being said, there are certainly other trends similar to ones witnessed during the dotcom bubble that do signal that growth stocks are in ‘overvaluation’ territory. More specifically, the fact that more and more growth stocks are being assessed using “nontraditional valuation metrics” that disregard the importance of revenues, profits and cash flows reflects the complacency of investors allocating capital to such securities. This is particularly true for companies with negative earnings and cash flows. Take for example Netflix, where ‘subscriber growth’ has been given great importance while driving the stock price higher over the past several years, despite its ballooning negative cash flow and debt levels.

This was the type of behavior that was witnessed during the dotcom bubble when companies were increasingly being valued using unconventional metrics such as ‘number of page views’. While some unconventional metrics are not necessarily indicative of stretched valuations, but when more and more stocks are being valued using such metrics as opposed to revenues/profits, it is certainly a troubling sign.

Growth sector's 'long duration' attribute

Growth stocks are often considered comparable to ‘long duration’ bonds, due to their nature of not returning cash flows to investors in the near-term, but are instead expected to do so over the long-term distant future (as profits/ cash flows are invested back into the company for growth). Well taking this notion into consideration, it is worth noting that long-duration securities tend to perform better during periods of declining/low-interest rates, as it has done so over the past decade. In fact, the Fed’s determination to keep monetary policy conditions accommodative over the foreseeable future should bode well for growth stocks.

However, over the years we have been witnessing the formation of a bond market bubble, induced by an extensively dovish Fed, negative interest rates around the globe and a diminishing US economic outlook. While Treasuries, particularly the 10yr, are considered risk-free assets, their ‘bubble-like’ behavior, with a convincing underlying narrative continuing to push prices higher, in fact, undermines this ‘risk-free’ nature. When this bond bubble eventually bursts/ reverses, yields will spike higher, which would not bode well for long-duration bonds. And given the long duration nature of growth stocks, this development is likely to further aggravate its underperformance relative to value stocks going ahead. Furthermore, the largest sector constituting the value space is the financials sector, making up 21.71% of the IVE ETF. The financials sector tends to benefit the most from rising yields, and therefore will help drive the value space higher when yields rise, thereby further inducing an out-performance of value overgrowth.

The current narrative driving Treasury prices higher is that the Fed (along with other global central banks) will need to continue maintaining loose monetary policy conditions amid a weakening domestic and global economy. Hence this is driving long-term yields lower and the inversely correlated bond prices higher. However, while a reversal in this upward trend may seem far-fetched presently, eventually all bubbles do burst, and this one is no exception. One prominent potential catalyst for the reversal in the bond price rally is actually already formulating: the expanding government deficit. The US budget deficit for fiscal 2019 was $984 billion, and this near-trillion dollar deficit is very abnormal to have amid a healthy economy with record low unemployment rates. This, in turn, means that the government will be running even higher deficits when the economy eventually requires increased fiscal stimulus. Hence, record debt issuance will inevitably push yields higher and bond prices lower, to the detriment of long duration securities.

When growth stocks eventually plummet from sky-high valuations, the natural question will be, when would be the right time to enter? In a previous article, it was acknowledged that growth stocks tend to bottom when the forward PE multiples of growth stocks and value stocks are approaching equality. Furthermore, given that the surge in government debt issuance is likely to result in yields spiking higher, which will transmit into the economy in the form of higher rates and thereby subdue economic growth, the Fed is likely to step in to push yields back lower and ease monetary policy conditions. This will involve monetization of government debt, most likely in the form of Quantitative Easing, to ensure this increased supply is met with adequate demand to absorb any excess debt securities, thereby ensuring rates remain at appropriately accommodative levels. Hence the Fed’s determination to keep rates lower for an extended period of time will continue supporting growth stocks higher again.

Bottom Line

An increasing number of market participants believe that the recent outperformance of value over growth stocks is here to stay. Moreover, the reversal of the bond bubble and resulting rising yields may further aggravate this under-performance going forward, as rising yields tend to favor the financials within the value space as opposed to the ‘long duration’ growth stocks. Nevertheless, this certainly does not mean all growth stocks will under-perform the value group, thus investors should still try to extract individual growth stocks that have the potential to continue outperforming, as opposed to shunning the entire group. Furthermore, when the forward multiples of growth stocks approach the levels of value stocks, growth investors should consider getting back into the space. Amid the persistence of low inflation levels, the Fed is likely to continue taking steps to ensure loose monetary policy conditions over long periods of time, thereby maintaining favorable conditions for growth stocks.