How To Approach The Growth To Value Rotation

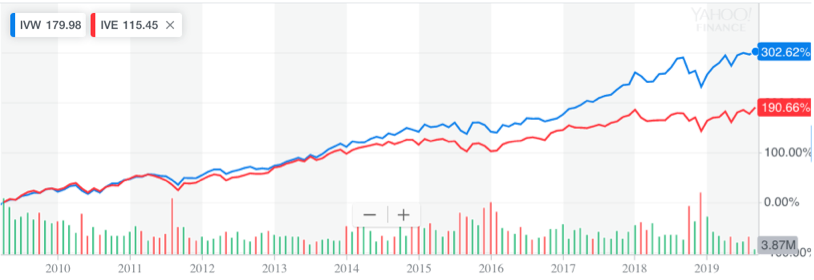

Over the past few weeks, there has been a notable hype around the shift from growth stocks to value stocks. Since the beginning of the bull market on Mar. 9th, 2009, the iShares S&P 500 Growth ETF (IVW) has returned 302.62%, while the iShares S&P 500 Value ETF (IVE) has returned 190.66%. In this article, we will assess various factors that induce such shifts and their sustainability. While as a group value could outperform growth for a certain period of time, it is important to keep in mind that individual stocks can still outperform both groups regardless of the investment-style it falls into.

(Click on image to enlarge)

Source: Yahoo Finance

When do valuations matter?

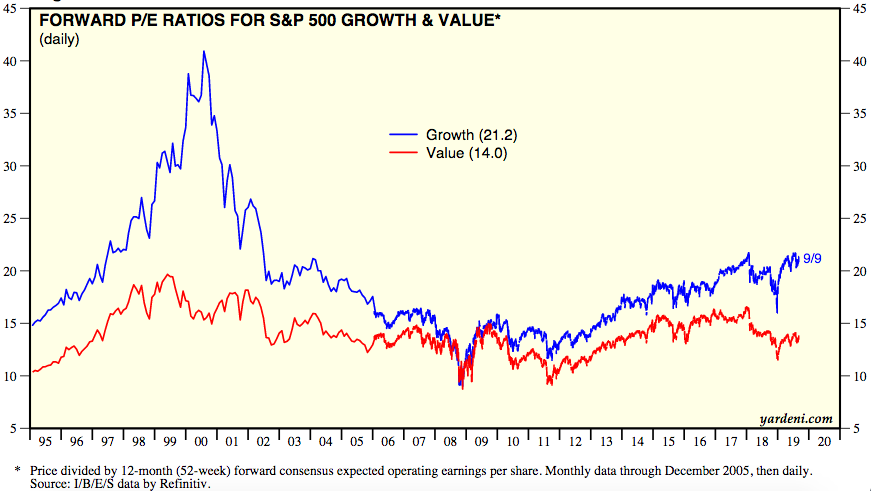

Amid the shift from growth to value recently, one of the main arguments in favor of this shift is the excessive valuation of the growth sector relative to the value sector. This is indeed valid, given that the forward PE multiples of certain individual growth stocks are sky-high, and the forward PE of the growth sector overall is 21.2 vs. 14 for the value sector. The chart below compares the forward PE of two investment styles since 1995.

(Click on image to enlarge)

Source: Yardeni

While there is certainly a notable divergence between the growth and value forward multiples presently, it is not nearly as divergent as it was during the dotcom bubble, following which we witnessed several years of value outperforming growth. Hence, recent calls of vast underperformance of the growth sector relative to value the way we saw during the mid-2000s may be overblown, as growth valuations overall haven’t gotten that excessive.

However, in the event that we do witness a plunge in growth stocks, the question then becomes at what point is it appropriate to buy into growth again? Well from the chart above we see that the multiples contraction in growth stocks ended when the forward multiple of both investment-styles reached equality. Hence in the event of a downturn, keep an eye out for the forward PE of the growth sector approaching that of the value sector, as this would signal that the underperformance of growth is nearing its end, and about to reverse.

That being said, while the excessive valuations of growth stocks is a rational reason to rotate out of them and into value stocks, the truth is that growth stocks have been expensive for a very long time, so why do valuations suddenly matter now and not earlier?

Let’s start off by exploring what induced the outperformance of growth stocks over the past decade. Amid the onset of the financial crisis, the forward PE multiple of both investment-styles were equal in early 2009. When the gap between growth and value forward multiples is narrow/non-existent, investors tend to focus on fundamentals such as earnings growth prospects, stability of such earnings growth, and ROIC. Hence given that growth stocks offered more attractive fundamentals overvalue, investors ended up allocating more capital towards growth. Furthermore, while loose monetary policy conditions since the crisis helped stave off another economic depression, the economic growth rates have been rather sluggish. As a result, investors sought pockets of above-average growth rates to generate excess returns amid sluggish economic conditions, which further encouraged them to turn towards growth stocks over value stocks and consequently helped further widen the divergence in forward multiples. This has been especially true since early 2018 amid the start of the global trade war, which has deteriorated global economic conditions and made the excessive growth rates of growth stocks, particularly software stocks, even more, attractive relative to value, bolstering investors to assign excessive premiums to the growth space.

However, while growth stocks offer appealing defensive characteristics during slowing economic conditions, one should also keep in mind that amid the onsets of recessions, it is the stocks with extreme valuations/over-crowding that tend to plunge most sharply, as they are most sensitive to reversals in investor sentiment. As a result, as a recession becomes more and more likely, the factor of ‘excess growth rate potential’ will take a backseat and ‘valuations’ will take priority, which will encourage investors to shun expensive growth names for either cheaper or safer assets.

Thinking ahead, another scenario to consider is the return of high economic growth rates. If the central bank and government policies were to effectively pull the economy out of a recession and induce higher economic growth rates than we have witnessed over the past decade, then, in theory, this should bode well for the earnings of both value and growth stocks. However, if growth stocks’ valuations remain excessive in such a scenario, then investors can expect value stocks to outperform growth stocks. This is because strong economic conditions would undermine the case for growth stocks being assigned premium valuations, as value stocks would also be able to offer strong earnings growth rates amid prosperous economic times, making them an attractive alternative to expensive growth stocks. Conversely, if growth stocks become cheap enough following a recession (or even equally valued as value stocks), then the investment-style could certainly still outperform during high-economic growth conditions. Therefore, when assessing which investment-style is likely to outperform, investors should consider macro-economic conditions and valuation gaps together.

Composition analysis

Amid recent signs of the rotation from growth to value, let us review the sector compositions of both IVW (growth) and IVE (value), and evaluate performance sustainability.

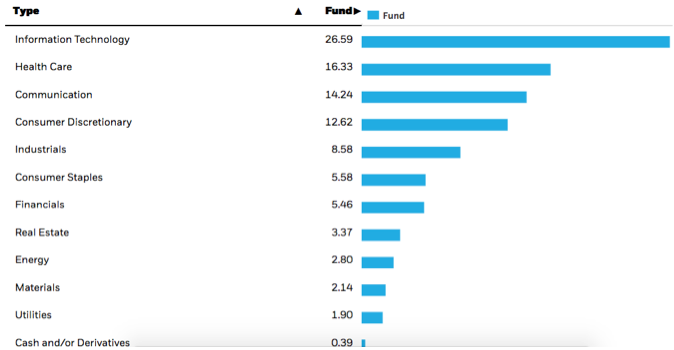

IVW sector breakdown:

(Click on image to enlarge)

Source: iShares

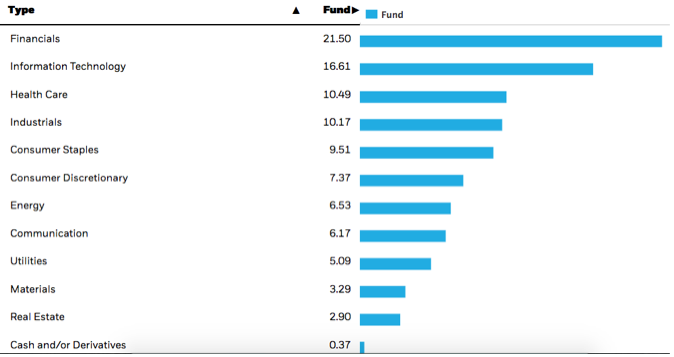

IVE sector breakdown:

(Click on image to enlarge)

Source: iShares

The prominent sector component in IVW (growth) is the Technology sector, with a 26.59% weighting, while the main component in IVE (value) is the Financials sector, with a 21.50% weighting.

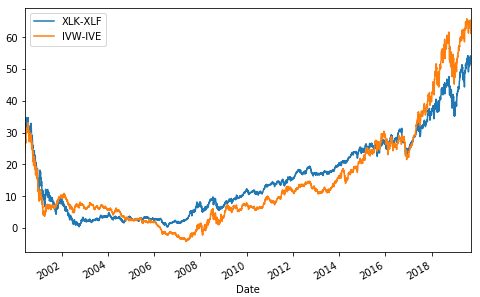

The Tech and Financial sector have consistently made up such a large weighting of the two respective investment-styles, that a performance comparison between growth and value is nearly the same as a performance comparison between tech and financials, as evidenced by the chart below:

(Click on image to enlarge)

Data source: Yahoo Finance (generated using Python)

In fact, the correlation between the two charts is 0.96. Therefore, when gauging the future performance potential of growth vs. value, it is essential to assess the performance potential of the Technology and Financial sectors.

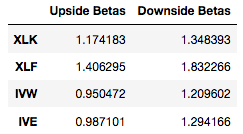

While the entire stock market tends to fall during times of economic deterioration/ recession, certain sectors/ investment styles tend to perform worse amid market downturns. This is where Beta analysis comes in handy. However, the conventional beta values are products of performances during both market up-days and down-days. And in a previous article, I discussed the advantages of separating beta values into upside beta and downside beta values in order to avoid misconceptions regarding true upside rewards and downside risks. Therefore, the upside and downside beta values (against the S&P 500 index) for four ETF securities: Technology Select Sector SPDR Fund (XLK), Financial Select Sector SPDR Fund (XLF), iShares S&P 500 Growth ETF (IVW), and the iShares S&P 500 Value ETF (IVE), have been calculated for the period since May 2000. The results can be found in the table below:

(Click on image to enlarge)

Note: these calculations are based on the period starting from May 2000; hence the bursting of the dotcom bubble will influence beta results accordingly.

While conventionally beta values are calculated for limited periods of times, our beta values incorporating such an extensive period of time (inclusive of bubble bursts) should give a better sense of risk/reward for over the longer-term.

Interestingly, the XLF ETF (Financials) seems to offer better upside reward compared to the XLK ETF (Tech), but simultaneously also significantly more downside risk during market downturns. Furthermore, we also find that IVW (growth) and IVE (value) offer almost the same level of upside reward during bullish market periods, though IVE poses notably more downside risk than IVW. Hence this measure actually makes the tech and growth sectors more appealing relative to financials and value.

Furthermore, the recent bounce in financials has not only been driven by cheap valuations but also due to a steepening in the yield curve (out of inversion territory). Hence the sustainability of this rally is dependent upon further yield curve steepening. Even if the steepening in the curve continues, it would not reduce the likelihood of a recession ahead, and a recession would not bode well for the financial sector, the heart of the economy, as not only would it lead to increased loan defaults, but it would also lead to an even lower rate environment (unfavorable for bank earnings). Keep in mind that the financial sector is of cyclical nature, and is therefore very sensitive to macroeconomic conditions. If these are not favorable going ahead (quite likely), then this would undermine the ability of financials to continue rallying higher, and consequently undermine the performance of the value investment-style as well going forward.

Conversely, growth tech stocks are rather secular, and are thus less sensitive to changes in unfavorable macro conditions, making them more appealing compared to financials and also supporting the growth space higher. However, as discussed earlier, investors must also take valuations into consideration, as overly stretched valuations could make them more prone to sharp pullbacks amid the onset of a recession/ severe market downturn.

Moreover, the crackdown on the power and competitive behavior of big tech firms is growing and is only likely to intensify if democrats gain more power in the house, senate and white house going forward. Therefore, this could undermine the performance of some of the biggest tech names that have been responsible for the massive outperformance of the growth space over the last decade, which includes companies like Facebook, Amazon, and Alphabet.

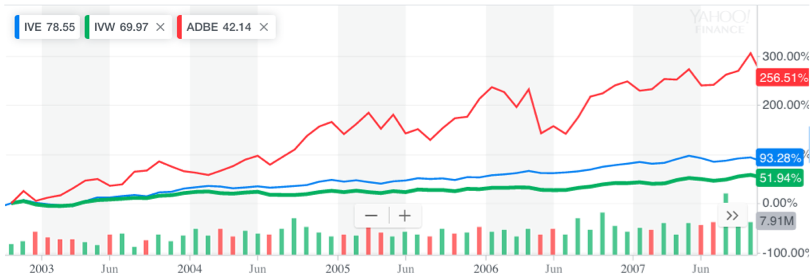

However, while some growth stocks could face hurdles going ahead, it does not mean all growth stocks will perform poorly going forward. Instead of adopting passive strategies by trying to gauge which investment-style will outperform, I would advise focusing on picking individual stocks with strong fundamentals, attractive earnings potential, and reasonable valuations. Even if we witness the value investment-style outperforming the growth investment-style going forward, it does not necessarily mean that all growth stocks will underperform the value sector. For example, during the period between October 2002 and October 2007 when the value sector outperformed the growth sector, Adobe ADBE (a growth stock) outperformed both IVW and IVE, as shown in the chart below.

(Click on image to enlarge)

Source: Yahoo Finance

Therefore, focus on fundamental-analysis and stock picking as opposed to passive investing amid this uncertainty over which investment-style will outperform going ahead.

Bottom Line

While the growth sector is certainly very expensive relative to the value sector, with a forward PE multiple of 21.2 vs. 14, respectively, the divergence in multiples is nowhere near where it was at the height of the dotcom bubble. Therefore, calls for a vast underperformance of the growth sector like we witnessed during the mid-2000s is unlikely. Nevertheless, as the chances of a recession grow, it is wise to wait for a downturn in the growth sector given such extended valuations. Simultaneously, be wary of buying into the recent rally in financials/ value, given their cyclical nature and concerning macroeconomic conditions ahead.

Overall, even once the likely downturn in stocks has occurred, it is advisable to pick individual stocks, whether growth or value, instead of adopting passive investment strategies, as a wise selection of securities is likely to outperform both the growth and value sector over the long-term.